Generating Philippines Government reports is extremely easy with PayrollHero!

Following the steps on this article will ensure you generate correct reports that can be used to submit to the different agencies in the Philippines.

This article covers:

- Requirements to generate government reports.

- Generating the reports via the Payrolls Page.

- Generating the reports via the Forms Page.

- Example screenshots of the exported reports.

- Other useful reports that can be generated with PayrollHero.

.

1. Requirements to generate correct and complete government reports:

Before generating a report you must make sure to add all the relevant information on the employee profiles to allow the system to pull the data it needs for each of the reports.

The mandatory details per employee are:

- First Name

- Last Name

- Middle Name

- Birthdate

- Employee’s SSS, PhilHealth, Pag-ibig, BIR details and effectivity date (added via enrollments)

- Company’s BIR, SSS, PhilHealth and Pag-Ibig details updated (edited via bank enrollments page)

- Position

- Date of Employment

- Monthly Salary

Before you can generate any PhilHealth, SSS, Pag-ibig and BIR reports, you must generate payroll first. If you try to export the report without generating payroll, it will not show any data.

.

2. Generating the reports via the Payrolls Page

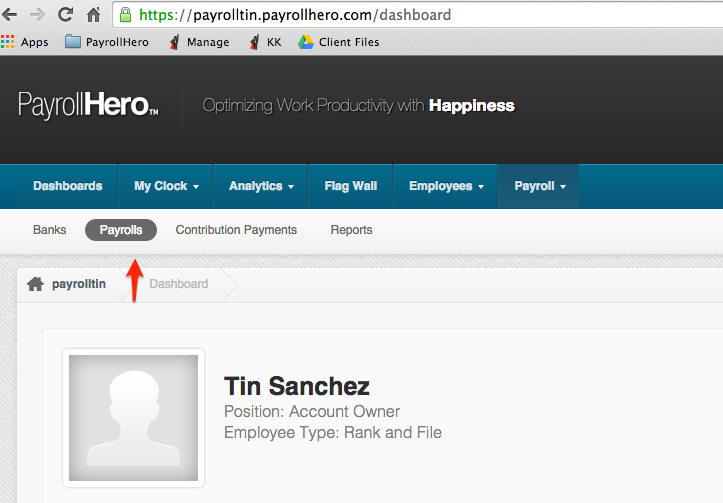

- Log in to your dashboard.

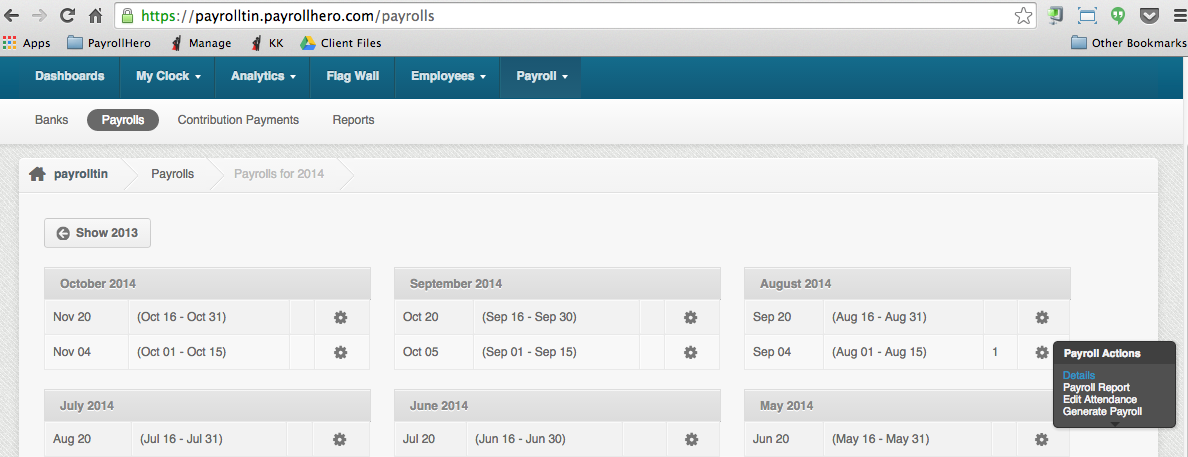

. - Click on the Payroll tab.

. - Select the pay period that you would like to generate the report – Hover into the gear tool and click on “Details”

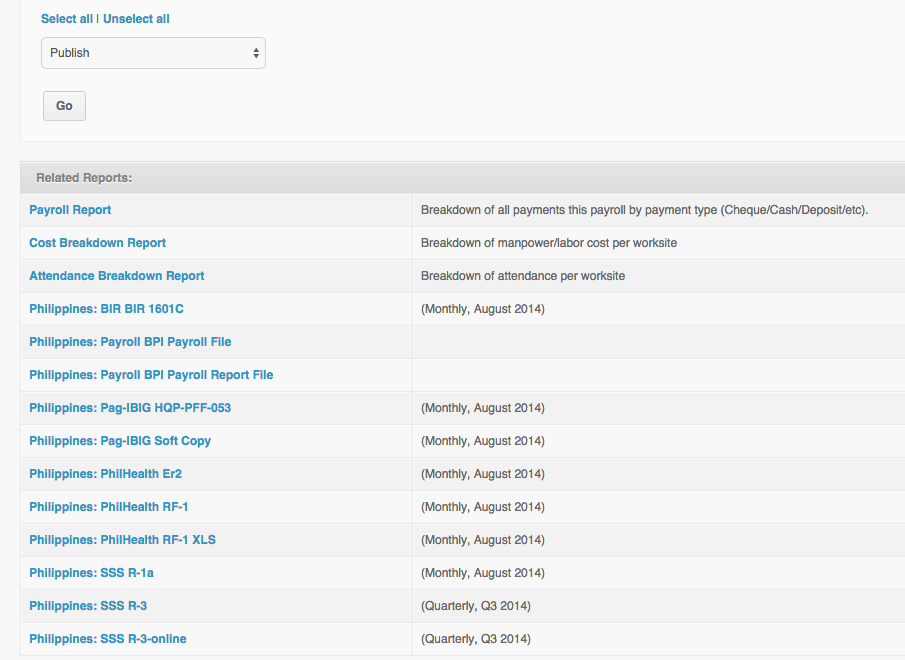

. - Scroll at the bottom of the page and you will see “Related Reports”

. - You will be able to see all the reports available for that pay period.

Note: If you already have generated payroll for two pay periods (monthly), then the reports will show a monthly report.

. - Click the desired report name to download to your computer!

.

.

3. Generating the reports via the Forms page

- Log in to your dashboard

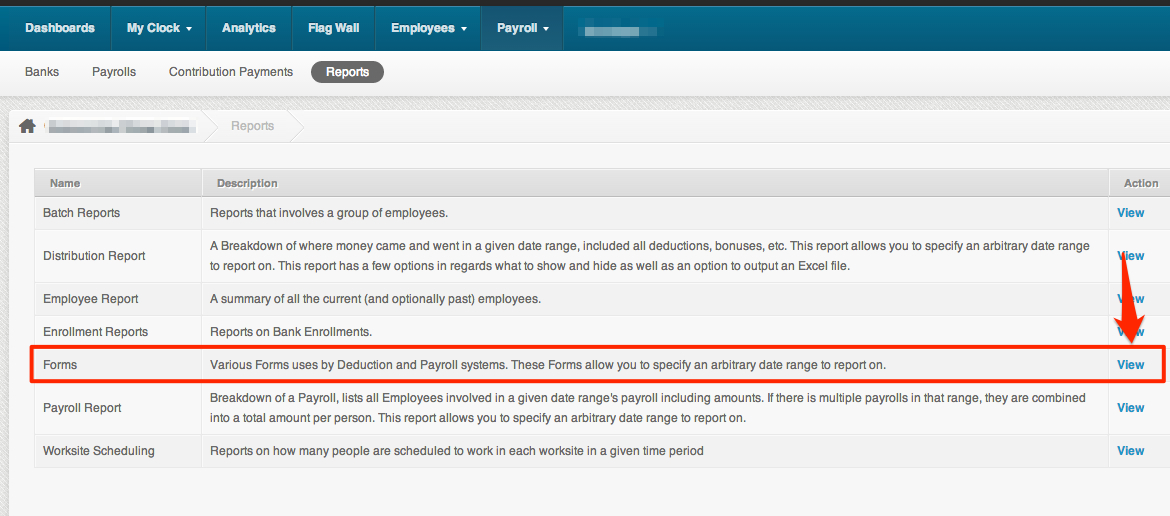

. - Go to “Payroll” tab

. - Go to Reports

. - Search for “Forms” and click “View”.

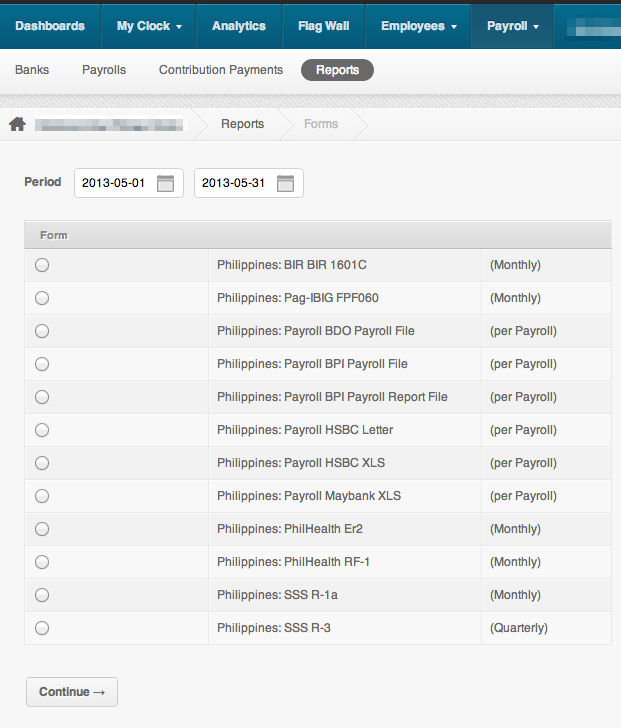

. - Set the start and end date of the month and select the reports you want to export:

. - The selected form will download!

.

.

4. Examples of Monthly Remittance Reports:

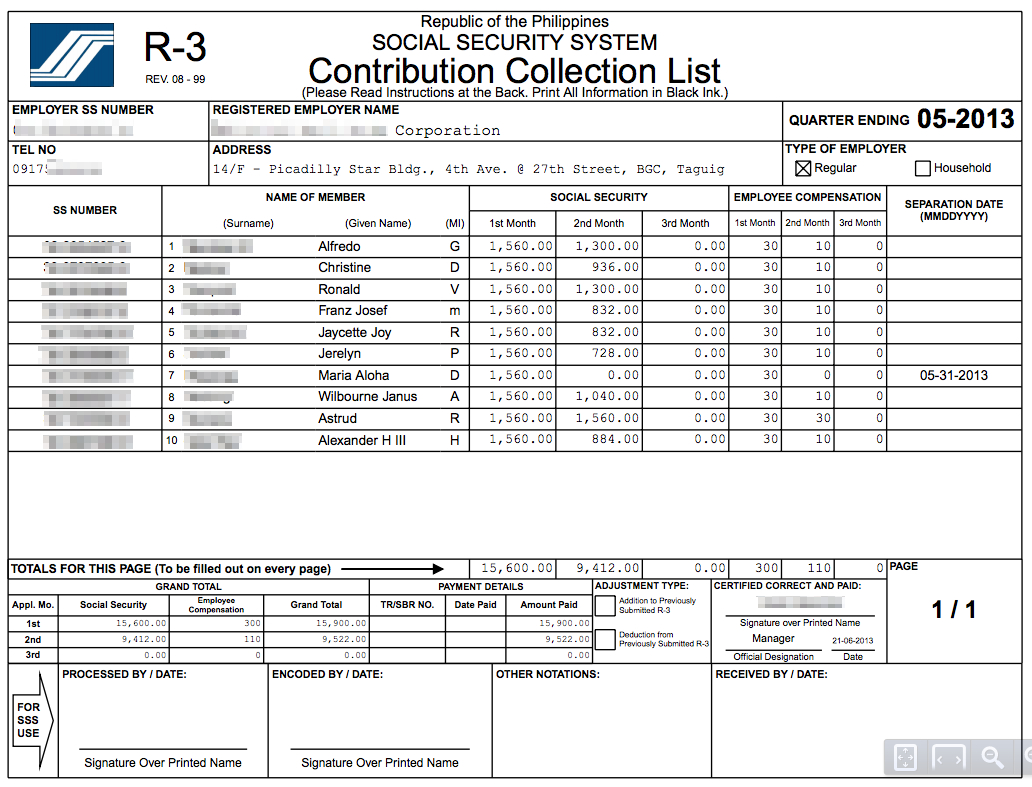

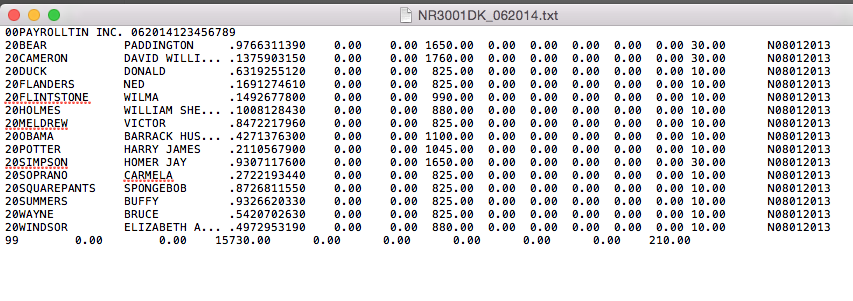

SSS R-3 (Contribution Collection List)

SSS R-3 online

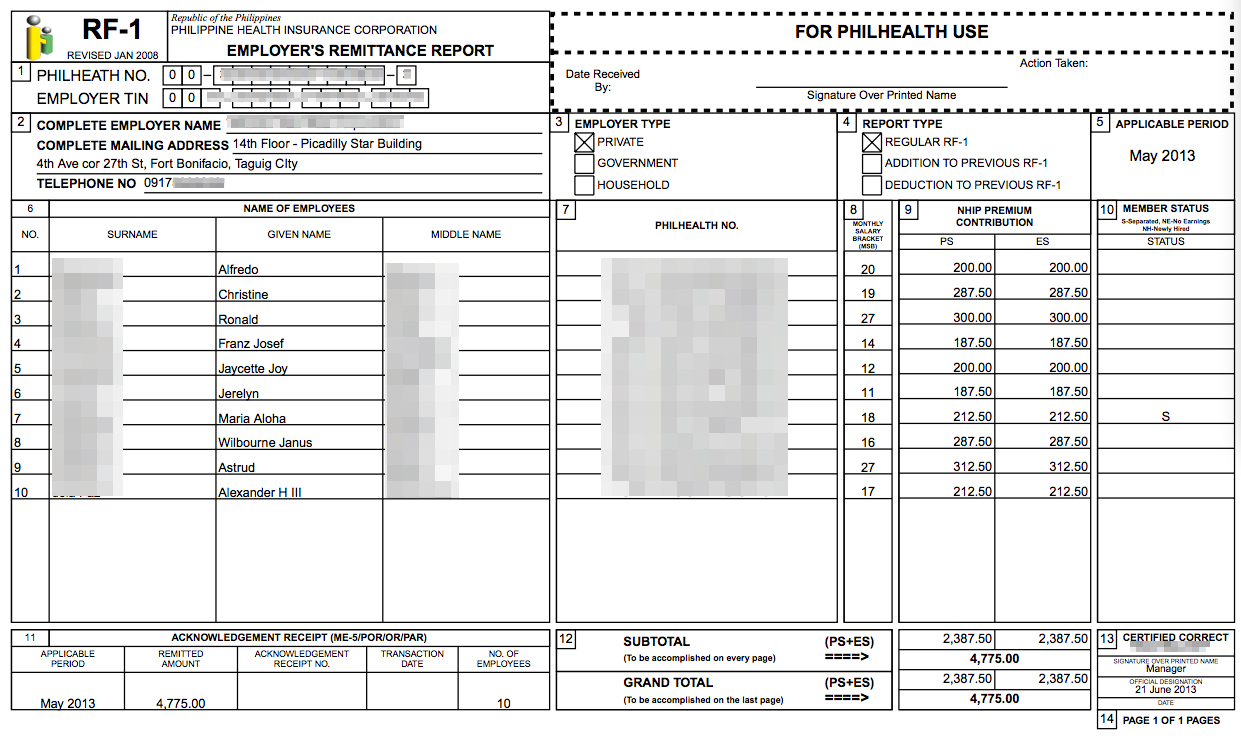

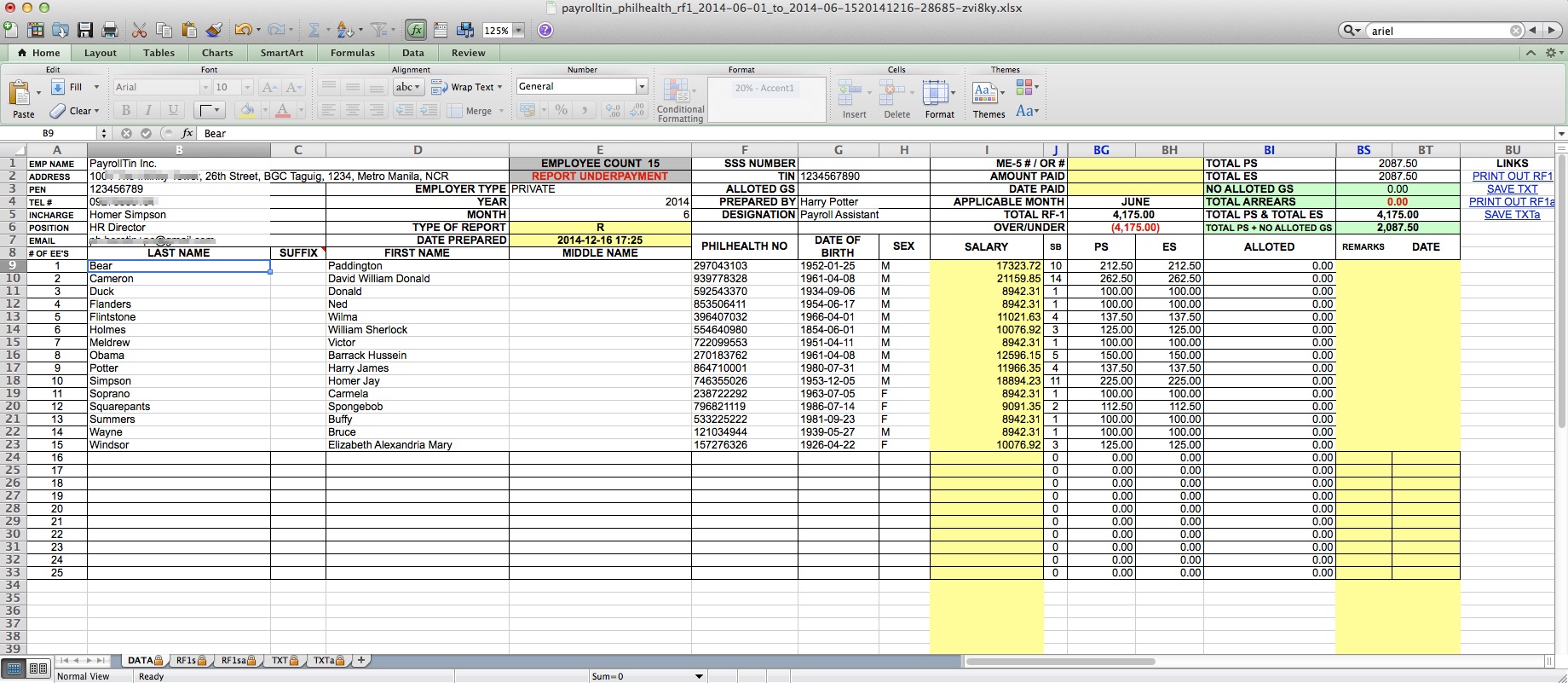

PhilHealth RF-1 (Remittance Report)

PhilHealth RF-1 XLS

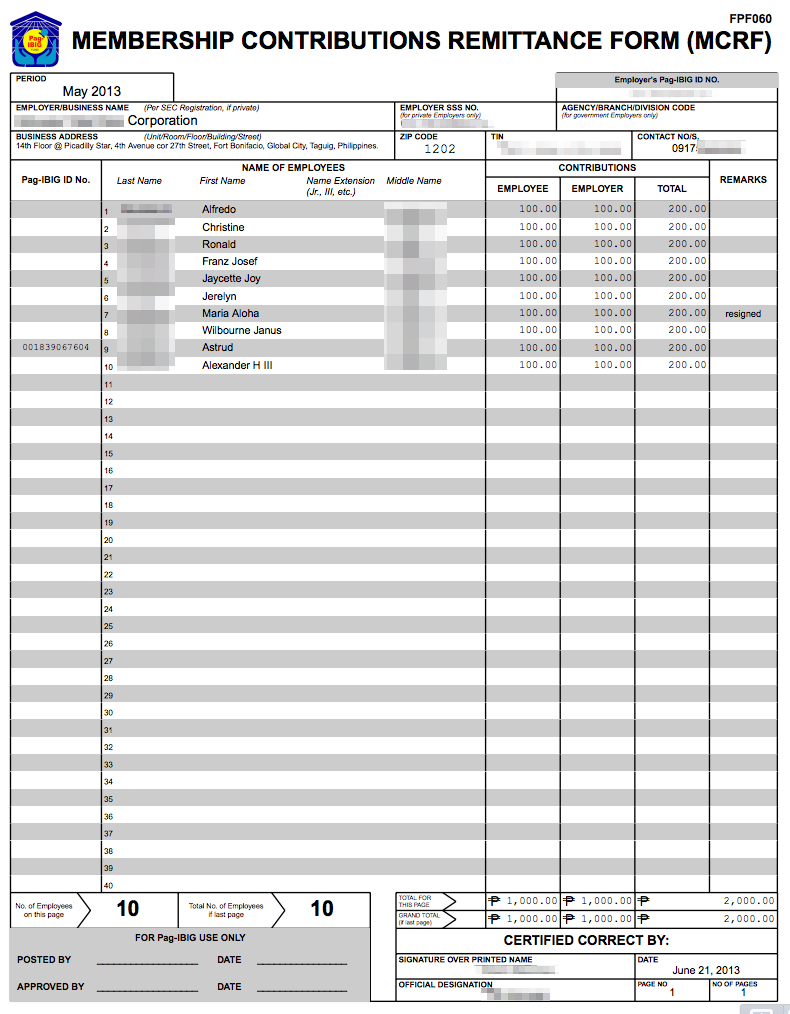

Pag-IBIG FPF060 (Remittance Report)

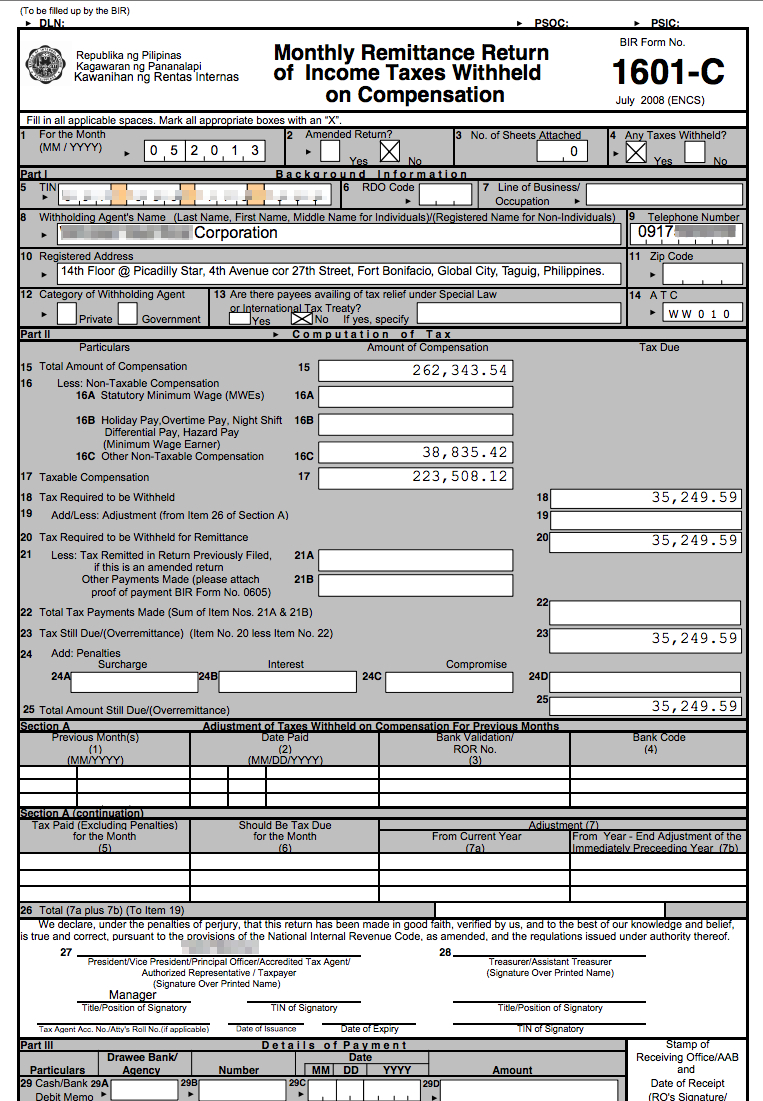

BIR 1601-C (Monthly Remittance Return of Income Taxas Withheld on Compensation)

SSS and PhilHealth’s (new) employment report

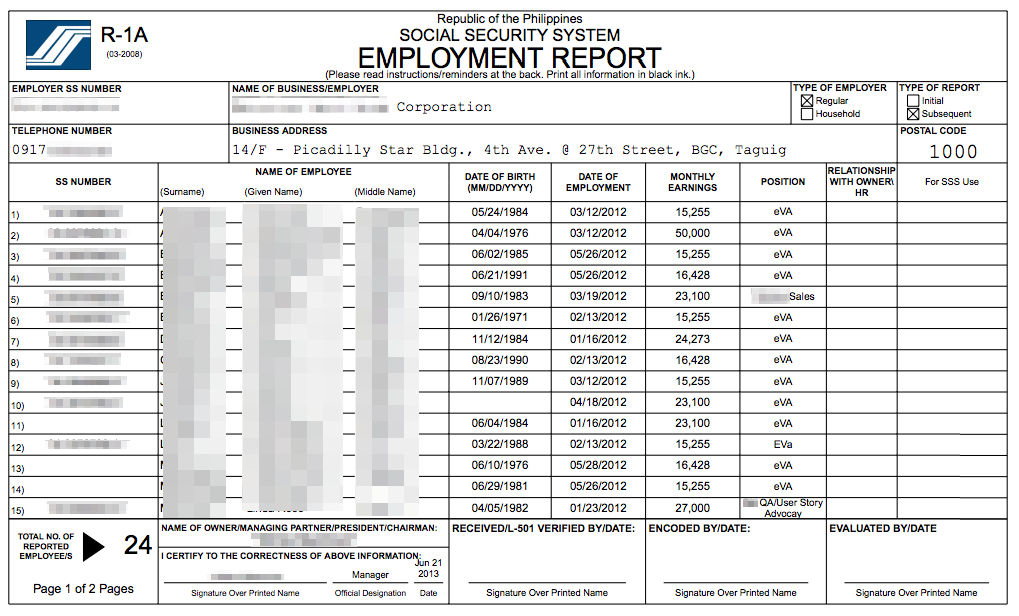

SSS R-1a

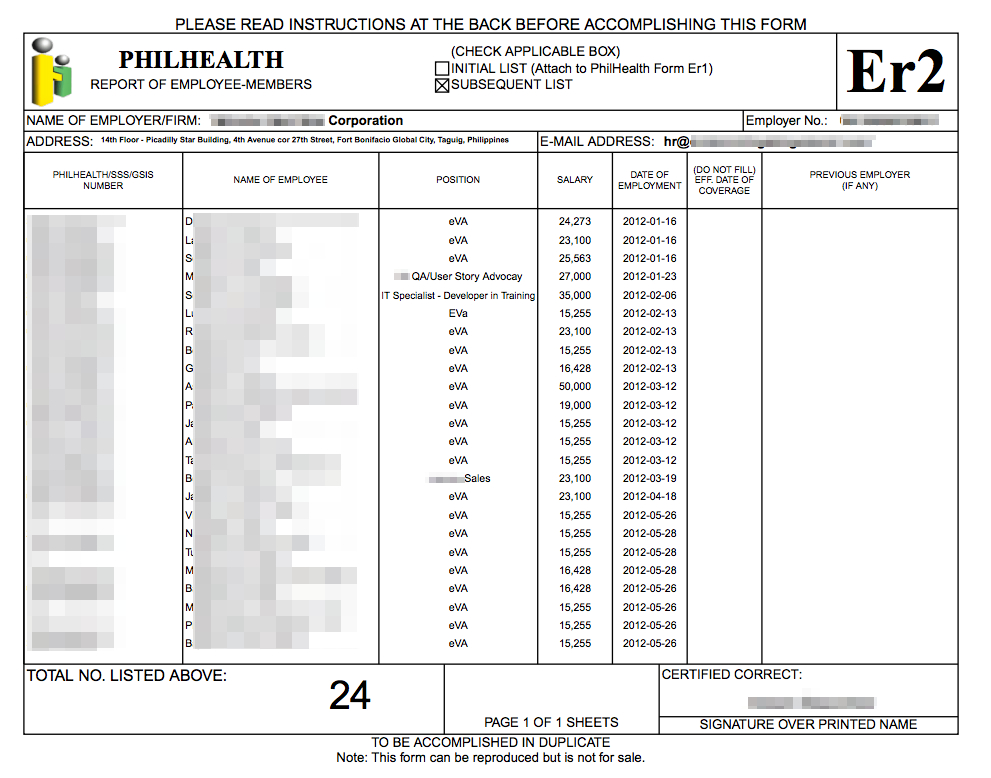

PhilHealth Er2

.

5. Other Reports:

With PayrollHero you can also export:

- Bank Payroll files: Further automate your operation with direct Payroll deposit on selected institutions.

- Quickbooks Journal Entries: Import your payroll items into your Quickbooks file for accounting.