There are instances where in HR/Payroll Admins would create a separate attendance adjustment payments on a different cut off period to correct the employee’s payroll. These adjustment payments should also be included on the 13th Month Pay of employees.

PayrollHero has now added an option to include attendance adjustments to the 13th Month Payment Feature.

How to add Attendance Adjustment payments to the 13th Month Payment Computation?

STEP 1: Make sure you have a specific bank being used when you create adjustment payments to your employees. Banks would keep a record of payments made to the employees. In this feature, the amounts on the payments recorded on the ‘bank’ you chose, will be added to the 13th Month Computation.

Once you know what banks you are using, you can then setup that bank to be included in the 13th Month Payment Computation. Here’s how:

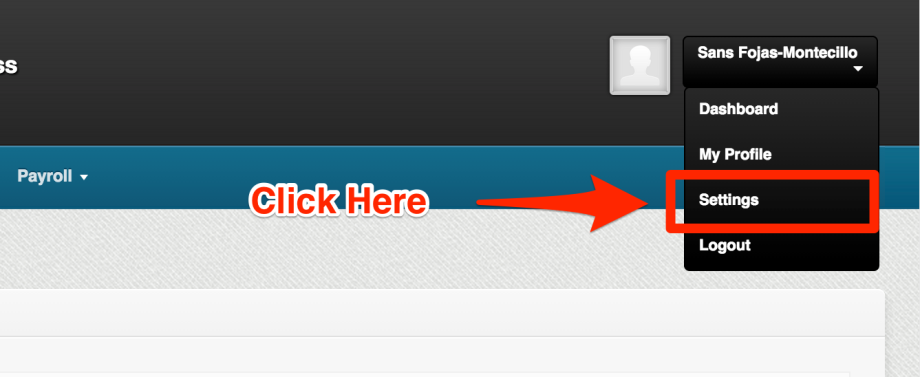

- Go to your Settings page.

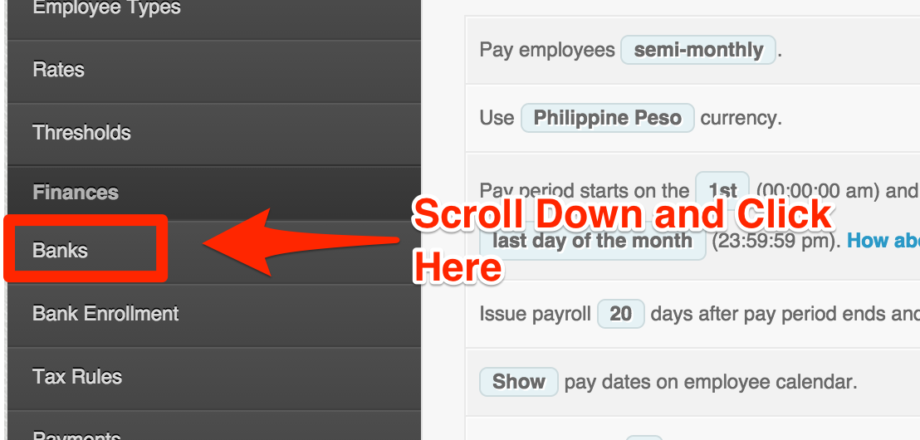

- Click on “Banks”

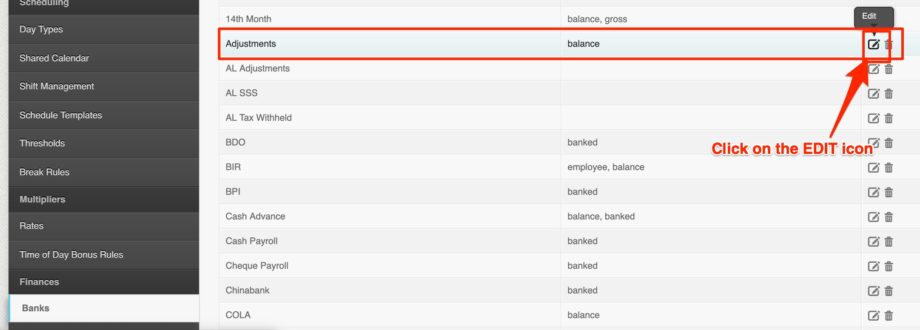

- “Edit” the ‘adjustment’ bank you are using:

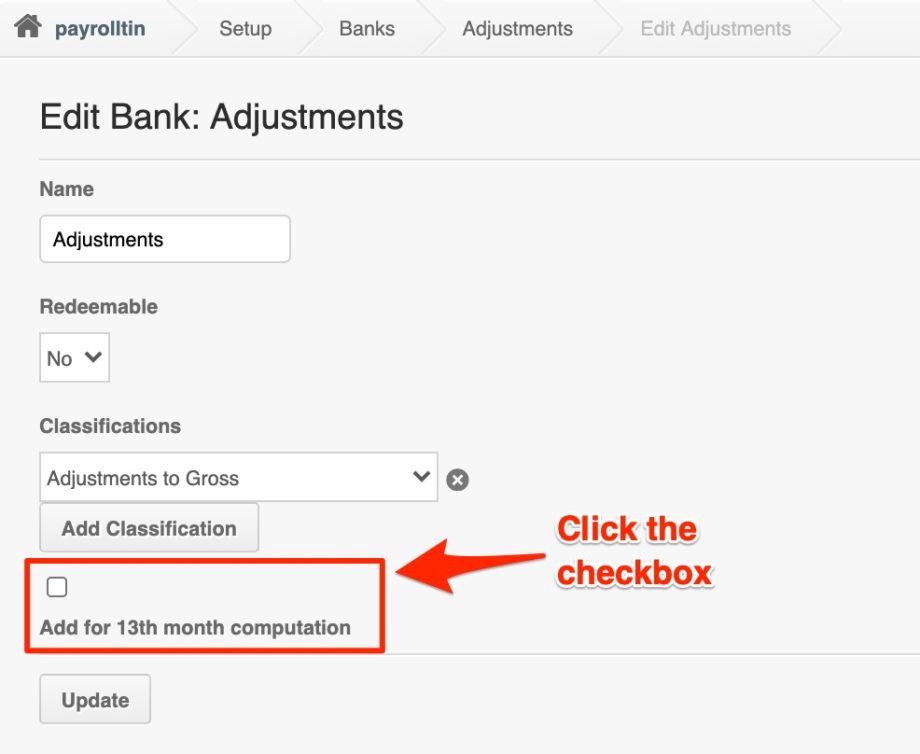

- You will then see a ‘checkbox’ to add the amounts on a specific bank to the 13th Month Payment Computation:

- Once you have clicked the checkbox, click on ‘Update’ and proceed to STEP 2.Note: Amounts inside the bank can be viewed on 2 different pages:

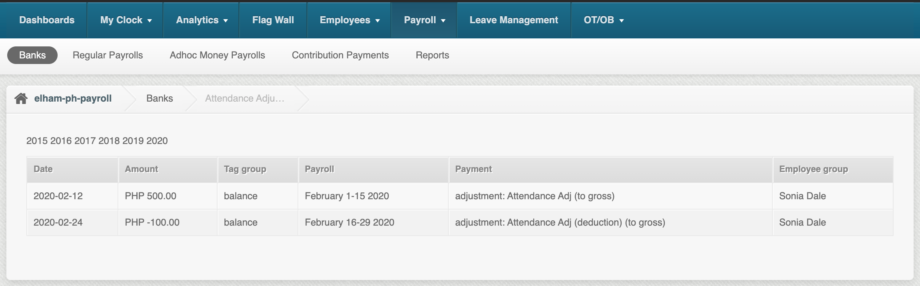

1. “Banks” page under the Payroll tab:

– Click on Payroll tab

– Click on ‘Banks’

– Click on the bank you’re using for the adjustment

– It will then show you a page that includes the amounts inside that bank and all employees that used the bank. See screenshot below:

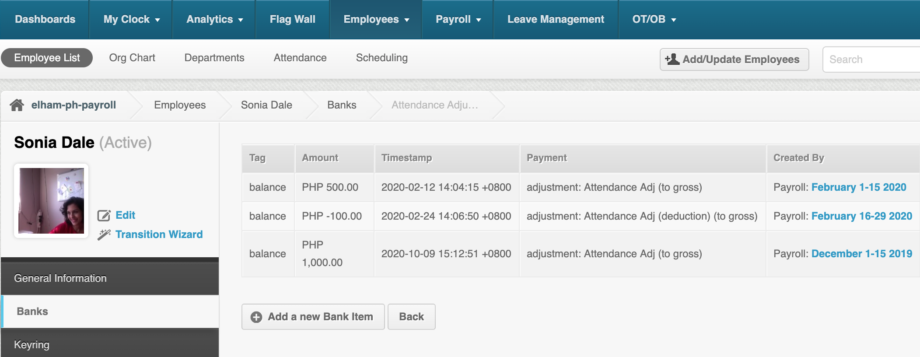

2. “Banks” page on the employee profile:

– Go to the Employee Profile

– Click on ‘Banks’

– Click on the bank you’re using for the adjustment

– It will then show you a page that includes the amounts inside that bank for the employee. See screenshot below:

Only bank amounts that is created (timestamp) within the 13th month period you selected will be included on the adjustments.

STEP 2: Generating the 13th Month Payment including the adjustments. Here’s how:

- Make sure that employee’s payslip / payrolls are FINALIZED.

- If payrolls are not finalized, you won’t be able to generate the 13th month pay. Here’s how you can finalize a payroll / payslip – Philippine Payroll Guide: Publishing Payslips and Finalizing Payroll

- Only payrolls that are finalized will be included in the 13th Month Payment Computation.

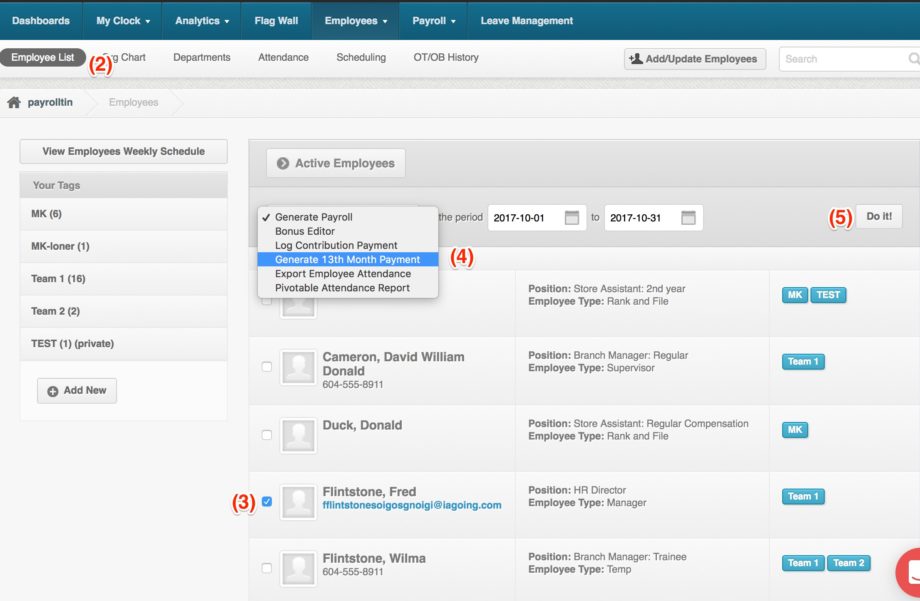

- Go to the Employee List

- Select the employees you want to generate the 13th month payment.

- On the drop down, select “Generate 13th Month Payment”

- And click on “Do It”. See screenshot below:

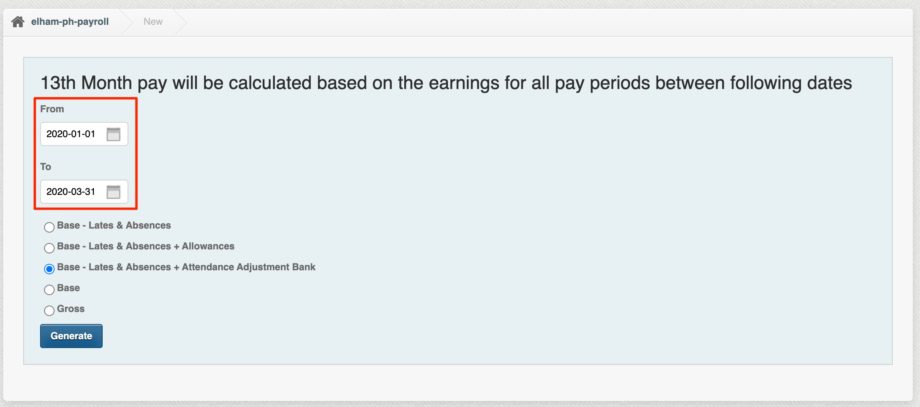

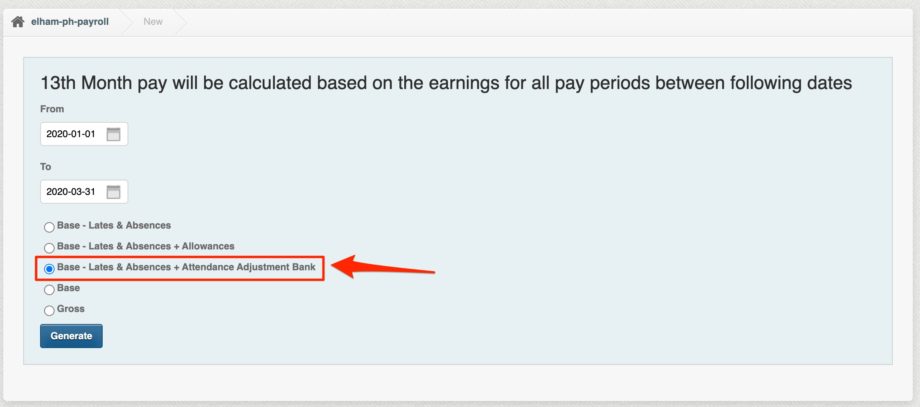

- It should then redirect to a page where you can choose how you want the system to compute your 13th month pay:

- Using the employee’s BASE pay only.

- Using the employee’s GROSS pay only.

- Using the employee’s BASE pay but LESS the lates and absences.

- Using the employee’s BASE pay LESS the lates and absences PLUS all allowances.

- Using the employee’s BASE pay LESS the lates and absences PLUS attendance adjustment

- Select the specific period that you will use for the 13th Month:

- Select “Base – Lates & Absences + Attendance Adjustment Bank”

- Only the amounts recorded on the attendance adjustment bank within the period you selected will be included in the 13th Month Payment Computation.

- Click on “Generate”

- This will generate the 13th Month Computation based on the specific period you selected.

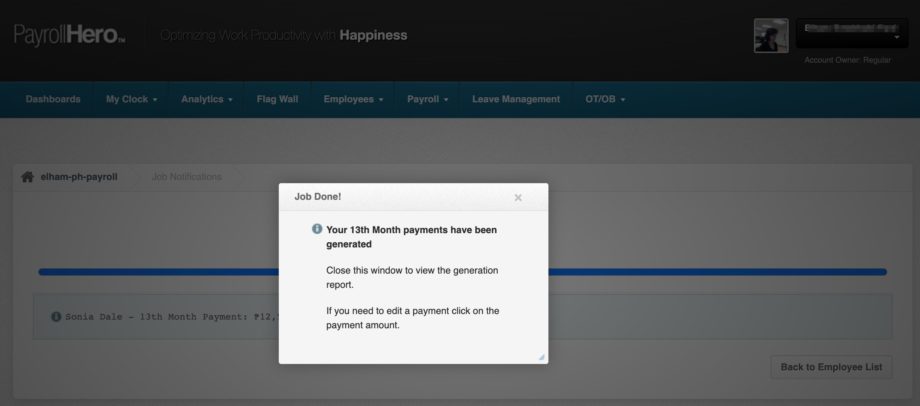

- After that, it should redirect you to the ‘Job Notification’ page that shows the list of employees it generated and let’s you know once that is done:

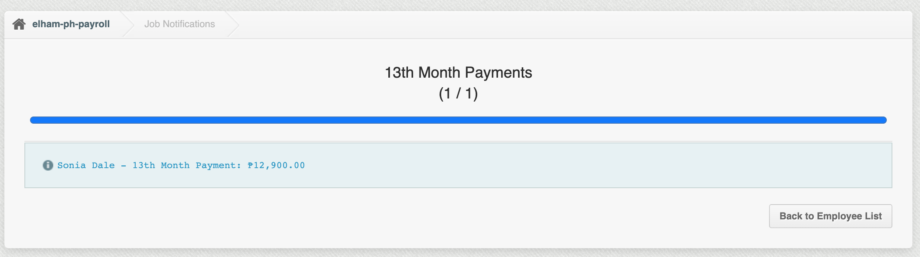

- If you close the pop up, it will show the employee’s name with the 13th month amount it generated.

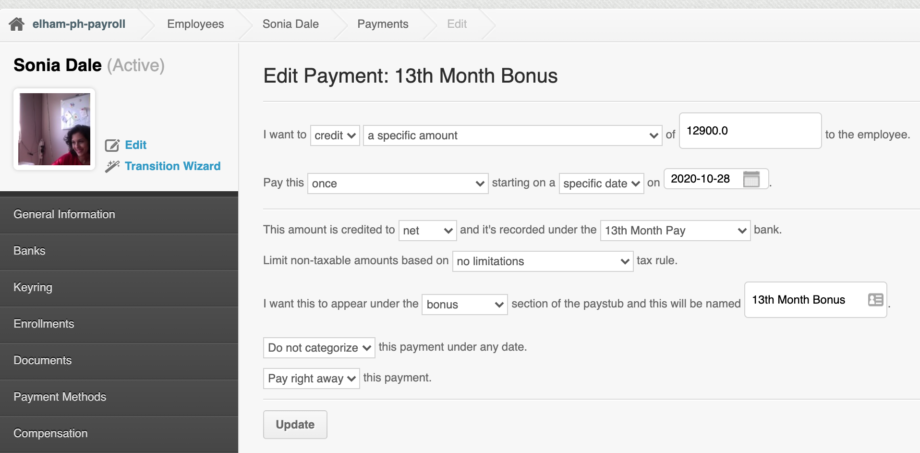

- If you would like to edit the payment, you can hover your mouse pointer to the employee name, and click on it to open the 13th month payment:

Sample computation of the 13th Month Payment for 3 months (January – March 2020)

- Adjustment amount: P400

- Employee’s Base Pay: P50,000

- 13th Month Payment: P12,900

50,000/12

= 4,166.66666666674,166.6666666667 x 3 months (Jan-Mar)

= 12,500 + 400 (adjustment)

= 12,900

The 13th Month Payment is now generated on the employee’s payments page. This will be included on the employee’s payslip once you generate the payroll.

And that’s it! You’ve now generated the employee’s 13th month payment!

If you have any questions, feel free to email support@payrollhero.com.