According to the DOLE handbook (Revised 2020), the basic salary of an employee for the purpose of computing the 13th month pay shall include all remunerations or earnings paid by his employer for services rendered. It does not include allowances and monetary benefits which are not considered or integrated as part of the regular or basic salary, such as the cash equivalent of unused vacation and sick leave credits, overtime, premium, night differential and holiday pay, and cost-of-living allowances. However, theses salary related benefits should be included as part of the basic salary in the computation of the 13th month pay if by individual or collective agreement, company practice or policy, the same are treated as part of the basic salary of the employees.

“Total basic salary EARNED during the year” means the actual salary they received. Employees don’t earn from the deductions due to tardiness/undertime.

And thus, PayrollHero have the following 13th month computations…

- Using the employee’s BASE pay only.

- Using the employee’s GROSS pay only.

- Using the employee’s BASE pay but LESS the lates and absences.

- Using the employee’s BASE pay LESS the lates and absences and includes ALL allowances.

To try out PayrollHero’s 13th Month Payment Feature, please email us at support@payrollhero.com to enable this for you.

The requirements to generate the 13th month are as follows:

- Payrolls / payslips needs to be finalized.

- If payrolls are not finalized, you won’t be able to generate the 13th month pay.

- No need for the 13th month enrollment.

- Generating the updated 13th month pay options doesn’t need any existing enrollment on the employee profile, this means it will not use the 13th month enrollment or accrued amounts as it automatically computes using the employee’s base pay less lates and absences or including the allowance.

- The period that the 13th month uses the specific dates you select. Only payrolls within that period will be included to the 13th month payment computation.

Sample computation for the 13th Month Payment with Specific Periods:

January 1, 2020 up to June 30, 2020 (6mos)

Monthly Base Pay: 10,000

Per Pay Period Base Pay: 5,000

Computations:

Per Pay Period 13th Month Base Rate:

5,000/12months = 416.6666666667

13th Month Payment Computation:

= 5,000 / 12 months x # of pay periods

= 416.6666666667 x 12 pay periods

= P5,000- NOTE: We have now released a feature to include the option to select specific dates that you would like to include on the 13th month payment computation. This is on beta release and is available by emailing support@payrollhero.com. We will fully release this to all PayrollHero accounts by end of October 2020.

How to generate the 13th Month Pay?

- Make sure that employee’s payslip / payrolls are FINALIZED.

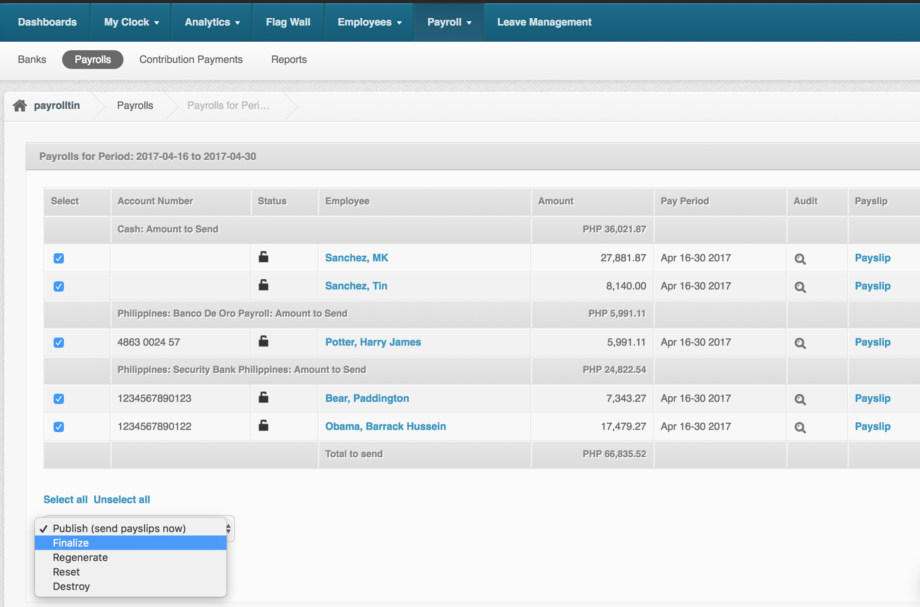

There’s 2 ways to finalize a payroll…- On the Payrolls page

– Go to the Payroll tab

– Click on the Payrolls page

– Click on a specific pay period

– On the drop down under the employee’s payroll details, choose “Finalize” and click on Go. (see screenshot below)

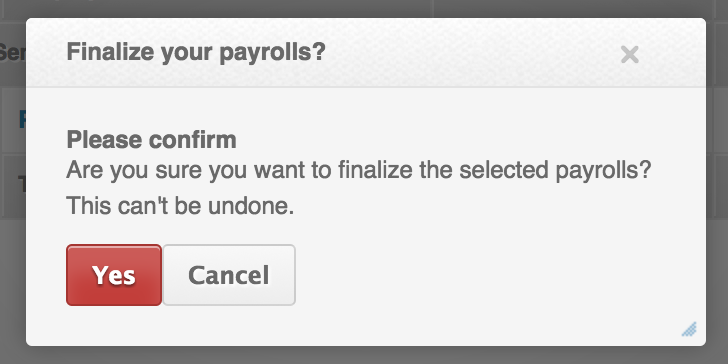

– A pop up should appear, click YES

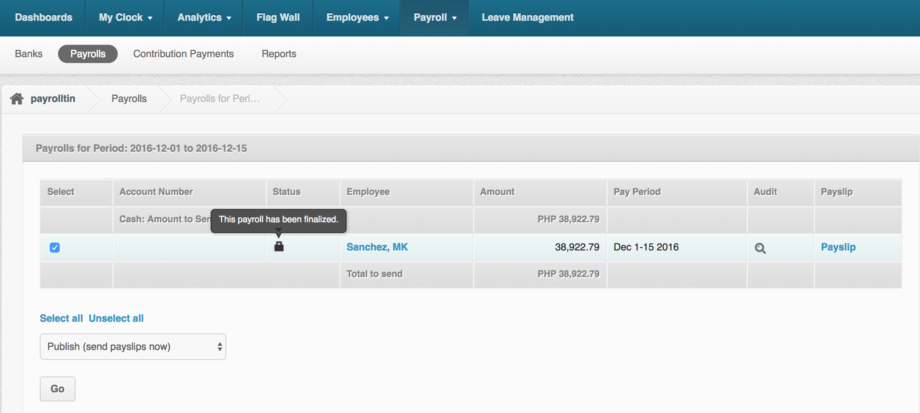

– And that should finalize the payslip

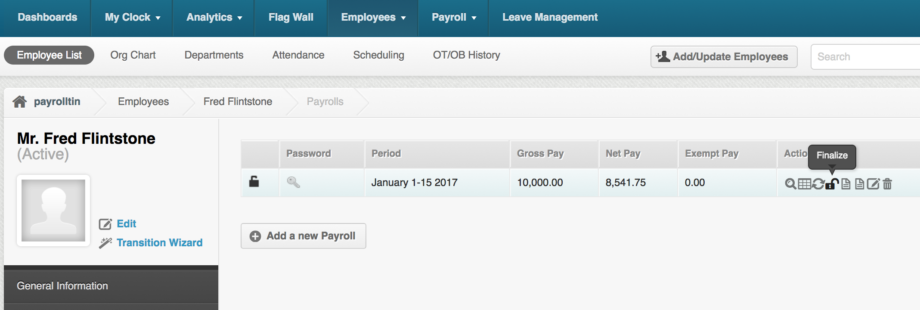

- On the Employee Profile

– Go to the employee profile.

– Click on the Payrolls page.

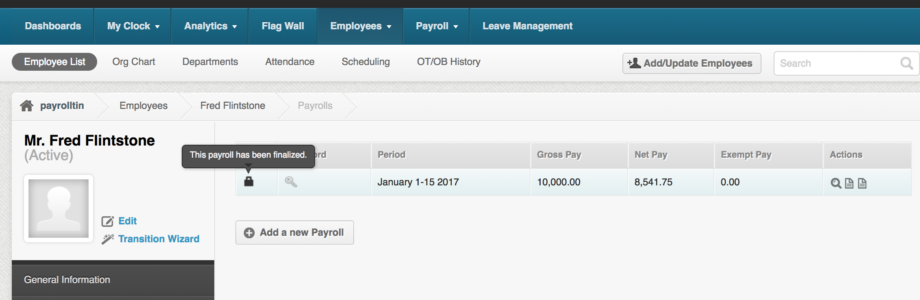

– Click on the “keylock” unlocked icon to ‘Finalize’ the payroll. See screenshot below

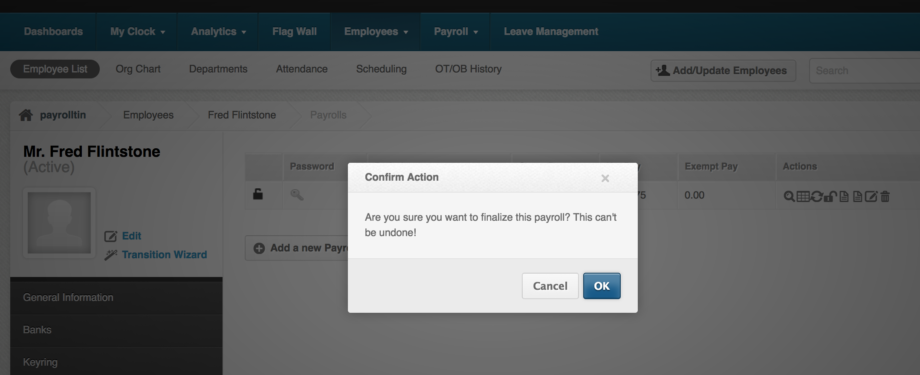

– It should the show a pop up like this

– Click OK, and it should then finalize the payslip showing a locked keylock like the screenshot below:

Here’s how you can finalize a payroll / payslip – Philippine Payroll Guide: Publishing Payslips and Finalizing Payroll

Here’s how you can finalize a payroll / payslip – Philippine Payroll Guide: Publishing Payslips and Finalizing Payroll

- On the Payrolls page

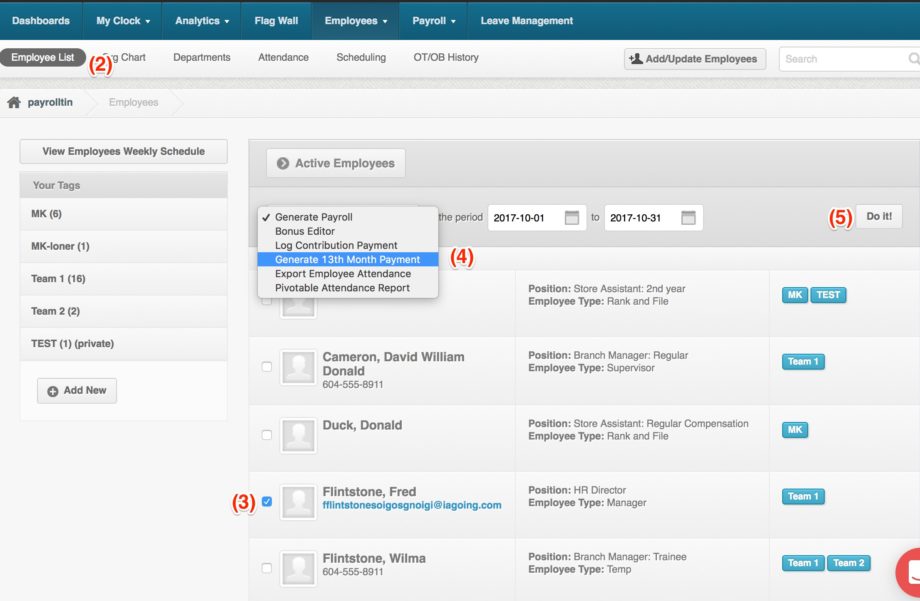

- Go to the Employee List

- Select the employees you want to generate the 13th month payment.

- On the drop down, select “Generate 13th Month Payment”

- And click on “Do It”. See screenshot below:

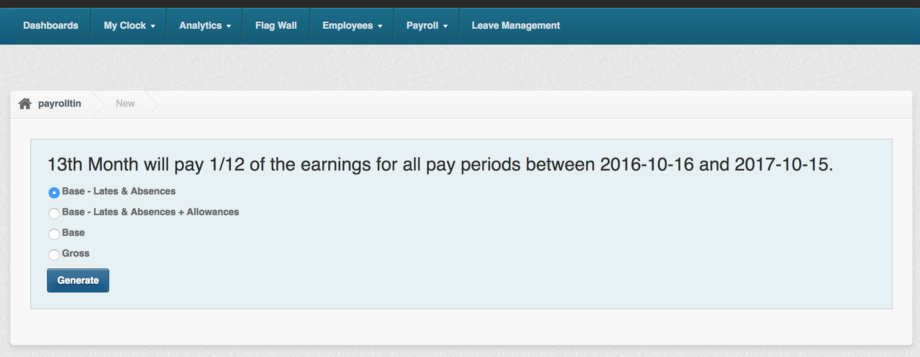

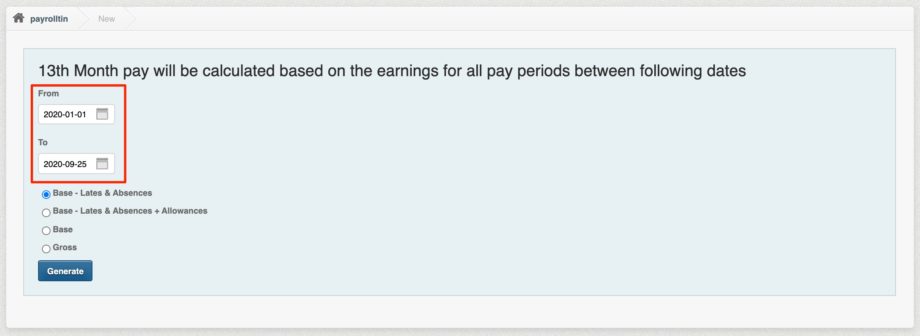

- It should then redirect to a page where you can choose how you want the system to compute your 13th month pay:

UPDATE: We have now released a feature to include the option to select specific dates that you would like to include on the 13th month payment computation.

- Click on “Generate”

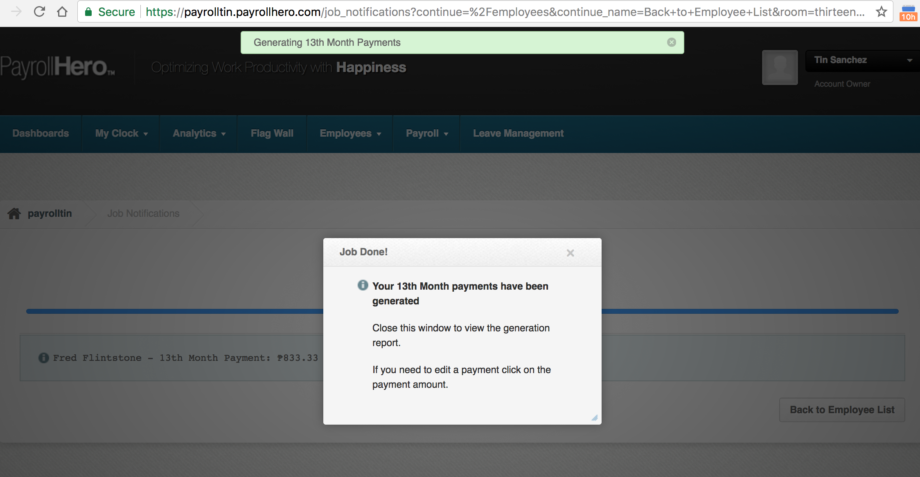

- It should redirect you to the ‘Job Notification’ page that shows the list of employees it generated and let’s you know once that is done:

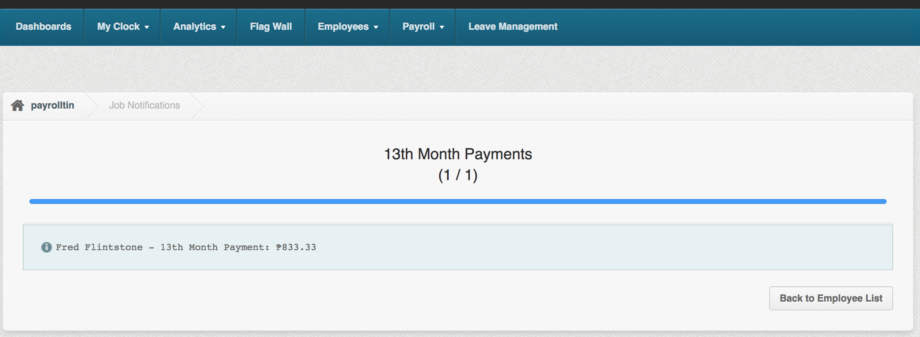

- If you close the pop up, it will show the employee’s name with the 13th month amount it generated.

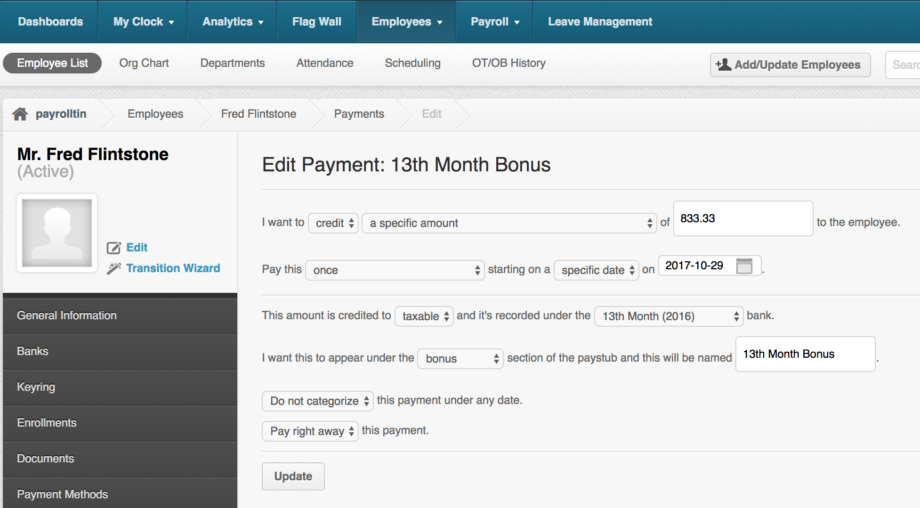

- 13th Month Payment is now generated on the employee’s payments page. This will be included on the employee’s payslip once you generate the payroll.If you would like to edit the payment, you can hover your mouse pointer to the employee name, and click on it to open the 13th month payment:

13th Month Payment (for 1 month)

13th Month Payment (for 1 month)

- 13th Month Bonus Payment: P833.33

= 5,000 / 12 months x # of pay periods

= 416.6666666667 x 2 pay periods

= 833.33

- 13th Month Bonus Payment: P833.33

- If you’re happy with the amount, click on ‘Update’ and then generate the payroll to include the 13th month pay on the employee’s salary.

And that’s it! You’ve now generated the employee’s 13th month payment!

If you have any questions, feel free to email support@payrollhero.com.