If employees get paid a monthly rate and divide that per cut off period… The Rest Days are not deducted. The system pays the same way if they start in the middle of the cut off…

The way the system computes the employees salary if they start in the middle of the pay period is that PayrollHero uses the same computation when it pays them the Semi Monthly Rate which is a fixed amount.

But with employees starting in the middle of the cut off, it computes using the Total Days for that Pay Period and then multiplies it using the employment date till the end of the cut off period.

SALARY INCREASE

Original Salary: 14093.83

= (Semi-Monthly Rate/Total Days for that Pay Period) x Hire Date

= (7046.915 / 16) 7days

= 440.4321875 x 7

= 3083.0253125 or 3083.03

Salary Increase: 18,000 monthly salary

= (Semi-Monthly Rate/Total Days for that Pay Period) x Hire Date

= (9000 / 16) x 9 days

= 562.5 x 9

= 5,062.50

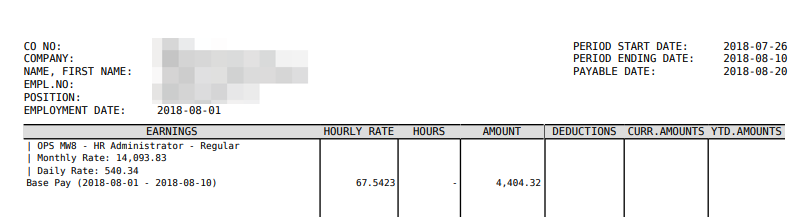

NEW HIRES

Cut off: July 26-August 10

Employment date: August 1

Initial Salary: 14,093.83

= (Semi-Monthly Rate/Total Days for that Pay Period) x Hire Date

= (7046.915 / 16) 10 days

= 440.4321875 x 10

= 4404.321875 or 4404.32

If you have any further questions or suggestions do not hesitate to contact us at support@payrollhero.com.