If you would like to deduct a fixed amount for your BIR deduction, you would need to do this on the Payments page of the Employee profile.

Here’s how to set it up:

- Go to the Employee profile

- Click on Payments page

- If you have the BIR (Strict or Smart Tax table) set up globally, it would be best to disable the payment for those employee’s who will be using a fixed amount for their BIR deduction.

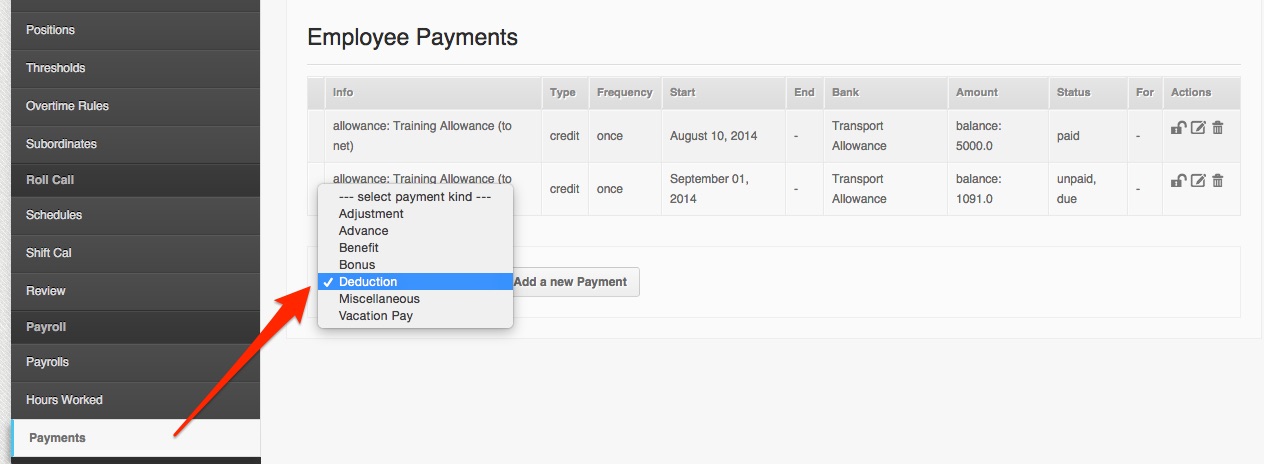

- Under the “Employee Payments” select the payment kind “Deduction” and click on ‘Add a new payment‘. See screenshot below:

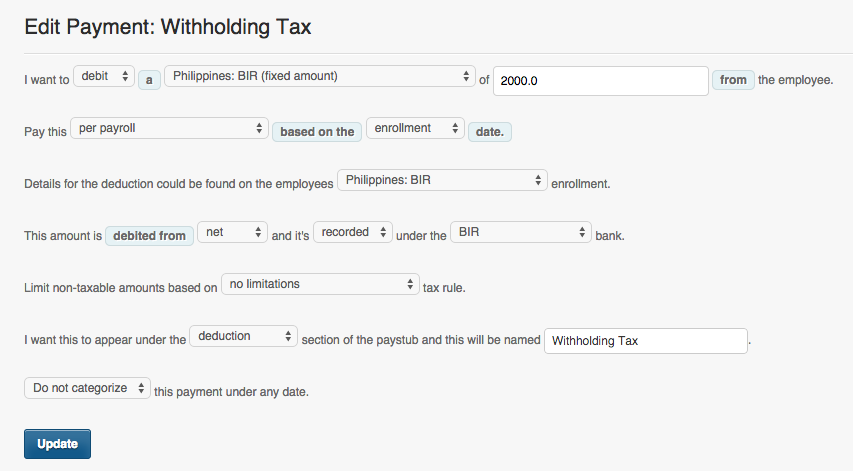

- On the deduction payment, choose the following settings:- I want to “debit” a “Philippine: BIR (fixed amount)”

– Pay this “Per payroll” based on “Enrollment” (make sure the employee has the BIR enrollment.)

– Select the “Philippines: BIR” enrollment.

– The amount is debited from “Net” and is recorded under the “BIR” bank.

– Add the employee’s BIR fixed amount on the field on the first row.

– Name the BIR deduction to any name you want it.See screenshot below:

- Once you’re done, click on “Create” and that’s it!

- The BIR (Fixed amount) feature should deduct fixed amount per payroll and should show up on the BIR 1601C.

If you have any questions, feel free to contact support@payrollhero.com