The Rates Page

The Rates Page is where the PayrollHero system learns what amount of pay an employee type should receive for working (or paid day off), or not working or “taking” (absent, unpaid day off), a particular Type of Day.

For example:

What pay should an employee receive for working on a holiday?

What pay should the employee receive for not working on a holiday?

What pay should the employee receive for working on a rest day?

All this can be configured via the Rates page.

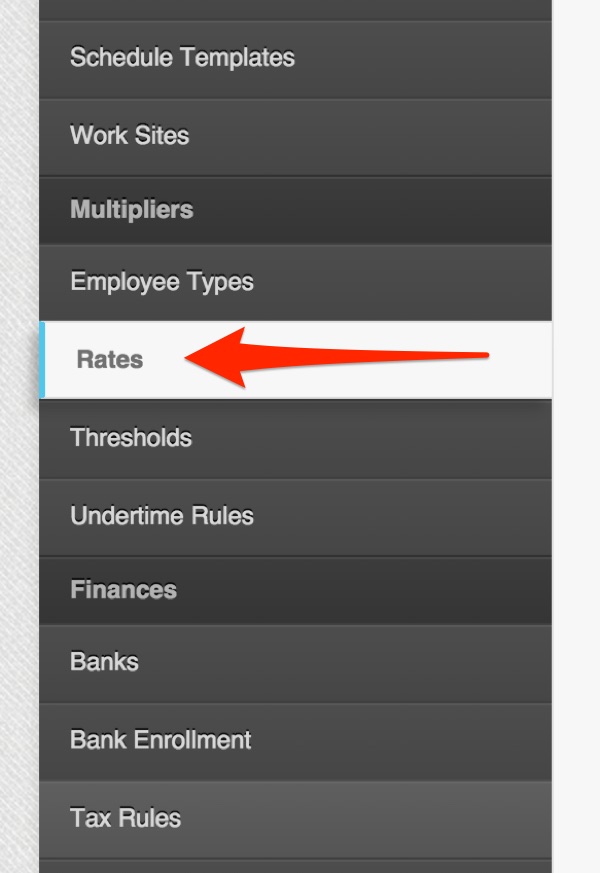

To configure the Rates for your account:

1. Go to your Account Settings

2. On the left side menu click on “Rates” under the Multipliers section.

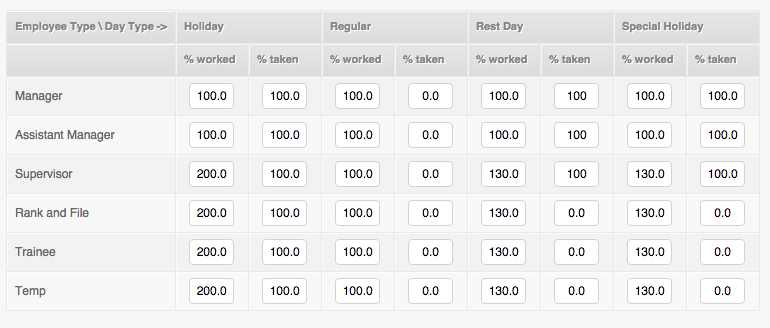

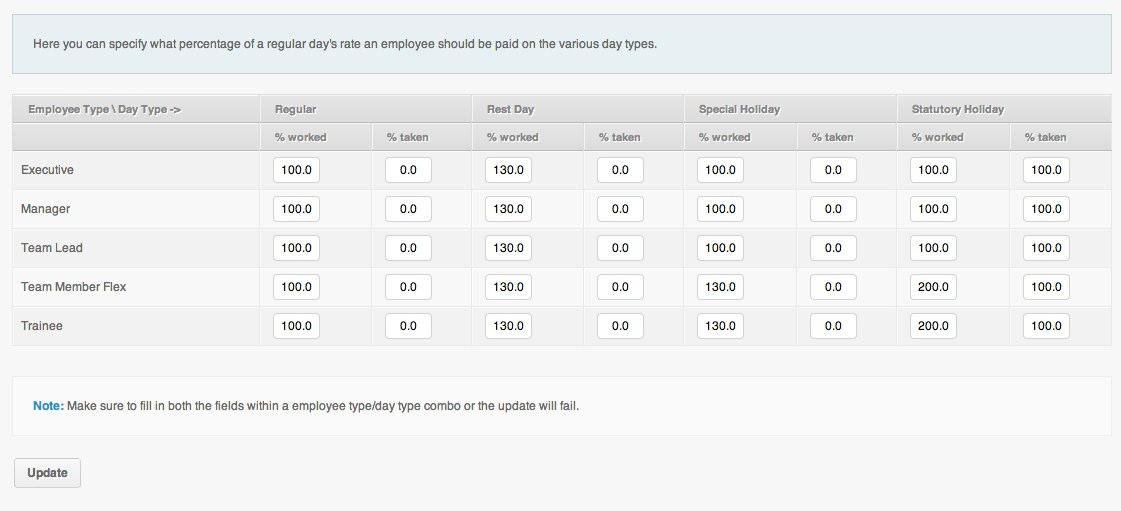

3. A page similar to this one will open.

On the left side you will see a list of all the Employee Types existing on the account.

Next to that is the day types divided by Worked and Taken:

- “% Worked” Is the multiplier for the employee type if they work on that day type.

- “% Taken” is the multiplier for the employee type if they do not work on that day type.

Note that the rates are calculated as percentages.

Differences between Hourly Pay Mode vs Monthly Pay Mode on Rates Page.

MONTHLY PAID EMPLOYEE refers to one who is paid his wage or salary for every day of the month, including rest days, Sundays, regular or special days, although he does not regularly work on these days. (Source: Dole Handbook)

The Rates Page works differently depending on the employee Pay Mode.

Monthly Paid: Setting a rate as 0 for a Monthly pay mode employee tells the system to DEDUCT from their salary for that day. Setting a rate as 100 will neither deduct or over credit for a day type. Setting a rate as 200 will pay an additional 100% of the hourly wage for the hours worked that day, on top of the salary.

Hourly Paid: Setting a rate as 0 for a Hourly pay mode employee tells the system to not credit for that day. Setting a rate as 100 will pay the rate per hour set on the compensation page. Setting a rate as 200 will pay twice the rate per hour set on the compensation page.

Examples based on DOLE regulation (Hourly Mode Employees):

- Regular Holiday: On a Regular Holiday a Rank & File employee should receive 200% of his hourly wage if he works that day and 100% of his hourly wage if he does not work that day. (its a paid day off)

- Special Holiday: On a Special Holiday a Rank & File employee should receive 130% of this hourly wage if he works that day and 0% of his hourly wage if he does not work that day. (its an unpaid day off)

- Regular day: On a Regular work day a Rank & File employee should receive 100% of his hourly wage if he works that day and 0% of his hourly wage if he does not work that day. (no work, no pay)

Examples based on DOLE regulation (Monthly Mode Employees):

- Regular Holiday: On a regular Holiday a Rank & File employee should receive 200% their hourly wage if they work the day, and 100% of their hourly wage if they don’t. (its a paid day off, and considered in their salary)

- Special Holiday: On a Special Holiday a Rank & File employee should receive 130% of this hourly wage if he works that day and 100% of his hourly wage if he does not work that day. (its a paid day off, and considered in the salary)

- Regular Day: On a Regular work day a Rank & File employee should receive 100% of his hourly wage if he works that day and 0% of his hourly wage if he does not work that day. (should be deducted from his fixed salary if he is absent or unpaid day off)

.

Common Example Setting of a mix between Monthly Pay mode and Hourly Pay mode:

On the following screenshot we have a common company set up:

The Manager, Assistant Manager and Supervisor Type employees Pay Mode is Monthly

The Rank and File, Trainee and Temp are on Hourly Pay Mode.

- On a Regular Day, being absent is deducted from the monthly mode employees salary, and is not credited for the hourly mode employees.

- On a Holiday, being absent is not deducted for the monthly mode employees, and its compensated for the hourly mode employees.

- On a Special Holiday, being absent is not deducted from the monthly mode employees, and its not credited for the hourly mode employees.

This concludes the ‘How to Set Up Rates’ article. You should now be able to set up rates, confidently!

To learn how rates are calculated, please check the following article: How Do I Compute the Holiday Pay and Rest Day Pay?