Employee Types will filter your employees when it comes to how long they work in a day or in a week. You may also set up a specific employee type who should not be entitled to deductions. There are default Employee Types that are System generated, you can edit them.

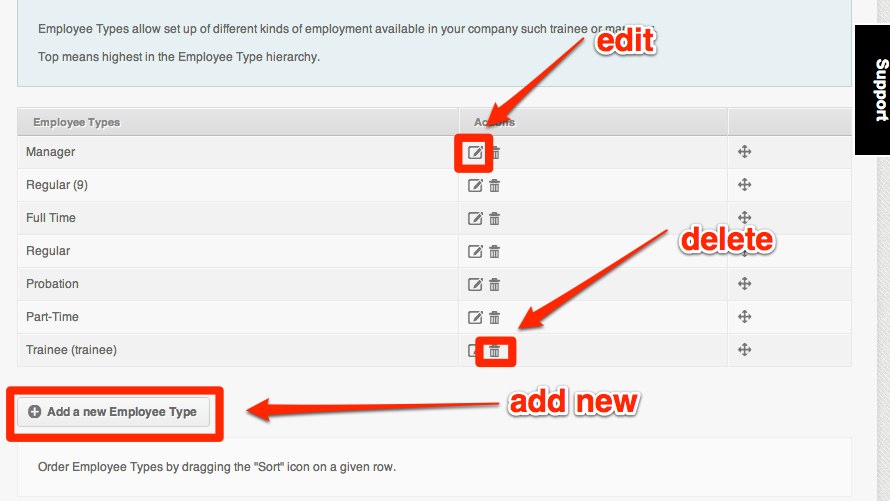

These are general types like Trainees, Part-time, Probationary, Regular and Manager but you can name them anything you like.

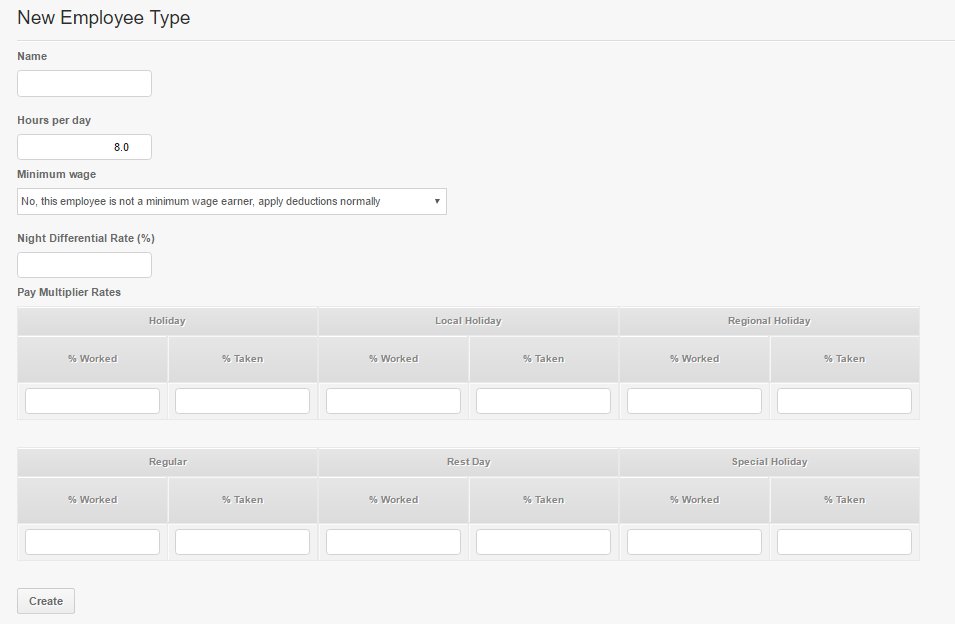

- Name

- Hours per day – The number of hours per day they are expected to work each day. It is also use to set the number of hours they are paid on a paid holiday.

- Minimum Wage – If the employee type is a minimum wage earner so the tax deduction wouldn’t be applied.

- Night Differential Rate – The percentage of the night differential bonus for the employee type

- Pay Multiplier Rates – Rates for the different Day Types (Worked & Taken)

Here’s how to set up the employee types:

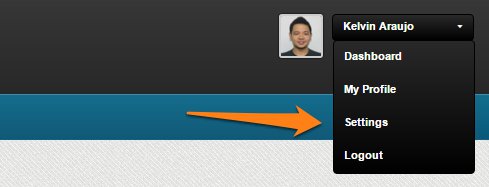

1. Go to Settings.

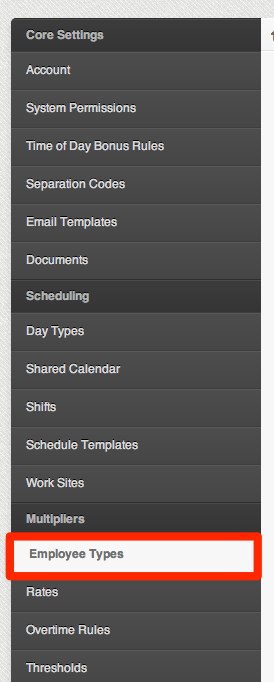

2. Click on Employee types below Multipliers

3. Click on the Add new Employee type. See illustration for other options:

4. Fill up the correct details for the Name, Hours/Day, Minimum Wage, ND Rate & Pay Multiplier Rate

5. Click ![]() to add the set up employee type.

to add the set up employee type.

After setting up a new employee type, remember to configure the following items:

- Thresholds and Employee Grace Period

- If you will have a special OverTime rule for this employee type, please contact us at support@payrollhero.com so we can assist you with this setup.

This concludes the article on How to set up Employee Types.

Now you should be able to confidently create new employee types for your organization!

If you have any further questions about this article, do not hesitate to contact us at support@payrollhero.com – we will be happy to help.