PayrollHero’s government payment settings are currently done automatically.

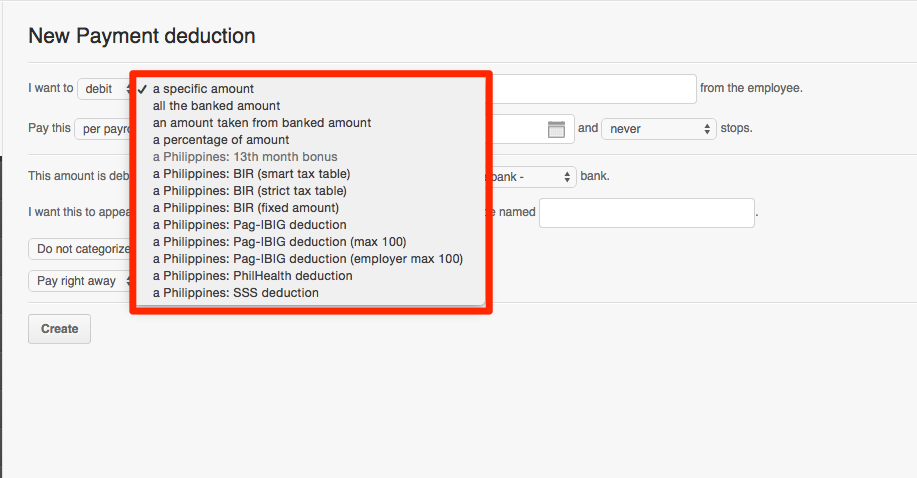

This means that the only option that you could select for setting up government payments are what we have on the system:

If you choose a different setting other than the items listed above, the system will still be able to deduct your custom or specific amount government deduction, it will show on the Payroll Register Report however, it will not be part of the automated government reports.

This means that even if the employee is deducted an additional government contributions on their payroll, once you generate the system’s Government reports, they will not be part of that report. If you need this setting, please do let us know by emailing us at support@payrollhero.com

If you only want to deduct the employees the additional or increased contributions, here’s how to set it up:

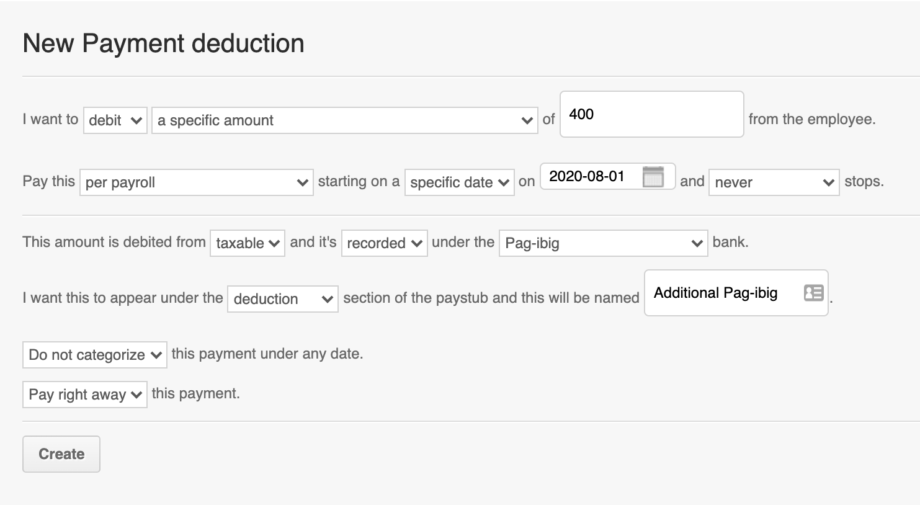

Let’s say the employee’s custom PAG-IBIG contribution is P500.

- Since the employee already have the main Pag-ibig Contribution of P100 (employee and employer) all that is left to add is the employee contribution of 400.

- Here’s how you can setup a Deduction payment for a Custom Pagibig Contribution:

If you have any questions, feel free to email us at support@payrollhero.com.