The Cost Of Living Allowance (COLA) is a government mandated allowance for minimum wage earners. It aims to help workers cope with the continuing increase in the prices of essential commodities, while minimizing cost to employers who are facing high fuel-related production costs, majority of whom are micro and small enterprises.

COLA is a part of the minimum wage that is excluded from the computation of wage related benefits such as overtime pay, night differential, and 13th month pay but is part of the computation of mandatory contributions to the Social Security System (SSS), PhilHealth, and Pag-ibig.

(Source)

As of January 2014, there has also been an increase of wage for the minimum wagers wherein P15 from the COLA is integrated to their salaries.

In PayrollHero, we can set up the COLA for each minimum wage employees. Here’s how:

1. Log in to your PayrollHero account and go to settings

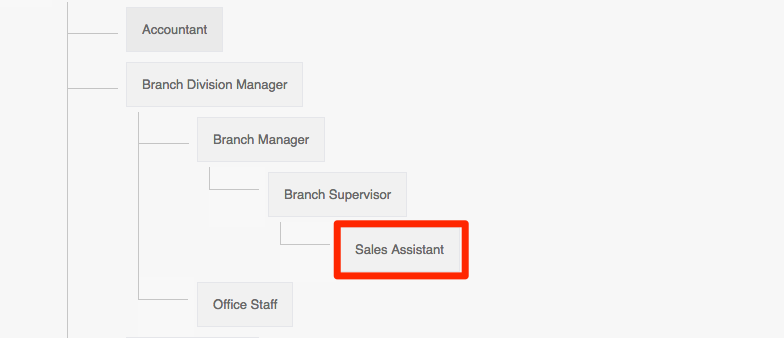

2. Under the Positions Tab select a positions that you want to add the COLA.

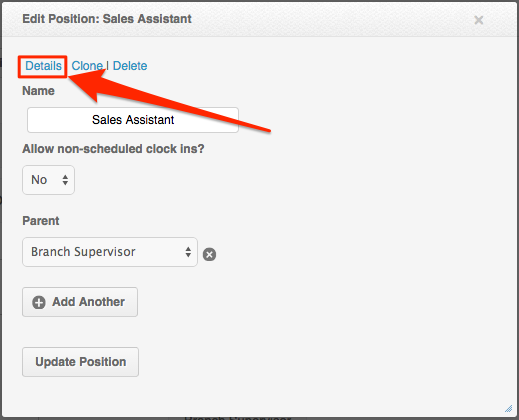

3. Click Details

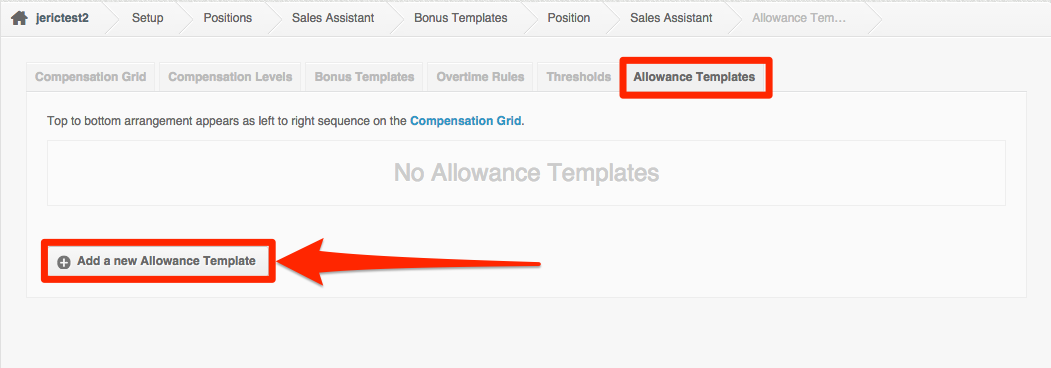

4. Click on the Allowance Templates Tab

5. Click Add a new Allowance Template

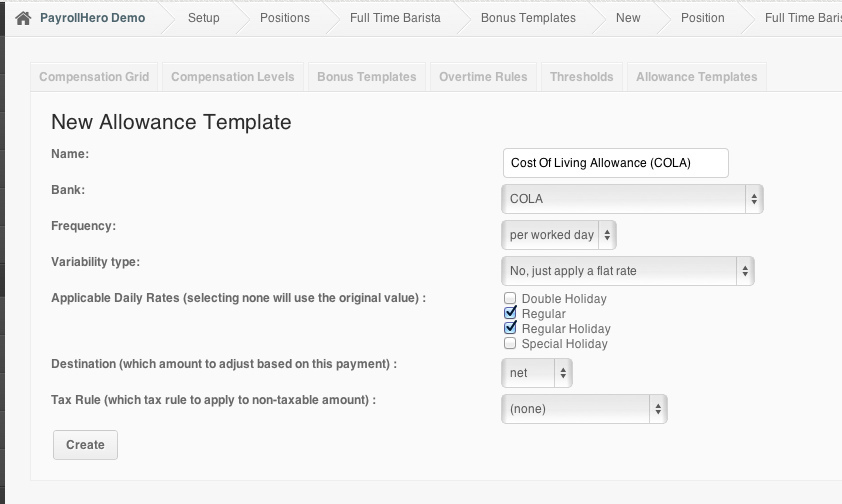

6. Under New Allowance Template enter the following:

7. Then click create.

8. Now click on the “Compensation Grid” tab

9. Add the 15 pesos and it should automatically add to all employees under that specific position.

10. You can also add amounts specifically on the employee profile under “Compensations” page

And that’s it! You have now successfully set up your COLA settings.

If you have any questions, please feel free to email us via support@payrollhero.com