The Social Security System (SSS) deduction can be set up in 2 ways:

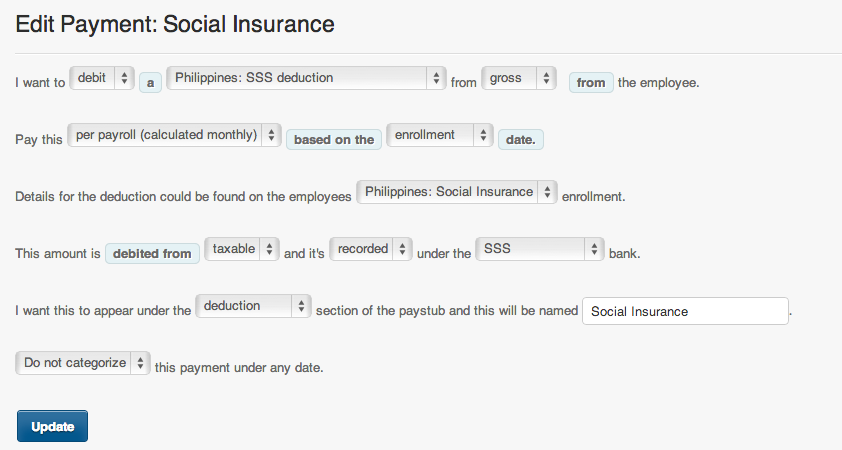

1. Using the “Per payroll (calculated monthly)”

In using this payment, the system will be based on the employee’s “half month” salary either using base or gross pay.

The deduction will then be computed in a split type payment that follows the SSS Contribution Table

Where in on the first pay period, it will use the “Half month” salary.

And the second pay period, it calculates the SSS deduction based on the whole month’s salary.

It then deducts the difference between the monthly calculation (2nd pay period) and the SSS contribution already deducted from the first pay period.

Example:

Employee’s basic pay is 25,000 a month.

January 1-15 (1st Pay Period)

Semi-monthly: 12,500

Using the SSS Contribution Table (12,500):

= 562.50

January 16-31 (2nd Pay Period)

Monthly Wage: 25,000

Using the SSS Contribution Table (25,000):

= 900 + 225 (WISP)

= 1,125

1,125 (2nd pay period) – 562.50 (1st pay period)

= 562.50

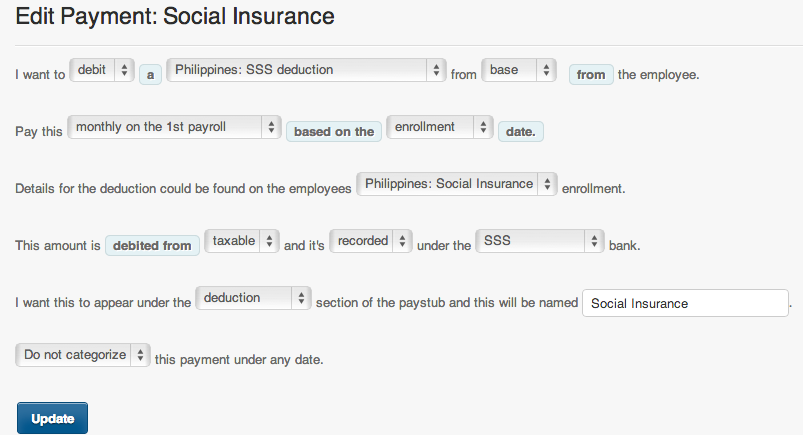

2. Using the “Monthly on the first or last payroll”

In using this payment, the system will be based on the employee’s full month salary either using base or gross pay.

The deduction will then be computed in a one time payment that follows the SSS Contribution Table

Where in if you select “Monthly on the first payroll”,

The system will deduct the SSS contribution based on the first pay period set up on your Account settings (Payroll Info)

If you select “Monthly on the last payroll”,

The system will deduct the SSS contribution based on the second pay period set up on your Account settings (Payroll Info)

Base – This is the Salary or Wage of an employee. This is constant for a Monthly Employee and for an Hourly Employee it would be calculated by multiplying their rate by hours worked.

SSS deduction set to ‘Base‘ will get the Base Pay amount

Gross – This includes the employees Base pay, OT, ND, Tardiness, Holiday pay and taxable allowances.

SSS deduction set to ‘Gross‘ will get the Gross Pay amount

Sample Breakdown for Gross

That concludes the ‘How PayrollHero computes the SSS deduction’ article.

If you have any further questions, please send us a message on our requests page at support@payrollhero.com – we’d be happy to help.