There are 3 ways to deduct Pag-ibig contributions:

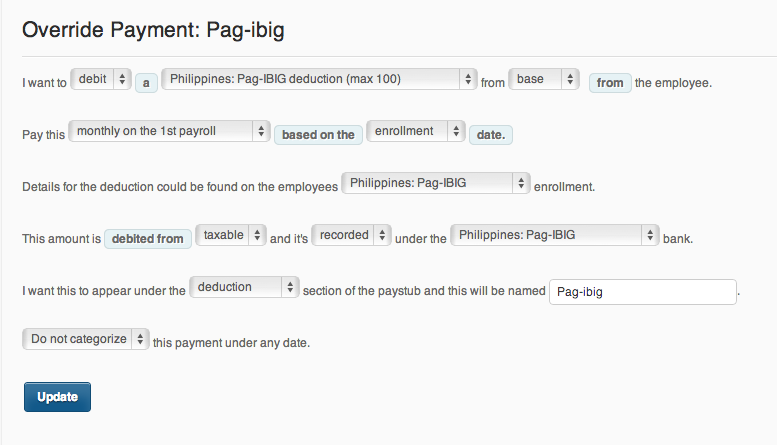

Pag-ibig deductions (max 100)

– If you use this option, this will deduct 100 pesos to both the employee and employer contributions.

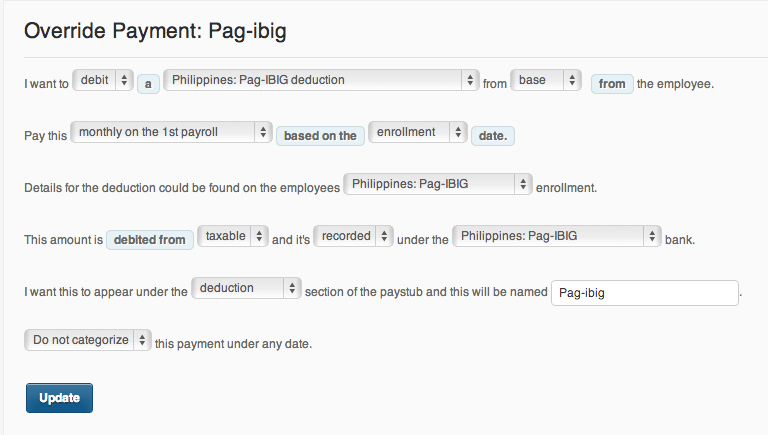

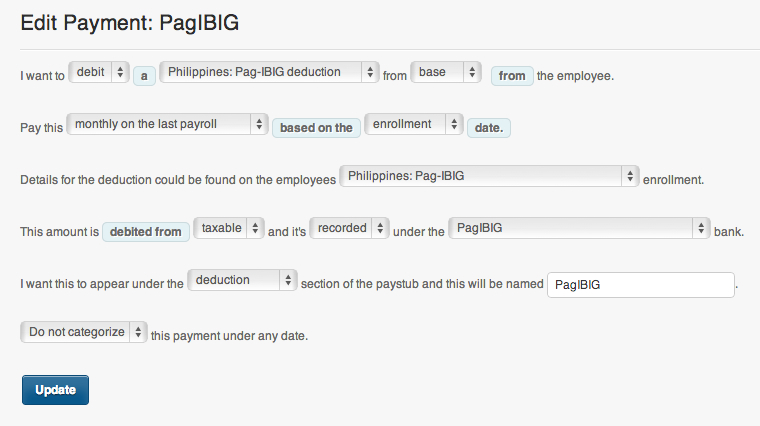

Pag-ibig deductions

– If you use this option, this will deduct 2% of the employee base pay for both the employee and employer contributions.

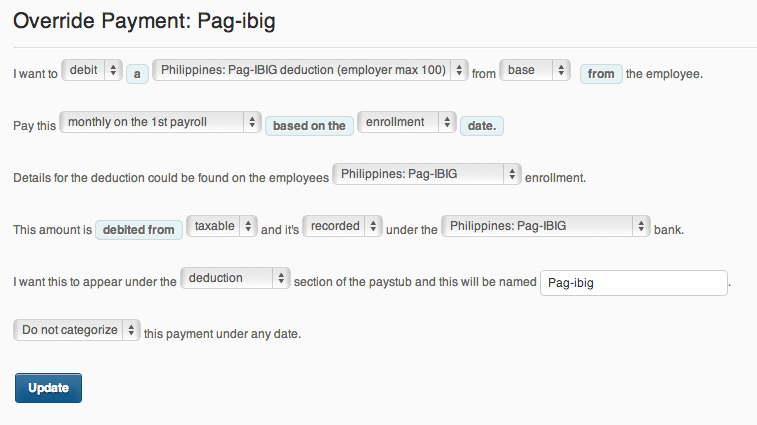

Pag-ibig deductions (employer max 100)

– If you use this option, this will automatically deduct 2% from the employee’s base pay and P100 for the employer’s contributions.

Here is what it’ll look like on the distribution report (Payroll register) – http://goo.gl/ycB693

The Pag-ibig deduction can be set up in 2 ways:

Using the “Monthly on the first or last payroll”

In using this payment, the system will be based on the employee’s salary either using base or gross pay.

The pag-ibig deduction will automatically deduct 100 pesos depending on which pay period you would like to deduct it.

If you select “Monthly on the first payroll“,

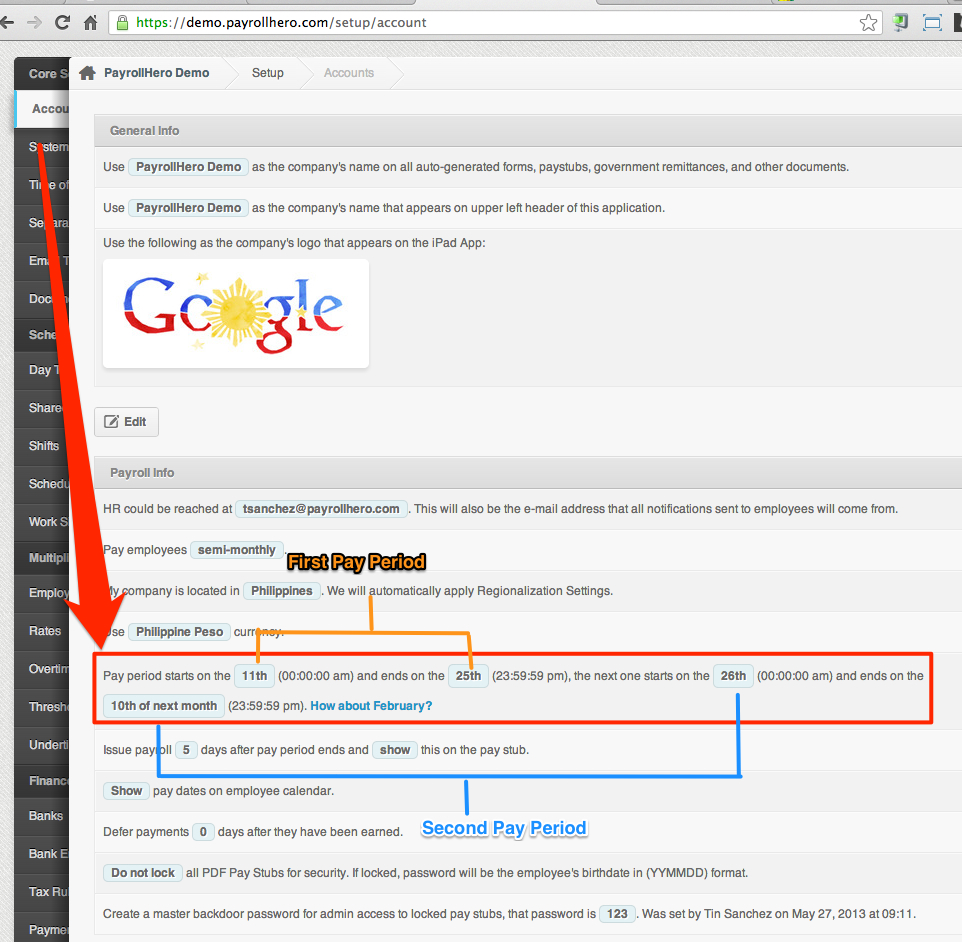

The system will deduct the Pag-ibig contribution based on the first pay period set up on your Account settings (Payroll Info)

If you select “Monthly on the last payroll“,

The system will deduct the Pag-ibig contribution based on the second pay period set up on your Account settings (Payroll Info)

See screenshot here: