The system currently has 3 ways to calculate BIR withholding (For employees paid semi-monthly):

1. Smart Tax Table (Calculated Monthly)

The BIR (Smart Tax Table) when set to calculate monthly uses the Semi-monthly BIR Tax table to compute the tax for the first pay-period in the month and the Monthly BIR Tax table to compute the tax for the second pay-period.

So the total taxable income for the month is used in the calculation but because this information is not available half-way through the month that pay-period computes the tax using the semi-monthly tax table.

The formula for this is:

Second Pay Period Tax Withholding = Monthly Tax Withholding – Tax Withheld during the first pay period (based on the semi-monthly computation).

The reason for this is that the tax computation is more accurate than using the semi-monthly calculation for both pay periods.

Just to be clear, when we are using the monthly tax table for the second pay period, the computation includes the first pay period as well. The system deducts the difference between the monthly calculation and the deductions from the first pay period.

Another reason why we use this computation is because the BIR table is not consistent when it comes to the tax calculations.

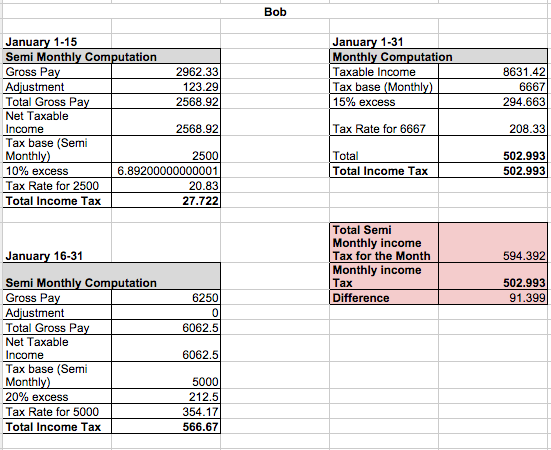

Diagram 1:

We have computed Bob’s taxes in using the two semi-monthly table versus one monthly tax table. As you can see, there is a discrepancy of 91.399 when using the semi-monthly tax table for both cut offs. In short, an employee will be deducted more if we use the semi-monthly tax table for both cut offs rather than the monthly computation.

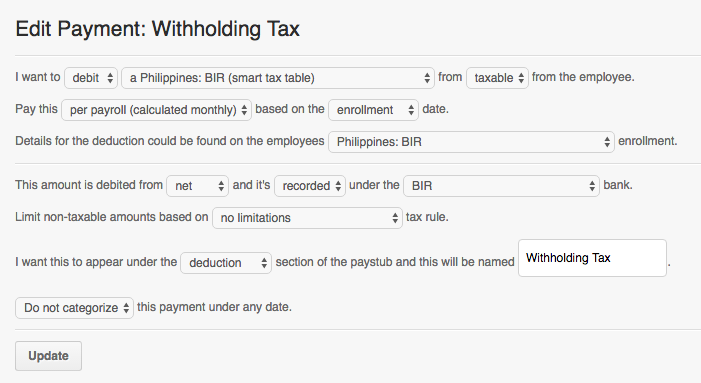

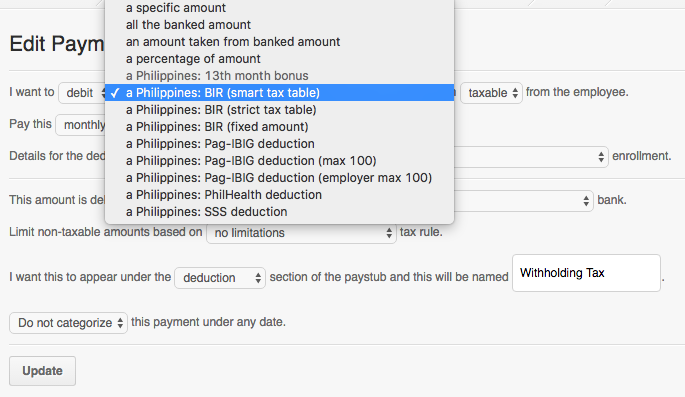

Here’s how to set it up:

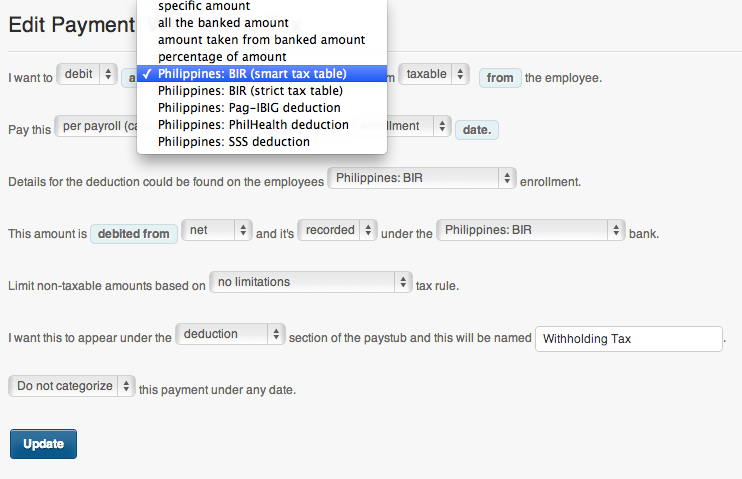

– On the first line,

– choose “debit”

– Then use the special default payment called “Philippines: BIR (Smart Tax Table)”

– and choose “taxable”

– See screenshot below:

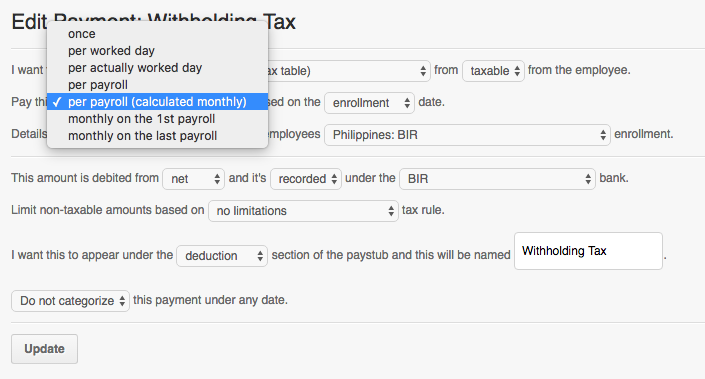

– On the second line,

– Choose “per payroll (calculated monthly)”

– And then choose “enrollment” date.

– TIP: Enrollments is where you can set effectivity date of the payment. Enrollments can be set up on the employee’s profile under the page “enrollments”

– See screenshot below:

– On the third line,

– choose the special default enrollment for BIR called “Philippines: BIR” enrollment.

– TIP: The special default enrollments can be set up under Settings > Bank Enrollments

– See screenshot above

– On the fourth line,

– choose “net” to where the amount shall be debited.

– and then choose a bank name like “BIR”

– Tip: Banks s a way to keep track credits and debits. It is best to create first all types of banks under the Settings page > Banks.

– See screenshot above

– On the fifth line,

– set the limitations for tax rule to “No limitations” since there isn’t any tax rules for the taxes.

– See screenshot above

– On the sixth and final line,

– choose “deduction” to where the amount shall appear on the paystub.

– Name the payment

– and set it to “Do not categorize (DNC)”

– Categorizing the payment to a specific date will show/unshow that payment on the paystub only that date.

– See screenshot above

2. Philippines: BIR (Strict Tax Table)

The BIR (Strict Tax Table) is using just the Semi-monthly BIR Tax table to compute the tax for both the 1st and last pay period.

Most companies use the Semi-monthly BIR Tax table when computing taxes for both pay Periods. It is believed that using the semi monthly table on both Pay Period is best since it’s least likely to result to an employee being given a Tax Due and most likely will get a tax refund.

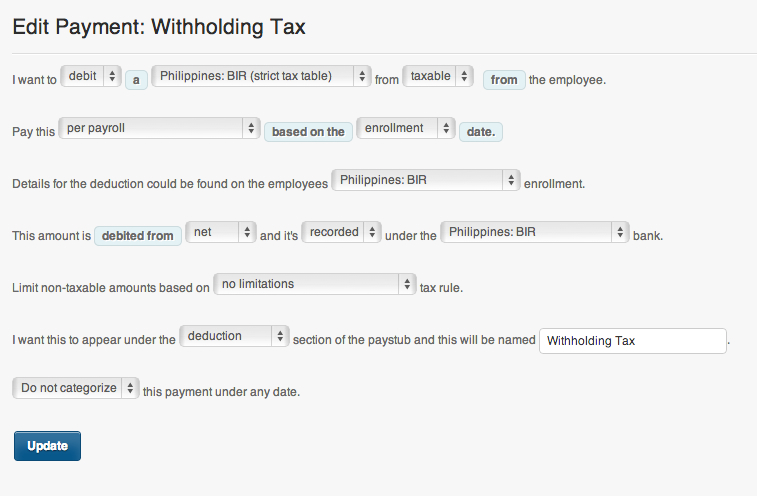

Here’s how to set it up:

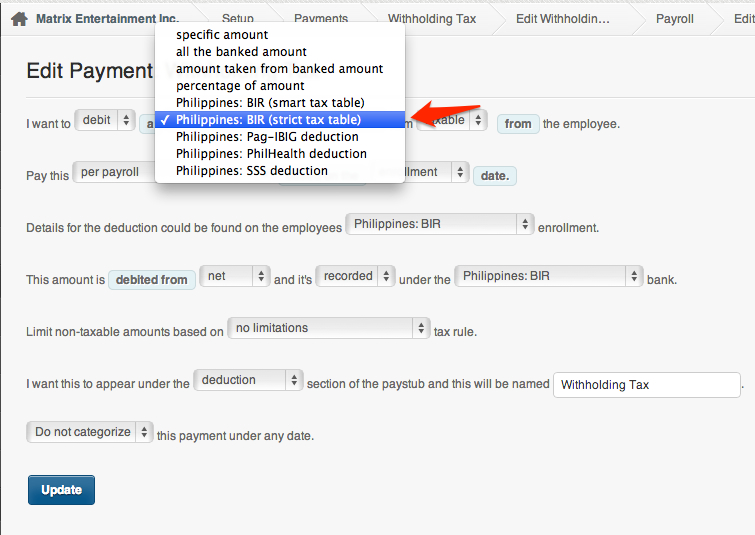

– On the first line,

– choose “debit”

– Then use the special default payment called “Philippines: BIR (Strict Tax Table)”

– and choose “taxable”

– See screenshot below:

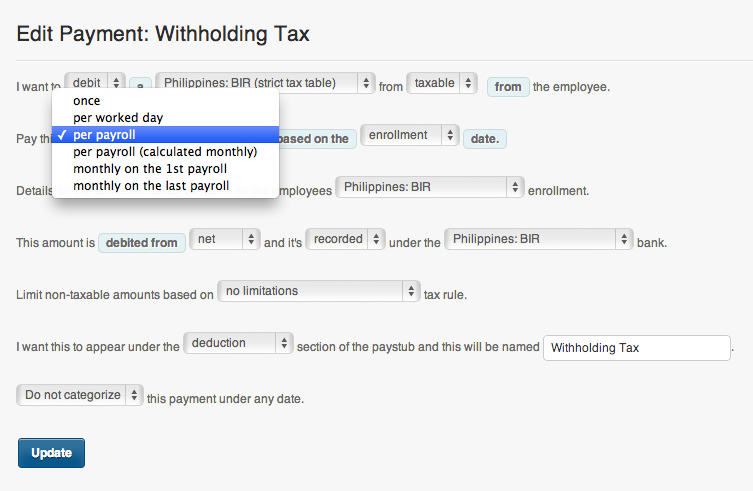

– On the second line,

– Choose “per payroll”

– And then choose “enrollment” date.

– TIP: Enrollments is where you can set effectivity date of the payment. Enrollments can be set up on the employee’s profile under the page “enrollments”

– See screenshot below:

– On the third line,

– choose the special default enrollment for BIR called “Philippines: BIR” enrollment.

– TIP: The special default enrollments can be set up under Settings > Bank Enrollments

– See screenshot above

– On the fourth line,

– choose “net” to where the amount shall be debited.

– and then choose a bank name like “BIR”

– Tip: Banks is a way to keep track credits and debits. It is best to create first all types of banks under the Settings page > Banks.

– See screenshot above

– On the fifth line,

– set the limitations for tax rule to “No limitations” since there isn’t any tax rules for the taxes.

– See screenshot above

– On the sixth and final line,

– choose “deduction” to where the amount shall appear on the paystub.

– Name the payment

– and set it to “Do not categorize (DNC)”

– Categorizing the payment to a specific date will show/unshow that payment on the paystub only that date.

– See screenshot above

3. Smart Tax Table Calculated in the Last Pay Period

The BIR (Smart Tax Table) is using just the Monthly BIR Tax table to compute the tax for both the 1st and last cut off.

Most companies use the Monthly BIR Tax table when computing taxes for the whole month. It is believed that using the Monthly table to be deducted either on the first or last payroll is better as it will be least likely to get a tax refund.

Here’s how to set it up:

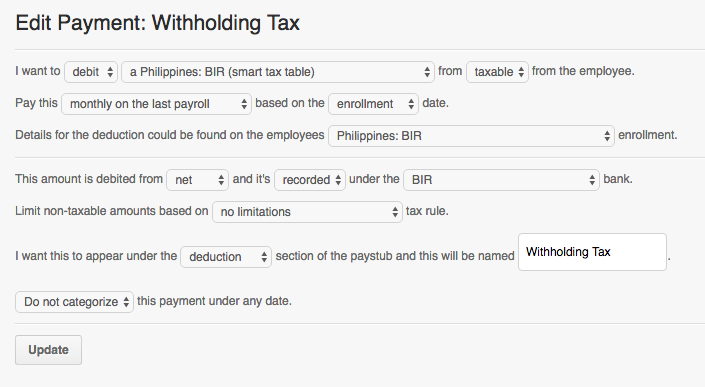

– On the first line,

– choose “debit”

– Then use the special default payment called “Philippines: BIR (Smart Tax Table)”

– and choose “taxable”

– See screenshot below:

– On the second line,

– Choose “Monthly on the last payroll”

– And then choose “enrollment” date.

– TIP: Enrollments is where you can set effectivity date of the payment. Enrollments can be set up on the employee’s profile under the page “enrollments”

– See screenshot below:

– On the third line,

– choose the special default enrollment for BIR called “Philippines: BIR” enrollment.

– TIP: The special default enrollments can be set up under Settings > Bank Enrollments

– See screenshot above

– On the fourth line,

– choose “net” to where the amount shall be debited.

– and then choose a bank name like “BIR”

– Tip: Banks s a way to keep track credits and debits. It is best to create first all types of banks under the Settings page > Banks.

– See screenshot above

– On the fifth line,

– set the limitations for tax rule to “No limitations” since there isn’t any tax rules for the taxes.

– See screenshot above

– On the sixth and final line,

– choose “deduction” to where the amount shall appear on the paystub.

– Name the payment

– and set it to “Do not categorize (DNC)”

– Categorizing the payment to a specific date will show/unshow that payment on the paystub only that date.

– See screenshot above