The Social Security System (a.k.a. the SSS) is a social insurance program for employees/workers in the Philippines. Members can avail of benefits for the following: sickness, maternity, and retirement among others. Members can also apply for salary loans. For more details on the program, you can visit the official website here.

The SSS R-1A is a report that contains the contribution details of newly hired members/employees and is submitted monthly by the company. For current employees, an SSS R-3 form is used instead.

Before beginning, please make sure that:

- New employees have been added on PayrollHero along with their respective SSS enrollments set up.

- At least one payroll has been generated within the start date of the employee and the cut-off period.

To learn how to add an enrollment to the employee’s profile, please see – How to Add or Edit an Employee’s Enrollment?

To learn how to generate payroll, please see – How to generate payroll.

To generate the SSS R-1A on PayrollHero, follow these simple steps:

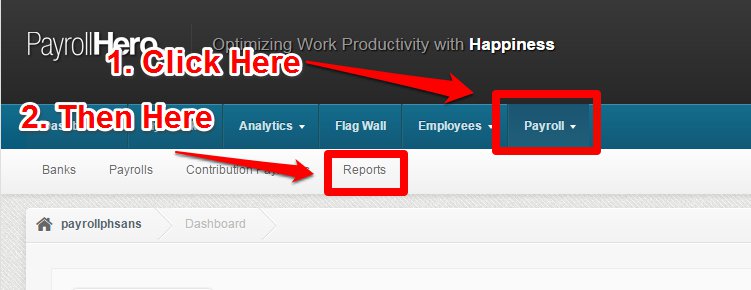

1. On your dashboard, click Payroll, then click Reports.

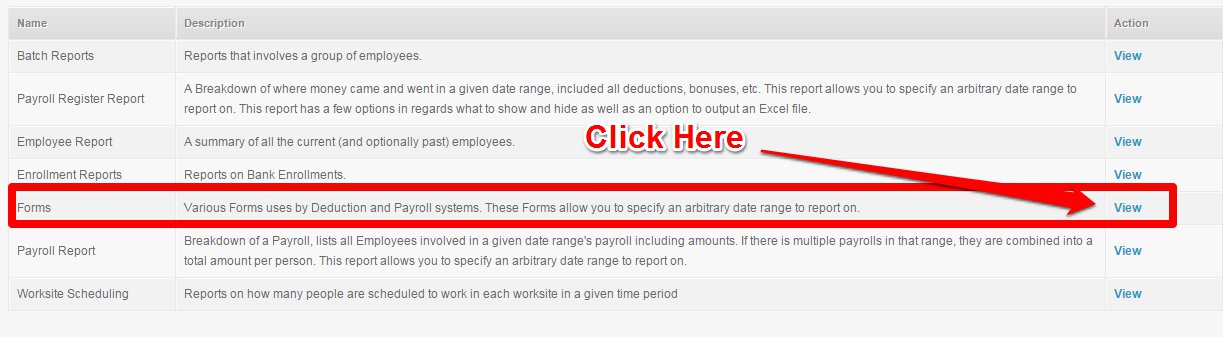

2. Click on the View action button for Forms.

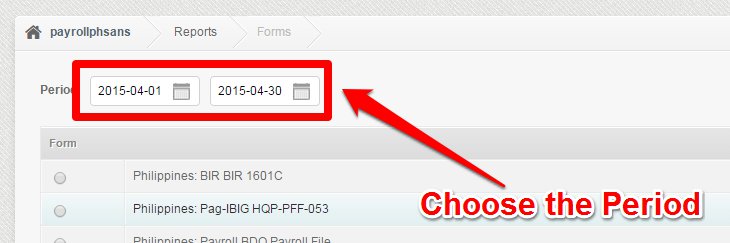

3. Choose the period covered.

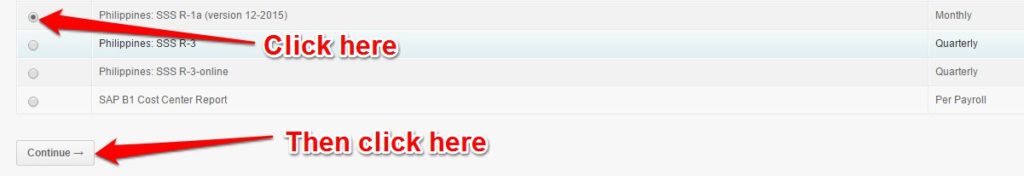

4. Select Philippines SSS R-1a (version 12-2015), then click Continue.

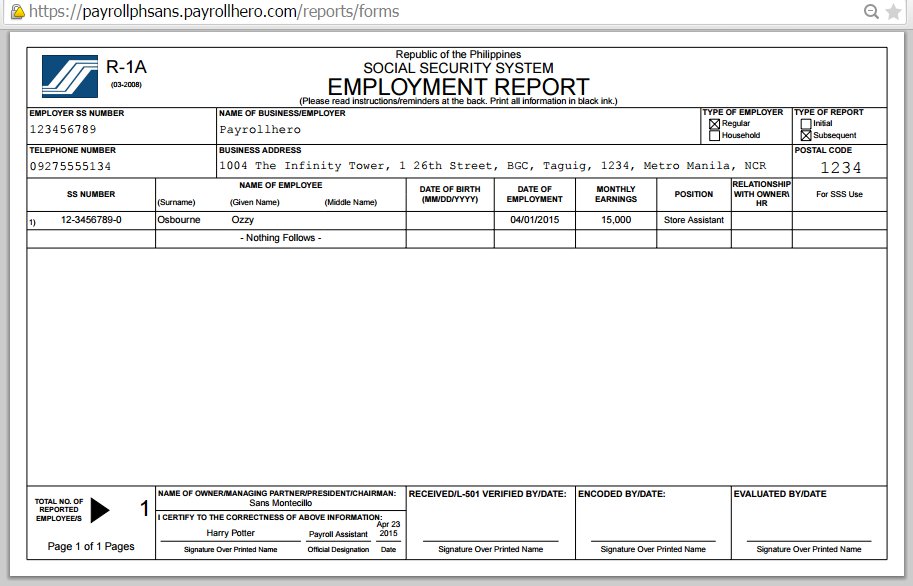

5. A new browser window will open showing the SSS R-1A form completely filled-out with employees’ names and contribution details.

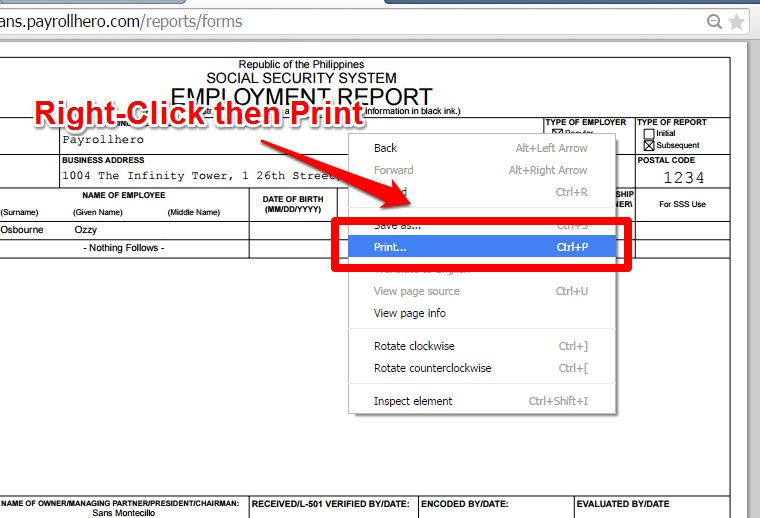

You can print this form by right-clicking the arrow over the form and clicking Print.

Just a reminder that the SSS R-1A form on PayrollHero uses the EFFECTIVITY DATE of the SSS Enrollment of the employee.

A sample scenario would be….

If you are exporting the SSS R-1A for January 2016.

And you added a new employee with the SSS Enrollment.

However, instead of using a January 2016 effectivity date for the SSS enrollment,

You use a December 2015.

Once you generate the SSS R-1A for January, the new employee won’t show up because of the effectivity date.

That concludes the ‘How to Generate the SSS R-1A Form’ article. You should now be able to generate the SSS R-1A form, confidently.

If you have any further questions, please send us a message on our requests page at support@payrollhero.com – we’d be happy to help.