The Social Security System (a.k.a. the SSS) is a social insurance program for employees/workers in the Philippines. Members can avail of benefits for the following: sickness, maternity, and retirement among others. Members can also apply for salary loans. For more details on the program, you can visit the official website here.

The SSS R-3 is a report that contains the contribution details of current members/employees and is submitted monthly by the company. For newly hired employees, an SSS R-1A form is used instead.

Before beginning, please make sure that:

- The current employees already have their respective SSS enrollments set up.

- At least one payroll has been generated within the start date of the employee and the cut-off period.

To learn how to add an enrollment to the employee’s profile, please see – How to Add or Edit an Employee’s Enrollment?

To learn how to generate payroll, please see – How to generate payroll

To generate the SSS R-3, follow these simple steps:

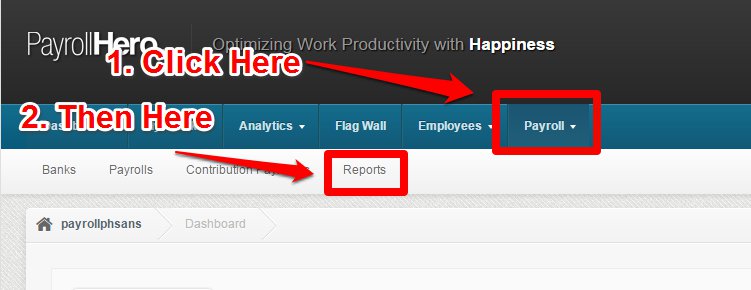

1. On your dashboard, click Payroll, then click Reports.

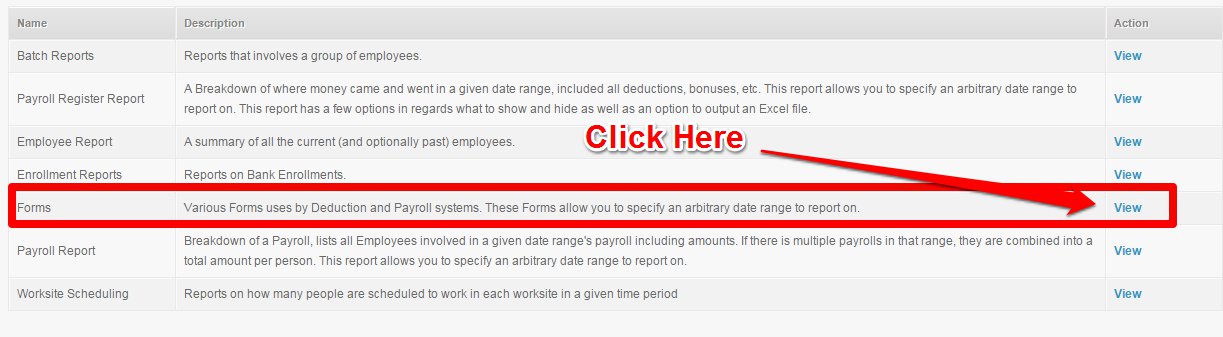

2. Click on the View action button for Forms.

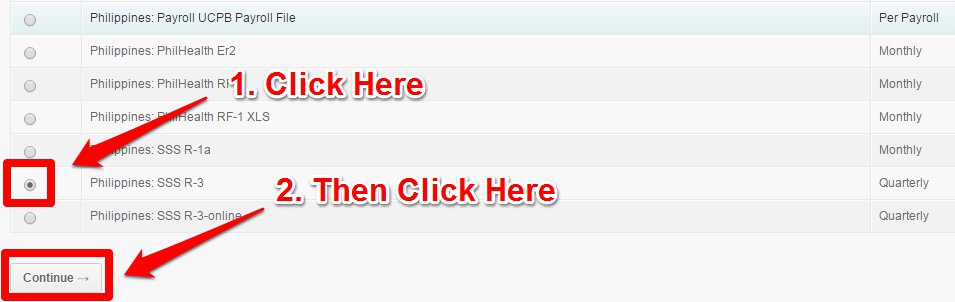

3. Choose the period covered.

4. Select Philippines SSS R-3, then click Continue.

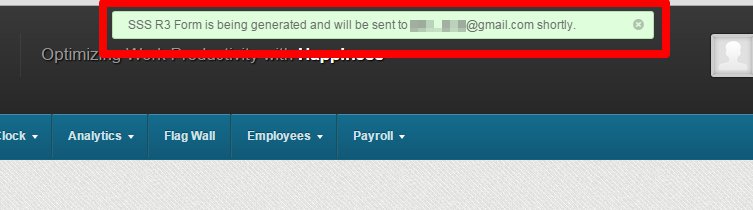

5. A pop-up notification at the top of your screen will inform you that the report is being generated and will be sent to your registered email shortly.

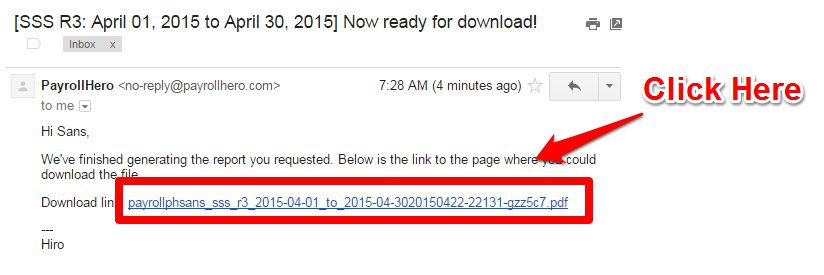

6. Check your email and click the link provided at the bottom.

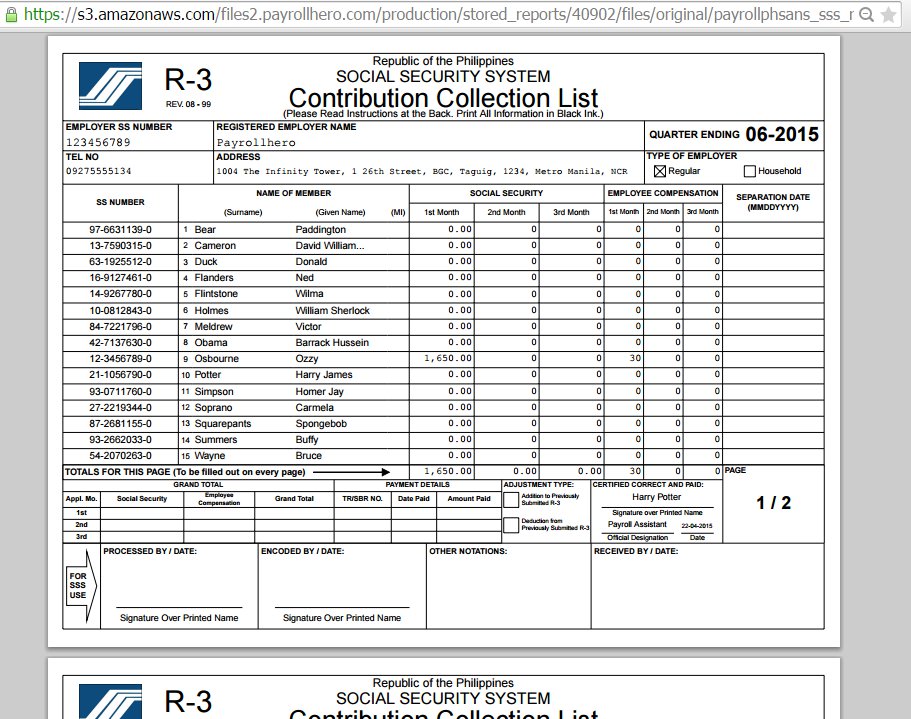

7. The link will open a new browser window and will show the SSS R-3 form completely filled-out with employees’ names and contribution details.

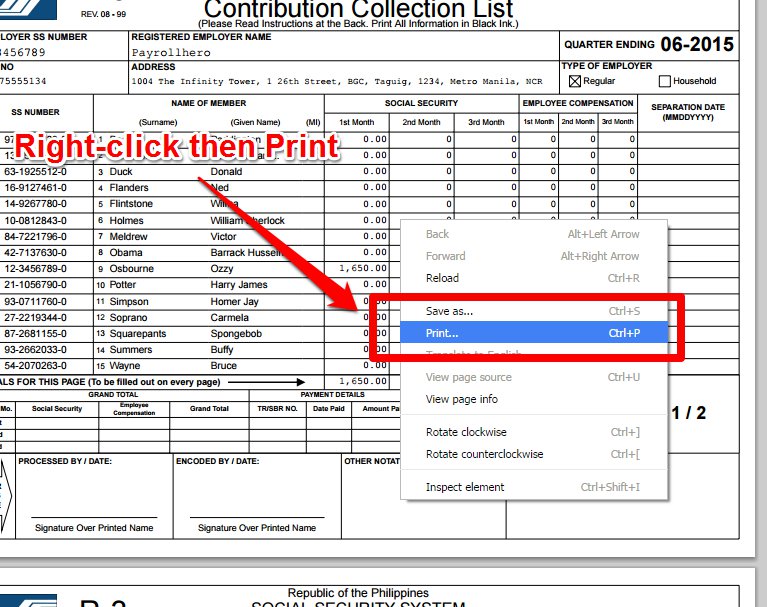

You can print this form by right-clicking the arrow over the form and clicking Print.

That concludes the ‘How to Generate the SSS R-3 Form’ article. You should now be able to generate the SSS R-3 form, confidently.

If you have any further questions, please send us a message on our requests page at support@payrollhero.com – we’d be happy to help.