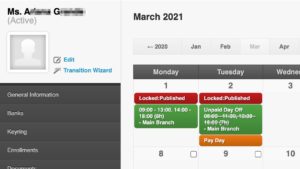

We’ve received reports that when the allowance template is set to “flat rate but deducting absences” it is not deducting when the day is scheduled to be an “Unpaid Day Off”

We have now fixed this…

When a day is tagged as “Absent” on the attendance page and “Unpaid Day Off” on the schedule, it will now also deduct on the allowance if you have your allowances set to “flat rate but deducting absences”. Here’s a sample computation having 1 absent and 1 unpaid day off on a payroll period:

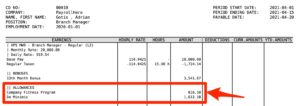

When payrolls are generated, the allowance gets deducted as well:

Per Day Allowance Computation based on PER PAYROLL settings

(Allowance x 24 months)/261 Days

Company Fitness Program

= (1000 x 24)/261

= 91.954022988505747 or 91.9540

De Minimis

= (2000 x 24)/261

= 183.908045977011494 or 183.9080

2 days deduction for absent/unpaid day off

Company Fitness Program

1000

= (91.9540×2)

= 183.908

= 1000 – 183.908

= 816.092 or 816.10

De Minimis

2000

= (183.9080×2)

= 367.816

= 2000 – 367.816

= 1632.184 or 1632.18