Skip to the next step by clicking here

Why do you need to do this?

Enrollments are linked with the employee’s payments. If there’s no enrollment, the payment for the employee will not be activated because the “Enrollment” is where we add the start date for the payment.

-

BIR

1. Membership Code: This is the employee BIR number, this is a 9 digit number. If the employee supplies 12 digit number, the last 3 digits can be ignored as they are the branch number which is not used.

2. Join Date: Date when they join this enrollment on your company.

3. Substituted Filing: If the company does the tax deductions on behalf of the employee this should be set as Yes. If the employee pays their Income Tax directly, this would be set as No.

4. Exemption code: The marital status of the employee – codes are: S=Single, ME=Married, Z=Zero exemption. The numbers are amount of qualified dependant children. For example S3 would be Single with 3 children. ME1 would be Married with 1 children.

5.Region of Enrollment: The Philippine region for this enrollment.

6. Is wife claiming the additional exemption for qualified dependent children?: Yes/No

7.Name and Date of birth for each of the claimed children.

-

Pag-IBIG

1. Join Date: Date when they join this enrollment on your company.

2. Membership Code: The 12 digit membership code, format is XXXX-XXXX-XXXX

3. Membership Program: Pag-IBIG I, Pag-IBIG II or Modified Pag-IBIG II.

-

SSS

1. Join Date: Date when they join this enrollment on your company.

2. Membership Code: The 10 digit membership code, format is XX-XXXXXXX-X

-

PhilHealth

1. Join Date: Date when they join this enrollment on your company.

2. Membership Code: The 12 digit membership code, format is XX-XXXXXXXXX-X

*Note that the membership code is the government account number for the specific contributions. If they don’t have the number yet, they can skip it and just set up the join date. If there’s no membership code, the account number itself won’t show on the gov’t reports. Enrollments do NOT act retroactively, they only affect payrolls generated after the details have been added. This is why it’s important to have the enrollments details as complete and as up to date as possible!*

What steps do you need to take?

How to update the Employer’s Government Details:

Bank enrollments for government deductions are automatically created for Philippine accounts but they need to be updated with your organization details. To do so, please follow the steps detailed on this article.

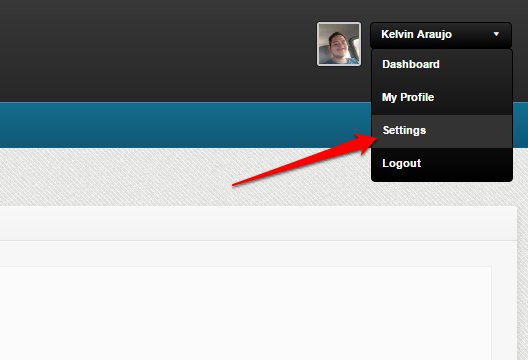

1. Go to the settings menu

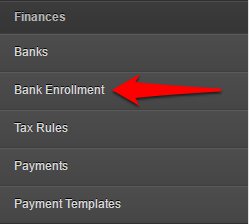

2. On the left side menu, scroll down and click on Bank Enrollment.

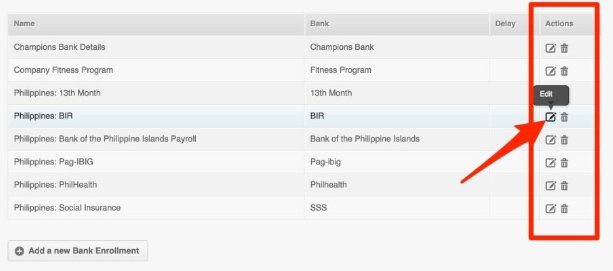

3. Then click “edit” on for the enrollment you wish to update

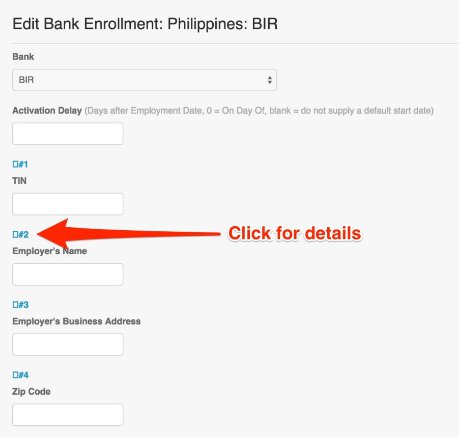

4. Complete all the required details. For help on filling up the government payments, click on the small box above the field. A new window will open explaining where to obtain those details.

5. When done, click on Update at the bottom of the page!