The Employment Act (Chapter 91) is the act that governs Singaporean payroll, contract law, Rest Days, Hours of Work, Contractual work, etc. etc. It only applies to Contracts of Service.

Above is a link to the actual act but below is a summary of the pertinent information

Criminal Offence

Employers who fail to pay a salary on time is liable for:

- a fine between $3,000 and $15,000 and/or imprisonment for a term not exceeding 6 months

- For repeat offenders, a fine between $6,000 and $30,000 and/or imprisonment for a term not exceeding 12 months

Salary computation and payout

- No salary period is allowed to exceed one month

- If not specified the salary period will be deemed as one month

Computation of Salary for incomplete months

- If a monthly-rated employee has not completed a whole month of service because:

- he commenced employment after the first day of the month

- his employment was terminated before the end of the month

- he took leave of absence without pay for one or more days of the month

- he took leave of absence to perform his national service under the Enlistment Act (Cap. 93)

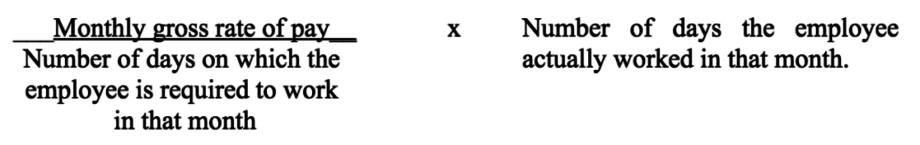

The formula for calculating an incomplete months service is:

- If an employee works 5 hours or less this will be considered as a half day

Time of Payment

- Salary earned by an employee under a contract of service, other than additional payments for overtime work, shall be paid before the expiry of the 7th day after the last day of the salary period in respect of which the salary is payable.

- Additional payments for overtime work shall be paid not later than 14 days after the last day of the salary period during which the overtime work was performed.

- The total salary due to an employee on completion of his contract of service shall be paid to him on completion of the contract.

- Payment must be made to an employee on a work day and during working hours

Dismissal and Termination

- Must be paid on the day of dismissal or within 3 days of the dismissal

- If an employee terminates their contract with notice it should be paid on the date their contract is terminated

- If an employee terminates their contract without notice it should be paid before the end of the 7th day after their contract expires

- If notice is not given (or partially served) by either party. That party is liable to pay the cash equivalent of the notice period

Authorised Salary Deductions

The total amount of all deductions taken from an employee’s salary must not exceed 50% of the salary payable to the employee for any pay period.

List of Authorised Deductions

- deductions for absence from work

- deductions for damage to or loss of goods expressly entrusted to an employee for custody or for loss of money for which an employee is required to account, where the damage or loss is directly attributable to his neglect or default;

- can not exceed 25% of their total salary

- They must be given the opportunity to defend themselves before the deduction is made

- A register must be kept for all damage and loss deductions

- deductions for the actual cost of meals supplied by the employer at the request of the employee;

- deductions for house accommodation supplied by the employer;

- Must not exceed 25% of their total salary

- This deduction can only be made if the employee has accepted as term of contract or otherwise

- The amount deducted for the accommodation must not exceed the value of the accommodation being provided

- deductions for such amenities and services supplied by the employer as the Commissioner may authorise;

- deductions for recovery of advances or loans or for adjustment of over-payments of salary;

- The term for loans and/or advances must not exceed 12 months

- The instalments must not exceed 25% of their total salary

- The recovery of an advance of money made to an employee before the commencement of a contract of service shall begin from the first payment of salary in respect of a completed salary period, but no recovery shall be made of any such advance made for travelling expenses.

- deductions of contributions payable by an employer on behalf of an employee under and in accordance with the provisions of the Central Provident Fund Act (Cap. 36);

- deductions made at the request of the employee for the purpose of a superannuation scheme or provident fund or any other scheme which is lawfully established for the benefit of the employee and is approved by the Commissioner;

- deductions made with the written consent of the employee and paid by the employer to any cooperative society registered under any written law for the time being in force in respect of subscriptions, entrance fees, instalments of loans, interest and other dues payable by the employee to such society; and

- any other deductions which may be approved from time to time by the Minister.

Deducting for Absences

- Can only be made if an employee fails to show up for work

- Salary deductions can be take for whole or part of a period

- Salary deductions can only be for absences based on the standard daily rate of the employee base salary.

- If any employee absents himself from work otherwise than as provided by this Act or by his contract of service, the employer may, subject to any order which may be made by a court or by the Commissioner on complaint of either party, deduct from any salary due to the employee the cost of food supplied to him during his absence.