The Foreign Worker levy, commonly known as ‘levy’ is a pricing mechanism to regulate the amount of foreign manpower in Singapore. It is not applicable to Singaporean Permanent Residents.

Who should pay for Foreign Worker levy?

Employers are required to pay Foreign Worker levy for their Work Permit Holders (WPH). The levy liability will start from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier. And it ends when the permit is cancelled or has expired.

How is the levy amount calculated

There are actually 4 things that will affect the amount of levy that is applicable for work permit holders. These are:

- Dependency Ceiling

- Worker’s Qualification

- Workers on Man-Year Entitlement (MYE) or MYE-waiver scheme

- Company Sector

Dependency Ceiling

Possibly the defining factor of the FWL. This is the main thing that dictates what levy should be taken for WPH. Depending on which Sector a company operates in it will either be based on a percentage tier depending on a company’s reliance on foreign workers (aka dependency ceiling), or a ratio of 1:x amount of workers.

Worker’s Qualification

They have two categories of worker, skilled or unskilled. For most sectors this is the only thing that affects the amount of levy to take for a WPH. There is a detailed breakdown of what is a skilled worker. The details can be found:

- Relevant qualifications – Appears to be for all

- Services Sector – Market-Based Skills Recognition Framework (Services)

- The WPH must have worked at least 4 years in Singapore and earned a fixed monthly salary of $1600 during this period

- Employer’s update their worker’s salary via WPOL

- The WPH must have worked at least 4 years in Singapore and earned a fixed monthly salary of $1600 during this period

- Construction –

- registered with the Construction Registration of Tradesmen (CoreTrade);

- issued with trade certifications recognised by the Building and Construction Authority, and who possess at least four years of construction experience in Singapore; or

- under Multi-Skilled Scheme

- Market-Based Skills Recognition Framework (Construction)

- Automatic upgrade to skilled after 6 years if they have earned a fixed monthly salary of $1600 during this period

- Basic skilled workers refer to workers who possess SPM and/or Building and Construction Authority’s Skills Evaluation Certificate (SEC) or Skills Evaluation Certificate (Knowledge) i.e. SEC (K)

Workers on Man-Year Entitlement (MYE) or MYE-waiver scheme – NEEDS MORE RESEARCH

To be exempted from MYE, the foreign worker must have at least two years of working experience in Singapore. This must be relevant to the sector they are employed under.

Company Sector

For the purposes of the FWL there are 5 sectors that will affect how much the levy will be for WPHs.

Manufacturing

Services

Construction

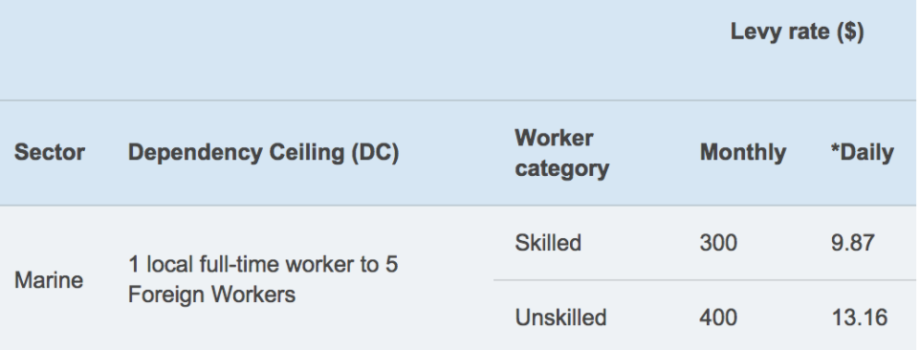

Marine

* Daily levy rate only applies to Work Permit holders who did not work for a full calendar month. From 1 January 2011, the daily levy rate is computed based on the following: (Monthly levy rate x 12) / 365 = rounding up to the nearest cent.

How it is managed

It seems to be managed using a system called the Internet Foreign Worker Levy Billing System (iFWLB.)

Steps to register:

Step 1:

First, the following conditions must be fulfilled before opening an account:

- Have active Work Permit and S Pass holders that have incurred liability in the previous month; and

- Registered address with Central Provident Fund Board is a Singapore address.

Step 2:

Appoint a Singaporean Citizen or Singapore Permanent Resident to register for the iFWLB account. This person will be appointed a “super user” role.

* Super user refers to one who performs the administrative role for the iFWLB account. Please refer to the user guide for more information on the roles of a super user.

Step 3:

Upon successful registration, we will send a notification to the email address provided during the registration. The user can log on to iFWLB now using SingPass to carry out levy transactions.

- Online Registration for a iFWLB account (For *super user only)

- Login to iFWLB

- User guide for iFWLB system

- FAQs on iFWLB

How the FWL is paid by the Employer

Employers will need to pay Foreign Worker levy using General Interbank Recurring Order (GIRO) every month. With GIRO, levy will be deducted automatically from the bank account.

The levy is deducted on the 17th of the month or the next working day if it falls on a Saturday, Sunday or a public holiday. The employer must ensure that there are sufficient funds in the bank for the deduction.

If GIRO is not available, employer must make payment of levy by the 14th of the month. So long as there is no full payment, interest for non or late payment will be charged.

Application for Inter-Bank GIRO (Foreign Worker Levy Payment)

If it’s not paid

If full payment of the Foreign Worker levy is not made on time, the following measures may be taken:

- A late payment penalty will be charged

- Existing Work Permits will be cancelled

- Employer will not be allowed to apply for new Work Permits or renew their existing workers’ Work Permits

- Legal proceedings will be taken to recover the unpaid levy liability

- If you, your partners or directors are sole proprietors, partners or directors of other companies, these companies will not be allowed to apply for Work Permits

Note:

It takes up to five working days to update your levy payment. Any application made before that time may be rejected. If you need to update your payment records urgently, send us a clear copy of your payment receipt and contact details using iSubmit. Please select option 9: Levy Matters under the Request Type. You may proceed to apply after two working days.

FWL Summary

I don’t think this is really a payroll function and it’s probably more of an HRIS feature. It looks like it lives entirely outside of payroll. You apply and manage it externally and it is deducted automatically via giro is deducted automatically based on how you manage it via the iFWLB.

There is probably a few issues from our perspective

- Tracking who is an FWL worker

- Whether that person is skilled or unskilled

- What percentage bracket or ratio needs to be used

- We must track what sector the company is in for this

- What the correct payment is based on the above