Before computing for the Holiday pay and Rest Day pay, please check if you have already set up your rates.

Hourly/Daily Employees who report for work during Holidays and Rest Days are entitled to an additional 130% premium on top of their daily/hourly rate. This is done as required by the Department of Labor and Employment (Source: DOLE).

However, if a monthly paid employees work on a Rest day, and the default Rest Day work rate is set to 130% (see rates page page article), there are two approaches for how this day is paid:

- The employee gets paid THE ENTIRE 130%, for working this day, on top of their monthly fixed salary.

- The employee gets paid ONLY THE EXTRA 30%, for working this day, as the 100% is already considered on their monthly fixed salary.

The default behaviour for monthly paid employees is they get paid only the extra 30% on top of their monthly fixed salary.

If you would like to change this behavior for your monthly paid employees, please contact support@payrollhero.com

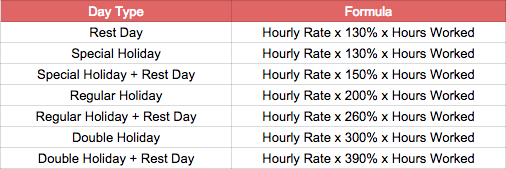

Here are the guidelines to compute the employee’s Holiday Pay and Rest day Pay:

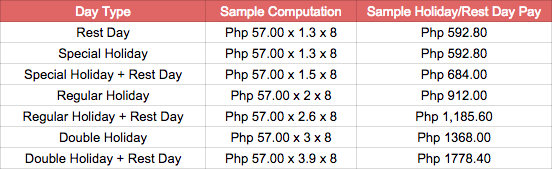

Let’s say that your employee’s hourly rate is Php 57.00, here’s how to compute for their holiday/rest day pay:

Please Note that default day types rates are automatically added to you PayrollHero account on the new account set up phase. (Regular, Regular Holiday, Special Holiday, and Rest Day). However if you add any new Day Types and Employee Types, you need to set up their rates.

That concludes the ‘How Do I Compute the Holiday Pay and Rest Day Pay?’ article.

If you have any further questions, please send us a message on our requests page at support@payrollhero.com – we’d be happy to help.