PhilHealth:

The PhilHealth deduction can be set up in 2 ways:

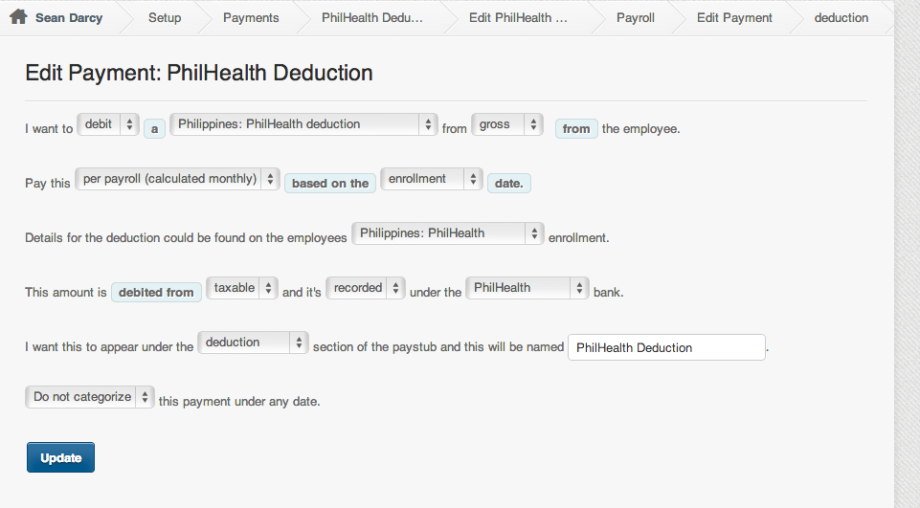

1. Using the “Per payroll (calculated monthly)”

In using this payment, the system will be based on the employee’s “half month” salary either using base or gross pay.

The deduction will then be computed in a split type payment that follows the PhilHealth Contribution Table

Where in on the first pay period, it will use the “Half month” salary.

And the second pay period, it calculates the PhilHealth deduction based on the whole month’s salary.

It then deducts the difference between the monthly calculation (2nd pay period) and the PhilHealth contribution already deducted from the first pay period.

Example:

Employee’s basic pay is 35,000 a month.

January 1-15 (1st Pay Period)

Semi-monthly: 17,500

Using the PhilHealth Contribution Table (17,500):

= 437.5

January 16-31 (2nd Pay Period)

Monthly Wage: 35,000

Using the PhilHealth Contribution Table (35,000): 875

875 (2nd pay period) – 437.5 (1st pay period)

= 437.5

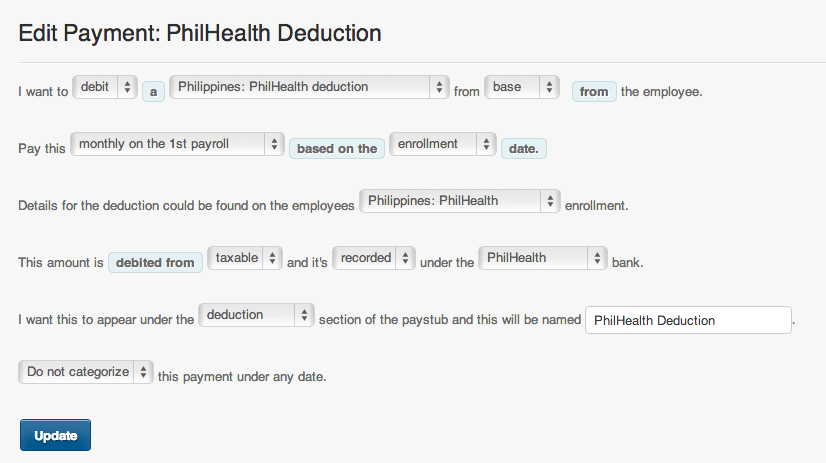

2. Using the “Monthly on the first or last payroll”

In using this payment, the system will be based on the employee’s full month salary either using base or gross pay.

The deduction will then be computed in a one time payment that follows the PhilHealth Contribution Table

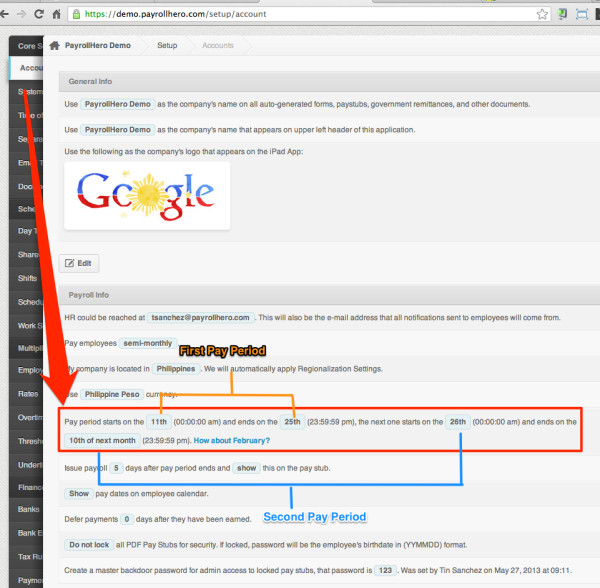

Where in if you select “Monthly on the first payroll”,

The system will deduct the PhilHealth contribution based on the first pay period set up on your Account settings (Payroll Info)

If you select “Monthly on the last payroll”,

The system will deduct the PhilHealth contribution based on the second pay period set up on your Account settings (Payroll Info)

See screenshot here: