As of the moment, we cannot automatically calculate the final pay. However, you can manually create a final pay using the payments and generating payroll.

This is how we create final pay:

- Once you generate payroll. Export the Payroll Register Report to know the employee’s net pay for the last pay period the employee worked.

- Manually compute the unused vacation/sick leave, convert it to a cash/amount value and then add it as a specific payment on the system.

- Manually compute the accumulated 13th month if the employee did not start January 1st on the system and then add it as a specific payment on the system or you can use the Multi Insert – Payment Template.If you are using the System’s 13th Month computation simply pay out the employee’s 13th Month by following the steps here – How to Generate the 13th Month Payment Report

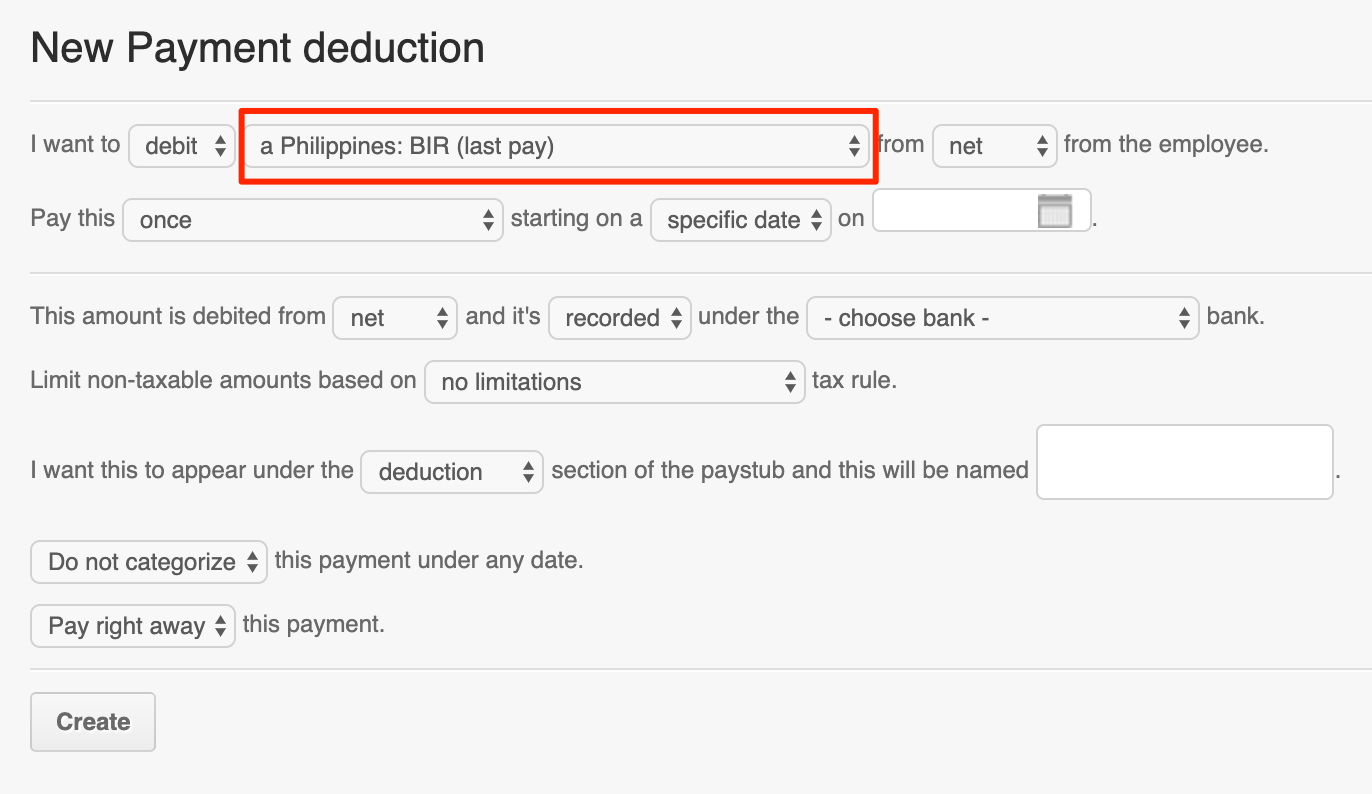

- Add a BIR Payment called “last pay” for the Tax Due/Tax Refund

*Make sure that there is a separation date before creating the BIR last pay payment.

*Make sure that there is a separation date before creating the BIR last pay payment. - Other than the payments mentioned above, if there are remaining deductions, bonus or allowance that the employee needs, add it on the system as a specific payment.

- Once all payments are added, you can then generate the last payroll.

This should serve as their “final pay” payslip.

If you have any questions, feel free to email support@payrollhero.com