We have the feature to called “Tax Rules” where you can create specific non-taxable amount limit to a specific payment. This is mostly used for the “De Minimis” Allowances. However, we received a report that when employees exceed the Payment Specific Tax Rule, the amount automatically goes into the taxable payments instead of falling into the General Tax Rule where the 90K Tax Threshold is setup.

We have now fixed this…

If users uses the “Payment Specific Tax Rule” any amounts that exceed the rule, now falls into the “General Tax Rule”.

Sample scenario:

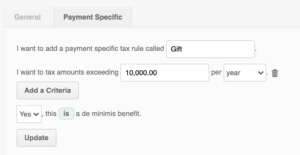

If a company uses the “Gift” Payment Specific Tax Rule, whereas the employee exceeds P10,000 a year

And the employee also hasn’t exceeded the “General” Tax rule of P90,000 here:

What will happened on the Alphalist and 2316, it will not show that they have taxable amounts since they haven’t exceeded the 90k Tax Threshold.