Singapore accounts have the capability to manually enter the payroll hours for payroll generation. This means that instead of using the time and attendance data collected from our devices you can input the numbers manually yourself. If you would like to use this feature please email support@payrollhero.com

1. Find the employee you wish to generate payroll for

You can search the employee list

or use the employee search box

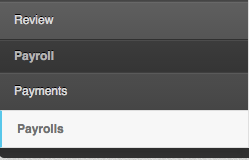

2. Click on “Payrolls”

3. Click on “Add a new Totals based Payroll”

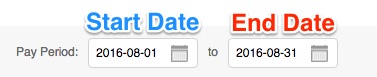

4. Choose the pay period you want to generate

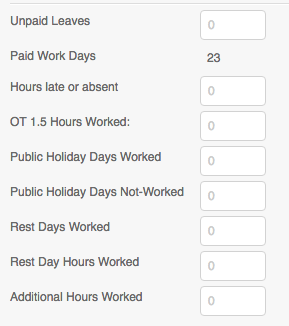

5. Input the data for that pay period

- Unpaid Leaves: If the employee took any unpaid leaves during this period input the amount of days here

- Hours late or absent: If you wish to make a deduction for absences or lates input the amount of hours here

- OT 1.5 Hours Worked: Input the number of hours you wish to pay the employee OT (if any)

- Public Holidays Worked: Indicate the amount of days the employee worked on a public holiday

- Public Holidays Not-Worked: Indicate any public holidays that occurred in the pay period that were not worked by the employee

- Rest Days Worked: If the employee worked on any of their rest days input the amount of days here.

- Rest Day Hours Worked: Input the total rest day hours worked (if any)

- Additional Hours Worked: If the employee worked any additional hours that were not considered overtime input them in this column

6. Click “Generate Payroll!”

And your done, you’ll be able to view the employee’s payslip and payroll information just as if you had generated their payroll used PayrollHero for the entire process.