Tax Rules is where you can create specific non-taxable amount limit to a specific payment. This is mostly used for the “De Minimis” Allowances.

Example: If you set a tax rule that has non-taxable payment amount limit for P2,000. Anything above P2000 is taxable.

Here’s how to add a tax rule:

1. Go to Settings

2. Click on Tax Rule

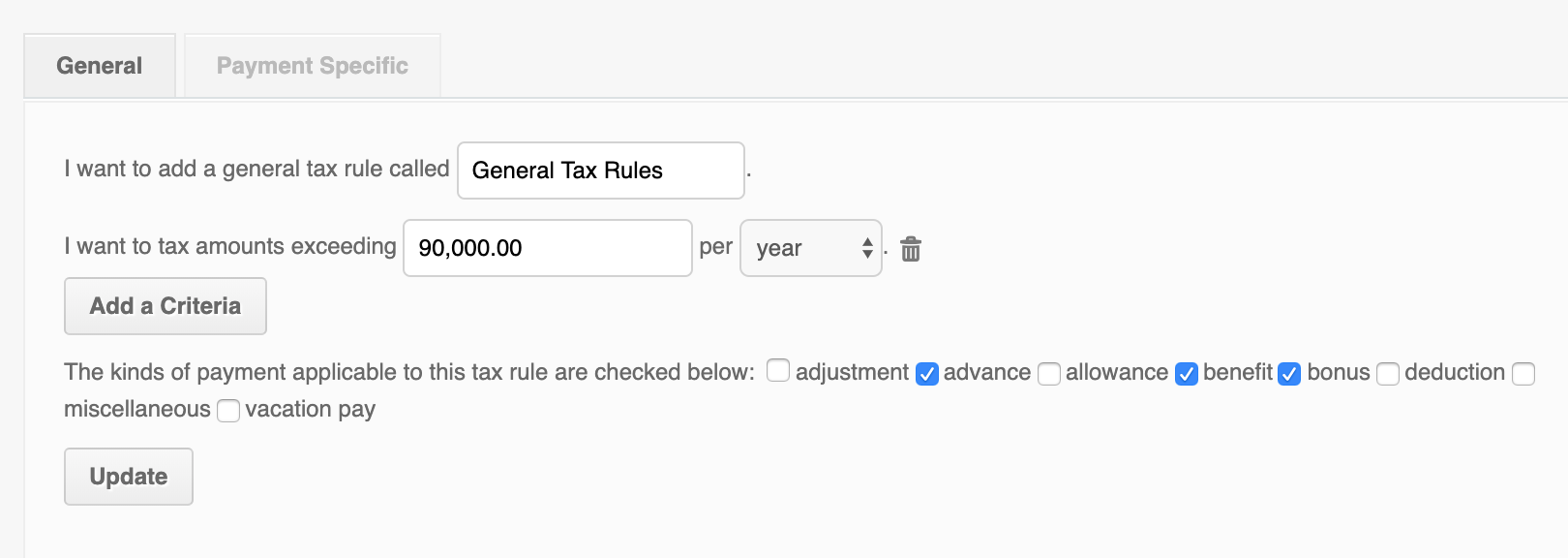

3. “General” tab is usually used for 90k non taxable limit which is applicable to different payment kinds.

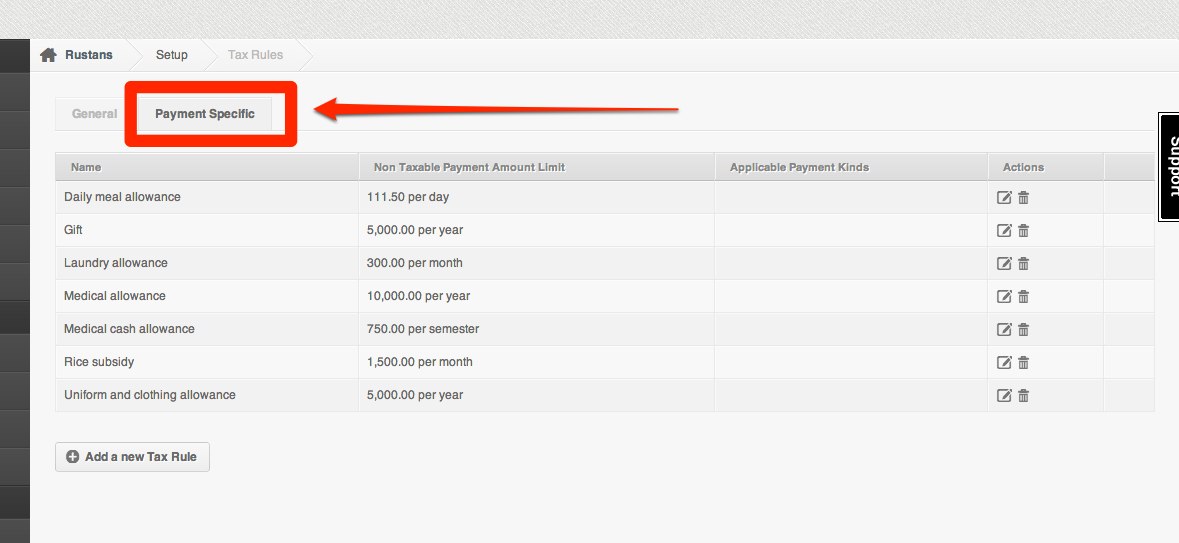

5. Clicking the “Payment Specific” tab is for de minimis benefits (non taxable benefits).

The tax rules set above are based on DOLE’s Revenue Regulation 05-2011

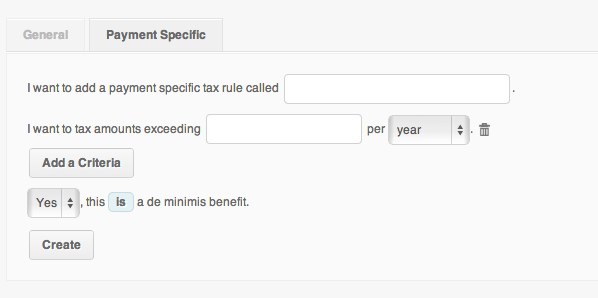

6. Click on “Add a new tax Rule”

7. Fill in the details on the required fields. Click “Create” to save added Tax Rule.

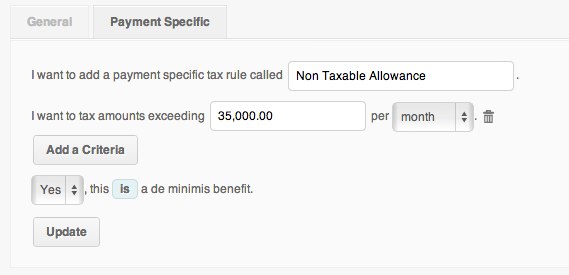

Here’s an example of a Non Taxable Allowance Tax Rule

Daily Meal Allowance:

Once you have created a tax rule, you can now select this on any payments or allowances.