In PayrollHero, the daily rate is computed based on the monthly “base pay” which is added on the Positions page. However, some companies adds their non taxable allowances on their base pay to get a higher computation of their daily/hourly rate.

They do this for the following reasons:

– To discipline employees attendance. Since they will have a higher daily rate, if they are late/absent, they’ll get deducted more.

– And at the same time, if they took an approved OT, they’ll get paid more.

And so we have added a new feature to do this 🙂

Below are the initial computations on how to calculate the daily rate:

With allowances

Daily Rate = ((Monthly Base Pay + Allowance) x 12) / day per year

Without allowances

Daily Rate = (Monthly Base Pay x 12) / days per year

and here’s how the Hourly Rate is computed:

With allowances

Hourly Rate = ((Monthly Base Pay + Allowance) x 12) / (day per year x Hours per day)

Without allowances

Hourly Rate = (Monthly Base Pay x 12) / (day per year x Hours per day)

Here are the steps on how to set up daily rate computations “with allowances”:

-

Login to your PayrollHero Account.

-

– You must have admin access, specifically the access to edit positions under settings.

-

Click on Settings

-

Click on the Positions page

-

– FYI. The positions page is where the allowance templates are set up.

-

Click on the position that you would like to edit.

-

Click on “Details”

-

Click on Allowance Templates

-

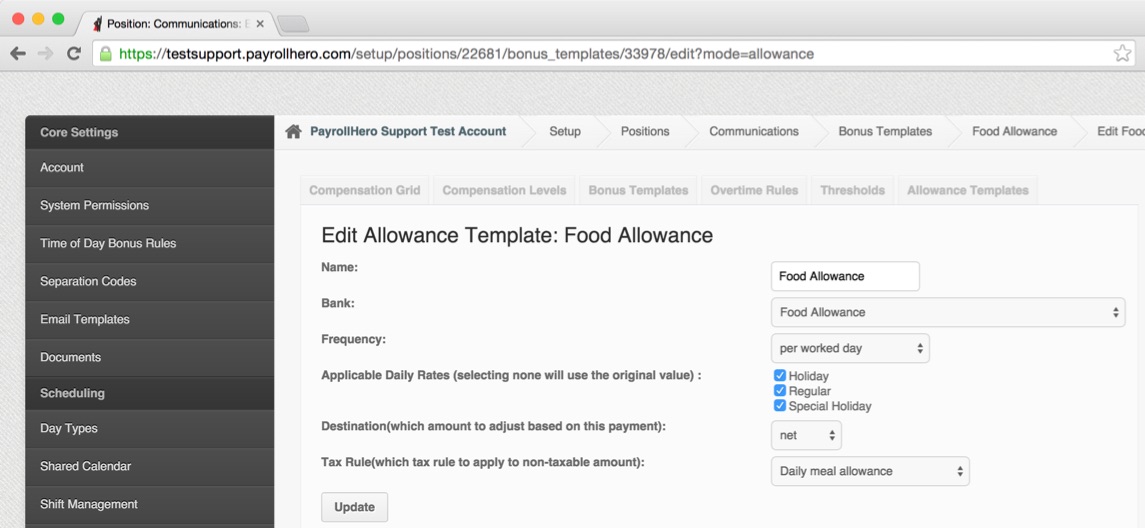

Click on the “Edit” icon of the allowance that you would like to add on the base pay.

-

Set the frequency to “Per Worked Day”

- Select Applicable Daily Rates – this means the multiplier for the day will be used on the allowance (e.g. Holiday will pay 200% of the allowance when checked).

- Set the destination to “net”

- And click on “Update”

See screenshot below:

Here are the steps on how to set up daily rate computations “without allowances”:

-

Login to your PayrollHero Account.

-

– You must have admin access, specifically the access to edit positions under settings.

-

Click on Settings

-

Click on the Positions page

-

– FYI. The positions page is where the allowance templates are set up.

-

Click on the position that you would like to edit.

-

Click on “Details”

-

Click on Allowance Templates

-

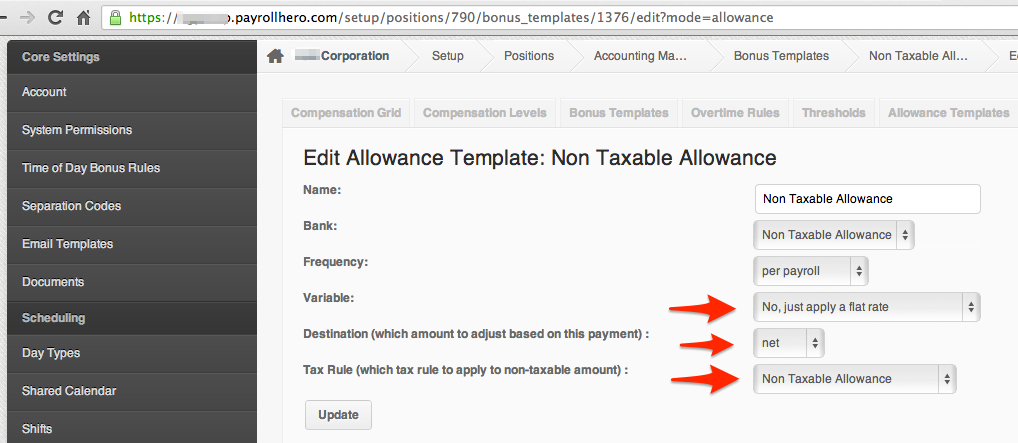

Click on the “Edit” icon of the allowance that is not added on the base pay.

-

Set the variable to “No, just apply a flat rate”

-

Set the destination to “net”

-

And click on “Update”

This is what the “variable” does:

If an allowance is set to variable.

It calculates the hourly rate from that allowance

(ie, if its per day worked its divided by 8, its its monthly its x 12 / 260 / 8 – whatever those are set for the employee)

Then it applies a bonus to every .. premium rate (holiday/ND/Restday/OT/etc) using that hourly rate instead of the employees.

These bonuses are appropriately applied to taxable or not.