The pay mode is the model by which you pay your employees. PayrollHero has currently 3 pay mode options: hourly, monthly, and salary.

Within one organization you can have mixed pay modes, which means that you can have a group of employees on monthly pay mode and others on hourly mode or salary mode.

What are the 3 Pay Modes in PayrollHero and how do these work?

Hourly:

- Employees must clock in and out.

- Employees get paid depending on the hours they worked.

- The employees’ time worked is affected by how you resolve late, undertime and overtime attendance.

- *Attendance must be published before generating payroll.

- You will see the employees’ worked hours on the paystub/payslip.

- If the employee is hourly paid, and no schedule was set, they won’t get paid for the day.

Monthly:

- Employees must clock in and out.

- Employees gets paid with their base pay (per pay period) but will be given additional bonus for extra time and receive deductions for missed hours, depending on the hours they work and how you resolve their attendance.

- *Attendance must be published before generating payroll.

- No work hours seen on the paystub/payslip but employees get paid with their base pay per pay period (cut off).

- If the employee is monthly paid, and there is no schedule, and all the days are blank, the employee will still be paid their monthly rate.

Salary:

- Employees don’t need to clock in and out.

- **Employees get paid their monthly salary or a portion, depending on the pay period length, with no modification for Undertime or Overtime.

- Attendance doesn’t need to be published before generating payroll and employees get paid the full salary.

- Employees will only see their compensations that include the government deductions and any additional payments created on their profile.

* If attendance has not been published, a notification would show up and say “Sorry we can’t generate your payroll until all work days have been published. Please publish the needed attendance.”

** If they need deductions or additional pay, you can create specific “payments” on their employee profile. If you want to deduct lates or absences for salary paid employees, they need to clock in and out and Managers/HR would need to resolve the attendance and publish it.

To change an employee’s pay mode follow these simple steps:

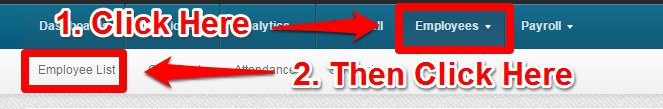

1. On your dashboard, click the Employees tab, then the Employee List.

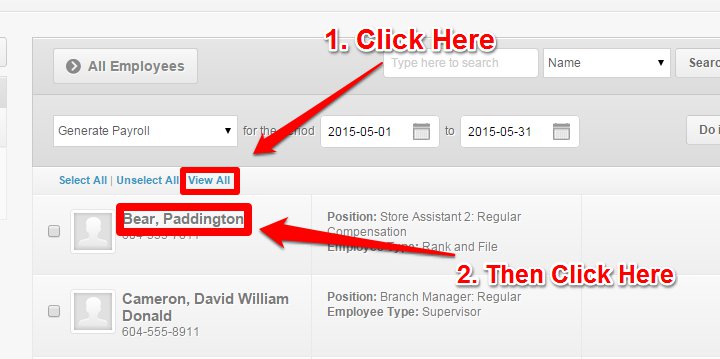

2. Click View All to make sure you see all your employees. Then click on the employee profile you’d like to edit the pay mode for. In this example, we chose Paddington Bear.

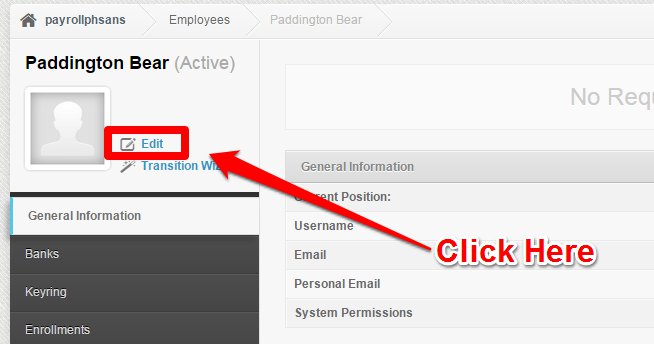

3. Click Edit.

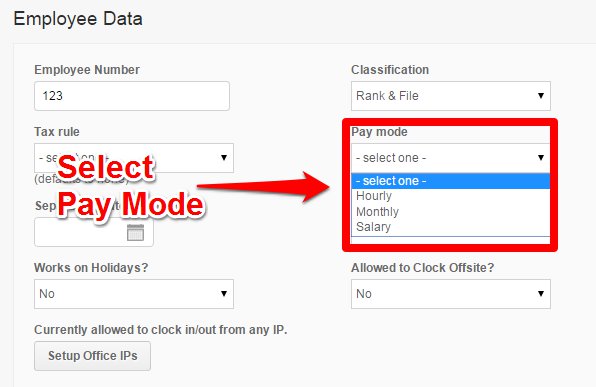

4. Scroll down to the Employee Data section then select the pay mode (hourly, monthly, or salary).

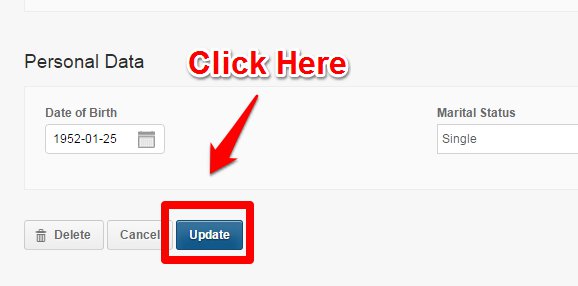

5. Click the Update button at the bottom of the page.

You have now updated the employee’s pay mode!

Additional information on Generating Payroll for Monthly Pay Mode:

1. Paid Long Leaves

On the “monthly” pay mode you can generate payroll as long as there’s no shift/schedules on the pay period. However, if there’s one schedule attached to the pay period, you will need to resolve all of the days within that cut off before you can generate the payroll.

This is applicable to employees who are on paid leave for a long period of time (e.g. Maternity Leave).

2. Paid Holidays (Regular and Special)

If an employee does not work on a specific day, they will receive 100% pay for the day. No additional rates on their salary. For special holidays though, if they are monthly paid, they still get paid for the half a month salary, without any deductions. However, if they are hourly paid on a special holiday, it is up to the company’s discretion if it will be paid or not.

You’ve just learned about Pay Modes on PayrollHero! This concludes the article.

If you have any further questions, please send us a message on our requests page at support@payrollhero.com – we’d be happy to help.