All employers are required by law [S68(2) of the Income Tax Act] to prepare Form IR8A and Appendix 8A, Appendix 8B or Form IR8S (where applicable) for all your employees who are employed in Singapore by 1 Mar each year. Employers need not submit the forms to IRAS.

To generate the report one needs to setup their IRAS information in the system first.

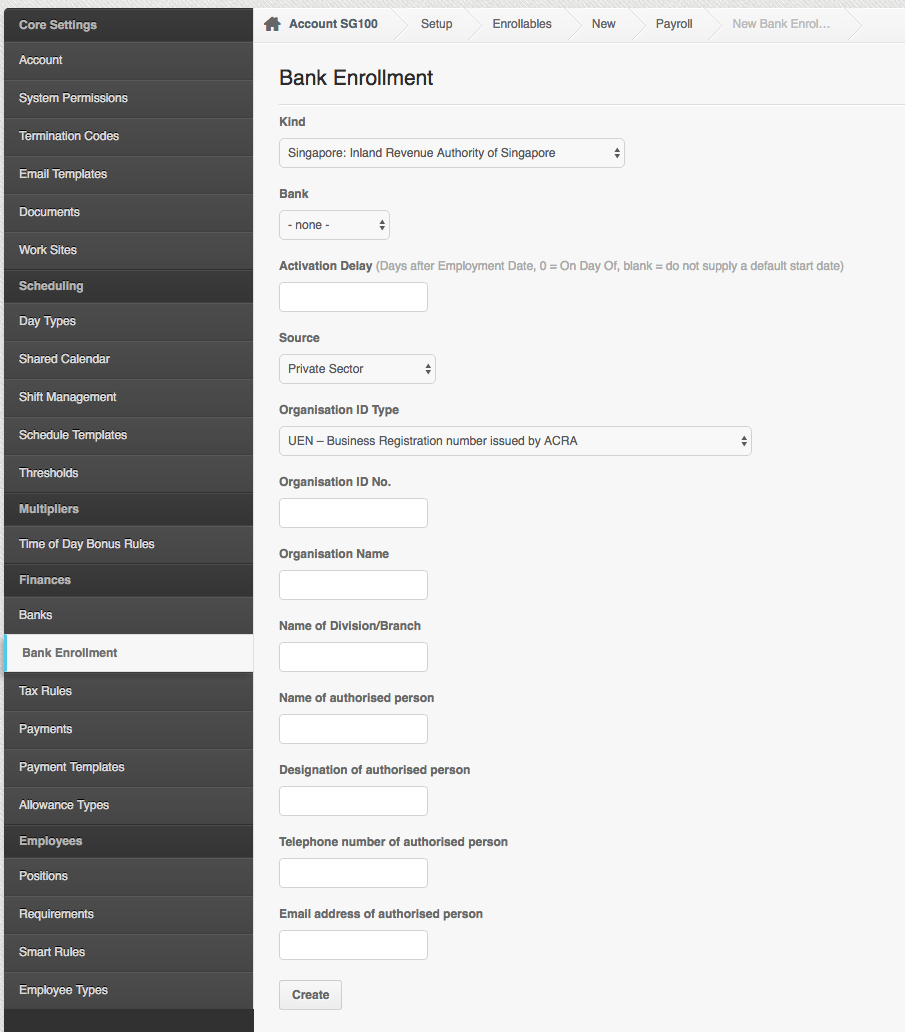

You’ll need to go to your Bank Enrollment page and add a new bank, add “Inland Revenue Authority of Singapore” bank enrolment.

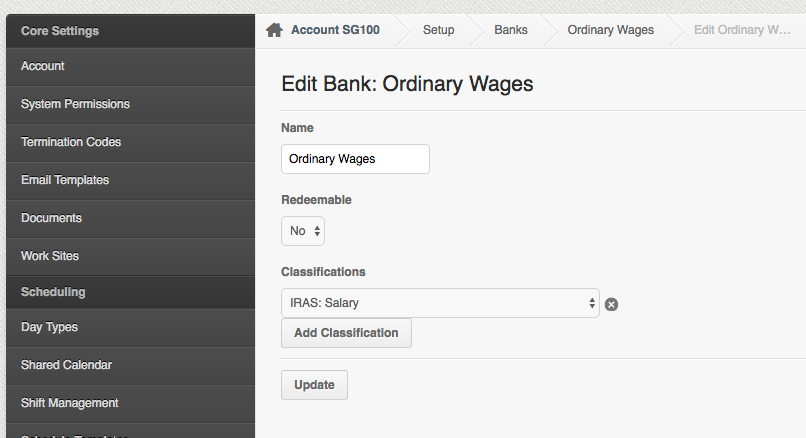

Go through your Banks Page and classify them based on IRAS classifications.

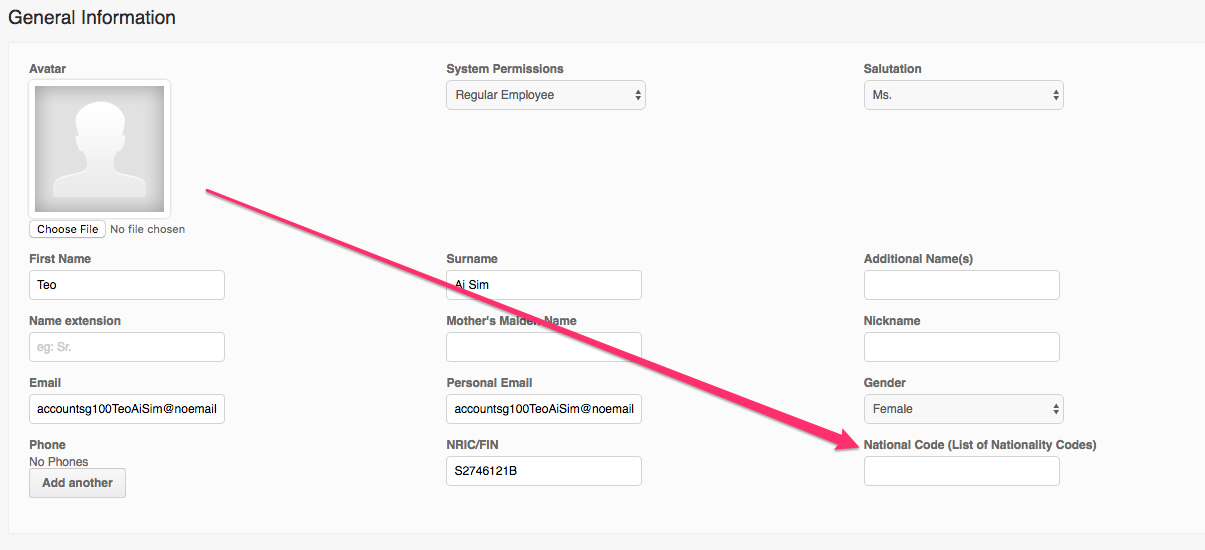

Once the account is setup the employee would need to be setup as well. There are new fields that are needed for IRAS IR8A. Set the nationality code based on IRAS

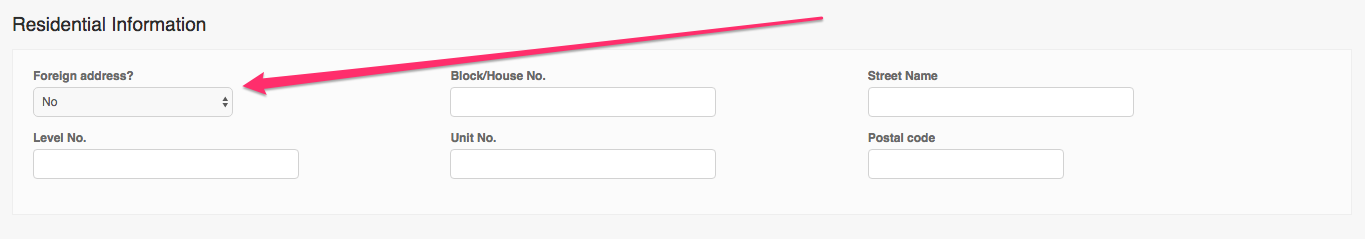

Indicate if the address is foreign or not.

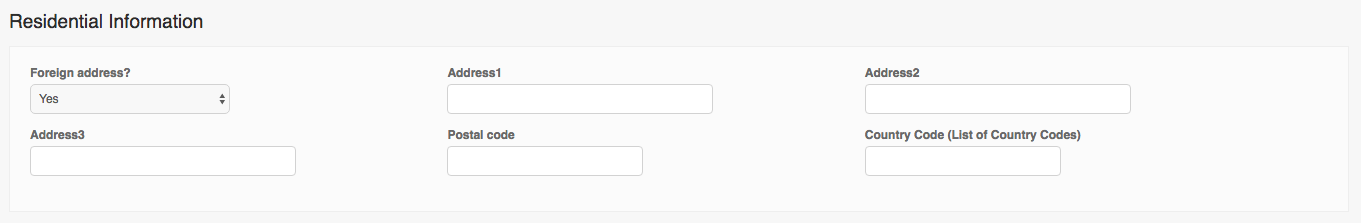

A different set of fields would be show if the address is foreign.

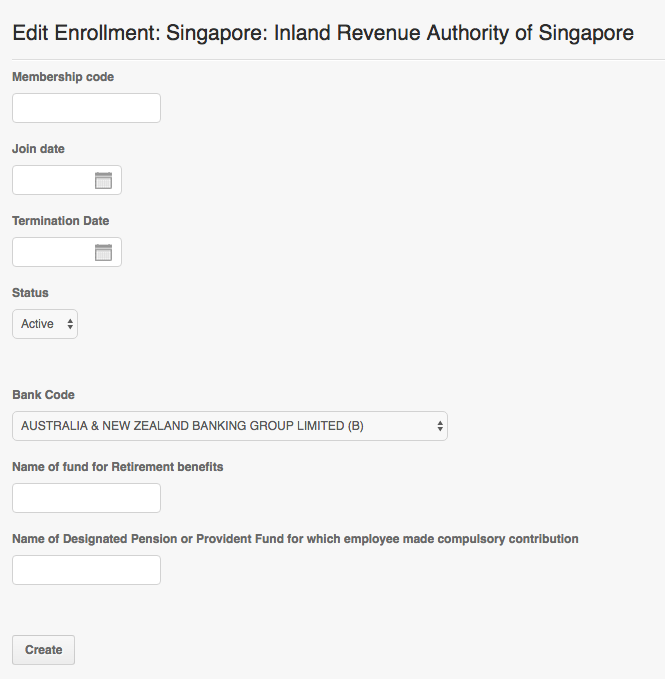

Enroll the employee to IRAS.

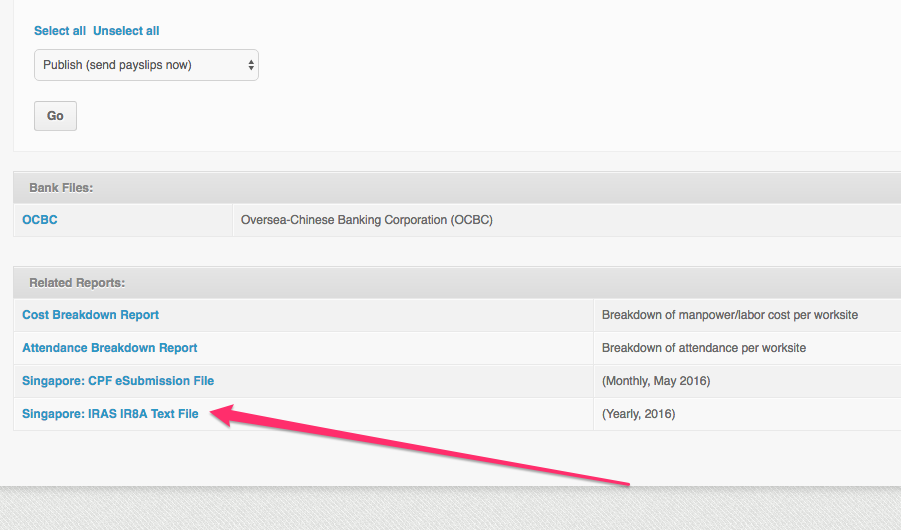

Once all the needed employees are setup, go to the `/payrolls` page and click on the details of any payroll period of the year you want to generate IR8A test file from.