The scenario is like this: Client filled up the form with UOB as their bank account but the employees have different bank accounts (OCBC, DBS, etc).

For the financial institution enrollments they are related to what institution the company uses and not where the employees bank.

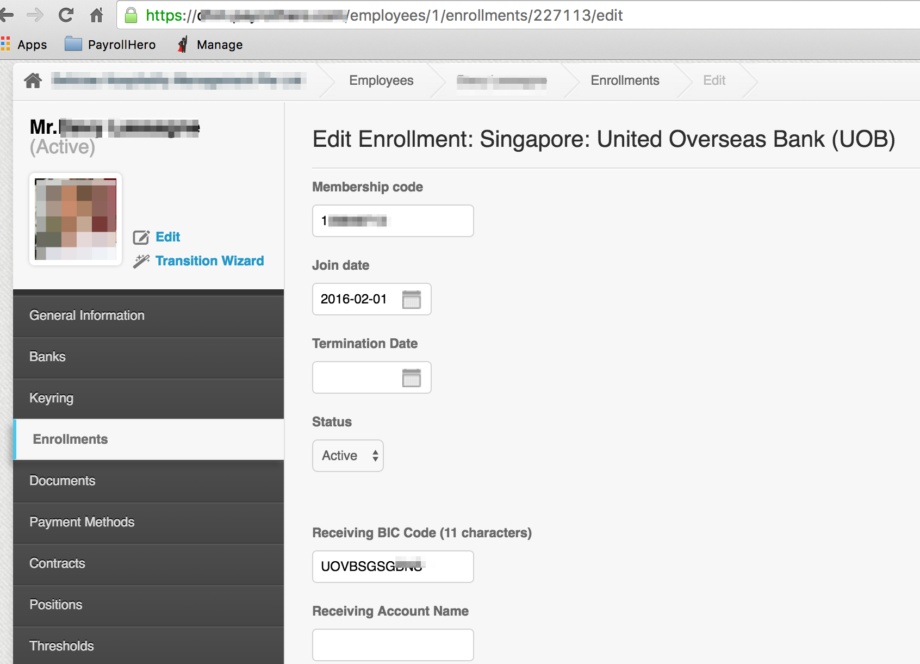

When setting up the financial institutions for a company in Singapore you only need to create the enrollment for where the company banks. In this case, it is with the UOB enrollment.

Employees that are paid out with this bank file will have to have the UOB enrollment.

In the UOB enrollment, you can specify different bank account numbers not necessarily from UOB, it can be from DBS, OCBC or any other bank.

- Receiving BIC code – This is the Bank Identifier Code or SWIFT code of the employee. For example, UOB is usually UOVBSGSGXXX where XXX is the branch code. The BIC code is different depending on the bank. For Singapore banks, you can check the BIC code here – http://www.theswiftcodes.com/singapore/

- Receiving Account Name – This is the bank account name of the employee. If this is not filled in, this defaults to the employee’s name on their profile.

So even though the set up on the employees shows UOB Enrollment, it still uses their own financial institutions based on the details you sent us before.