All employers are mandated to remit payments for employees and employer premiums to the Social Security System (SSS). Employers can remit either every month or every quarter. This ensures complete SSS postings and to ensure employees are entitled for SSS benefits whenever the needs arise. (source)

Here are the requirements in paying SSS Contributions.

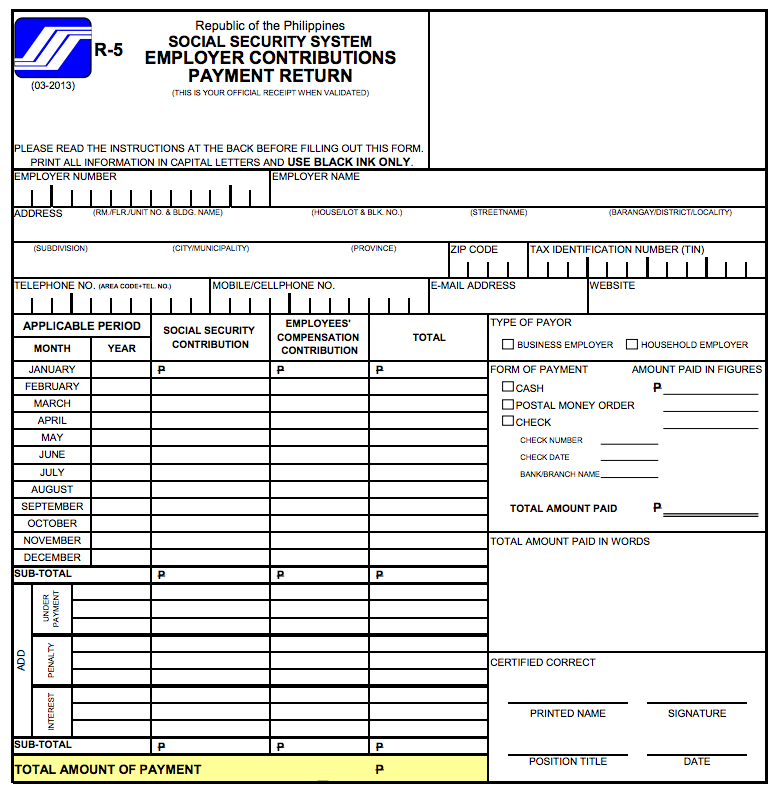

1. SSS Form R5 – Employer Contributions Payment Return:

(Click on the photo to download the form)

This form is submitted monthly together with the SSS form R3 (see form #2 below). It looks like a bank deposit slip where you will need to write all the information like the following:

- Employer No.

- Business Name

- Business Address

- Business Tin

- Applicable Reporting Period

- Type of Payor

- Form of Payment (If cash or check)

- Total Amount of Payment

After the employer paid the contribution, the bank or the SSS Office will put a stamp on the R5 form that will served as the employer proof of payment.

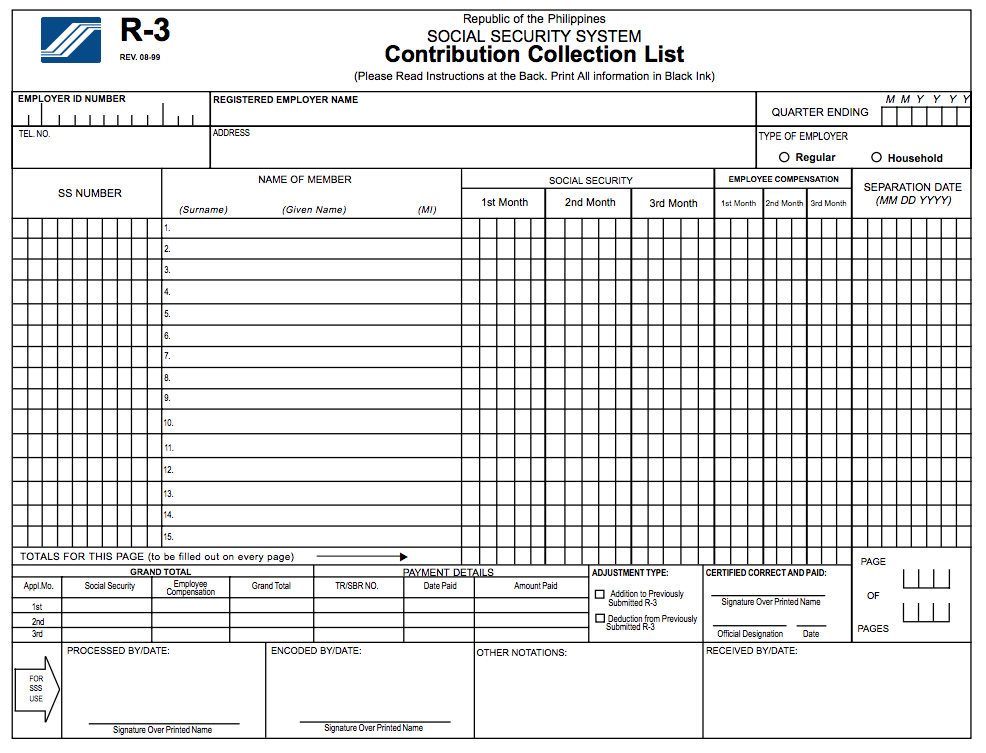

2. SSS Form R3 – Contribution Collection List:

(Click on the photo to download the form)

This form is submitted monthly or quarterly before the 10th of the following month. If the due date falls on weekend or Holiday it must be submitted by the first working day after.

The purpose of this form is to submit names of employees and employer contributions to SSS.

3. Cash or Check Payable to Social Security System (SSS)

Here are the steps in paying SSS Contributions.

1. Fill out 3 copies of SSS Form R5 (see form #1 above) and make sure all the company’s information are all correctly written.

2. Fill out 3 copies of SSS Form R3 (see form #2 above)

3. Go to SSS office near you and pay the contributions.

4. Once you the contributions are paid, you still need to submit the receipt together with the SSS R3 File in a USB flash drive. This SSS R3 file can be created by the SSS R3 generator. Click here to download the SSS R3 generator from the SSS website.

This R3 File Generator Program was developed to assist employers in the preparation of their monthly contributions report. This R3 File generator will help employer to submit contributions online. It is also an assurance that each employee’s SSS contribution are posted properly to their account.

By the way, there’s a minimum hardware requirement when downloading R3file Generator:

Minimum Hardware Requirement:

- 166 MHZ Pentium IV or equivalent

- 256 MB memory

- 100 MB extra hard disk space

- CGA Display

Minimum Software requirement

- JRE 6 or WIndows

- JRE 6 for Linux