PayrollHero now provides an option to restrict newly hired employees from using their leave credits.

In many companies, new employees begin earning leave credits monthly as part of their benefits package. However, some organizations prefer to prevent the use of these credits during the probationary period or until the employee reaches a certain tenure (for example, after 6 months or 1 year of employment). This approach helps ensure that new hires meet performance or attendance expectations before being granted access to paid leaves.

With this new feature, you can now easily configure your leave policies so that specific employee types—such as Probationary, Trainee, or New Hire—can accrue leave credits without being able to use them until they become eligible.

If your company follows a similar rule, this article will guide you through the steps to set it up in PayrollHero.

Steps to Restrict Leave Usage for Newly Hired Employees

- Add a New Employee Type

– Create a new employee type for your newly hired staff (e.g., Trainee, Probationary, or New Hire). 👉 Learn how to add a new employee type - Go to the Leave Type Page

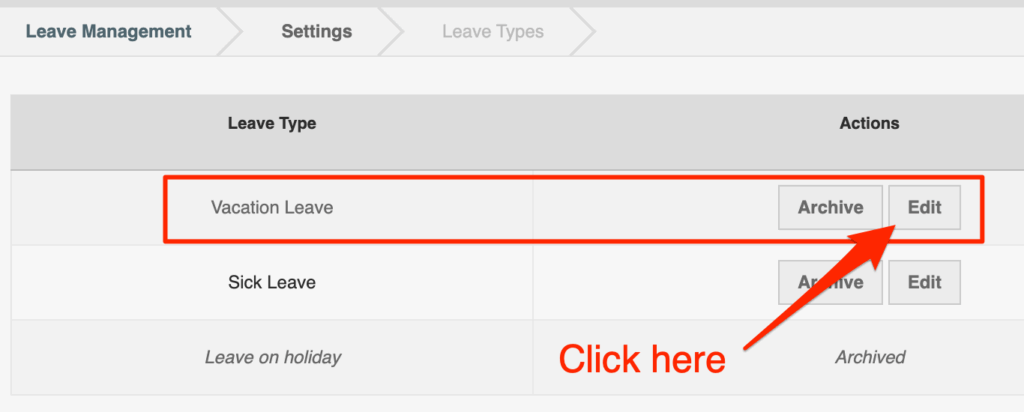

– Navigate to your Leave Management section and open the Leave Type page. - Edit the Leave Type

– Click the Edit button beside the leave type you want to restrict.

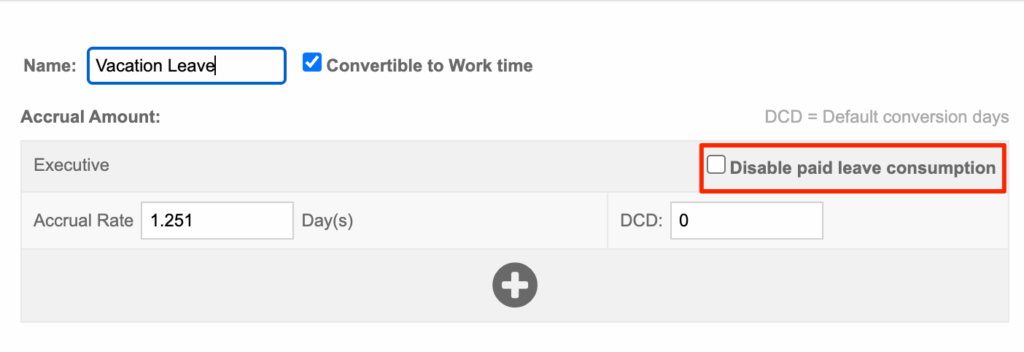

4. Enable the Restriction OptionOn the right side of the Leave Type settings window, check the box labeled “Disable paid leave consumption.”

Once this option is enabled, employees under the designated employee type (e.g., Probationary or Trainee) will still earn leave credits, but will not be able to consume or apply them until the restriction is lifted.

✅ Note:

- Employees under the restricted employee type can still submit leave requests through the Leave Management page, but they can just request for Unpaid leave.

- Once the employee reaches the required tenure, you can allow them to use their leave credits by reassigning them to an Employee Type that has access to paid leave usage (for example, Regular Employee).

If you have any further questions about this article, do not hesitate to contact us at support@payrollhero.com – we will be happy to help.