Learn how PayrollHero deducts leave credits when an employee files a previous-year leave request in the current year — ensuring accurate balances and year-end leave conversion.

Overview

Some employees file their leave requests late — for example, an absence dated December 15, 2024 but submitted on January 5, 2025. Many companies allow this, but still require the deduction to come from the previous year’s leave credits, even if those credits have already expired on December 31.

PayrollHero now fully supports this workflow.

When a previous-year leave request is filed and approved in the new year, the deduction automatically comes from the expired leave credits of the prior year, not from the current year’s entitlement.

This ensures:

- Employees’ current year leave credits remain protected

- Year-end leave conversion remains accurate

- Policies that allow late filing are properly supported

How to Enable This Feature

To ensure PayrollHero correctly deducts from expired credits when employees file leave for dates in the previous year, enable this setting:

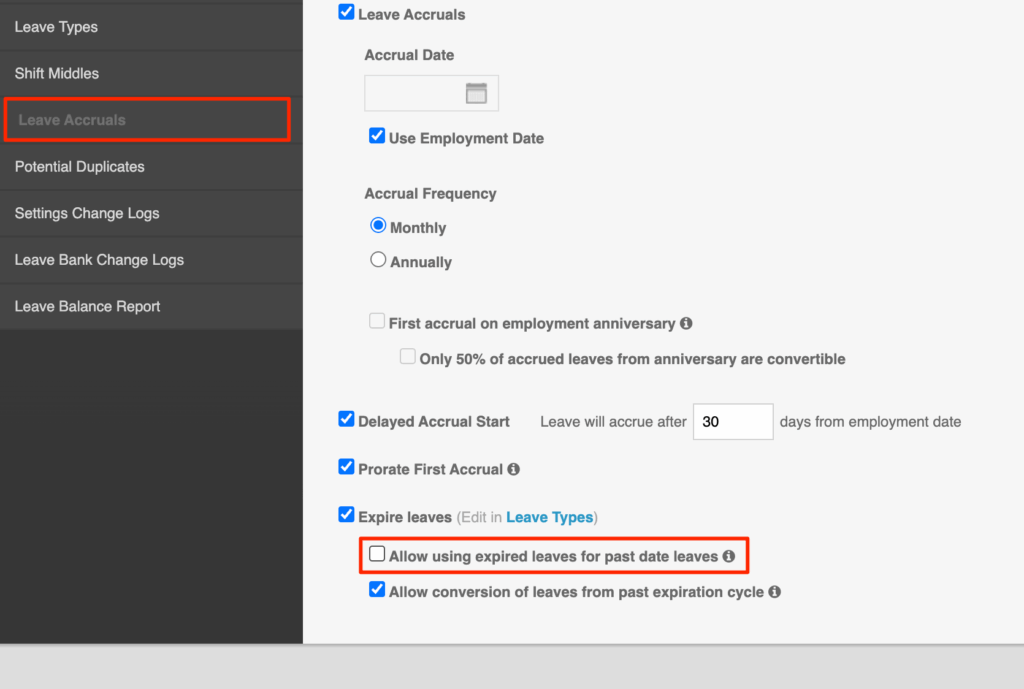

- Go to your Leave Management page.

- Click on Leave Accrual.

- Scroll down to the Expire Leaves section.

- Enable Allow using expired leaves for past date leaves by clicking the checkbox.

Once enabled, the system will automatically handle deductions from expired credits for any approved past-year leave requests.

How It Works

1. Filing the Leave

Employees can file leave requests dated in the previous year even after the year has closed.

Example:

- Leave date: December 15, 2024

- Filing date: January 5, 2025

PayrollHero will accept the request as usual.

2. Approval by Admin

When reviewing the request, PayrollHero checks the leave date:

- If the date falls in the previous year, the deduction will be taken from the previous year’s leave balance — even if those credits are marked as expired.

- The current year’s leave credits remain untouched.

This ensures predictable and accurate leave balances at the start of every year.

3. Deduction From Expired Credits

If the previous year’s credits have expired, PayrollHero still uses them specifically for late-filed, previous-year leave.

Why this matters:

✔ Prevents accidental use of current-year credits

✔ Keeps leave conversion accurate

✔ Aligns with company policies that allow late filing

This improvement directly supports policies like Miladay’s, where credits expire every December 31, but employees may still file previous-year leave in January.

Field Behavior & Tooltips

Leave Balance (Admin View)

Internal Admin Display

- Shows remaining credits for both current and previous years

- Includes expired credits that may still be used for deduction in this scenario

Leave Request Form (Employee View)

Employee-Facing Display

- Employees may select any date, including those from the prior year

- PayrollHero automatically determines which leave credit pool to deduct from

- No manual configuration required

What Happens in Year-End Leave Conversion?

When a previous-year leave request is approved in the new year, PayrollHero:

- Deducts from the expired credits of that previous year

- Reduces the amount available for leave conversion (e.g., payout or carryover) for that same year

- Does not affect the current year’s leave conversion or available credits

This ensures that conversion calculations reflect actual usage of prior-year credits.