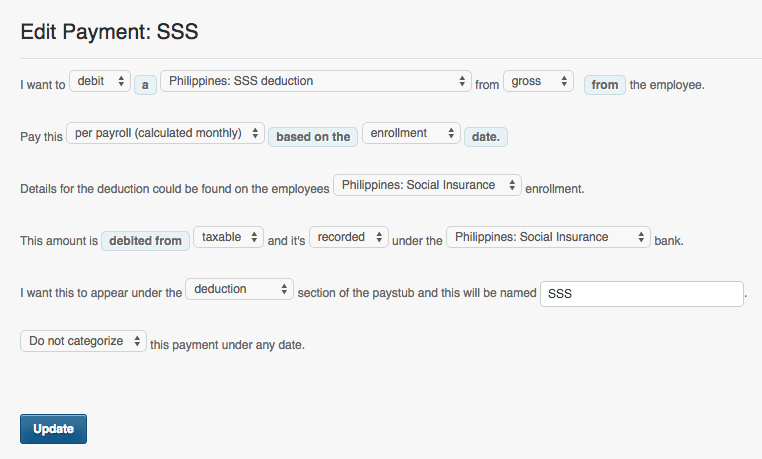

SSS Deduction

Using the “Per payroll (calculated monthly)”

In using this payment, the system will based its deduction on the employee’s salary for that pay period.

The deduction will then be computed and follow the SSS Contribution Table. Where in on the first pay period, it will use the “1st Pay Period” salary. It then deducts the difference between the monthly calculation (2nd pay period) and the SSS contribution already deducted from the first pay period.

Example:

Employee’s Daily Rate is set to 466 per day.

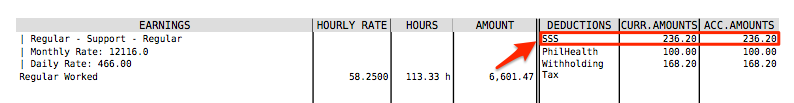

January 1 – 15 (1st Pay Period)

Salary = 6,601.47

Using the SSS Contribution Table (6,250 – 6,749)

= 236.20

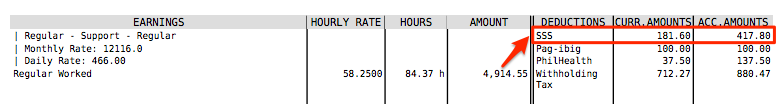

January 16 – 31 (2nd Pay Period)

Salary = 4,914.55

Using the SSS Contribution Table (4,750 – 5,249)

= 181.60

The system automatically deducts the difference between the monthly calculation (2nd pay period) and the SSS contribution already deducted from the first pay period.

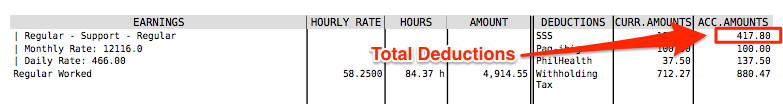

Monthly Computation:

Salary

= 1st Pay Period + 2nd Pay Period

= 6,601.47 + 4,914.55

= 11,516.02

Using the SSS Contribution Table (11,250 – 11,749.99)

= 1st Pay Period + 2nd Pay Period

= 236.20 + 181.60

= 417.80

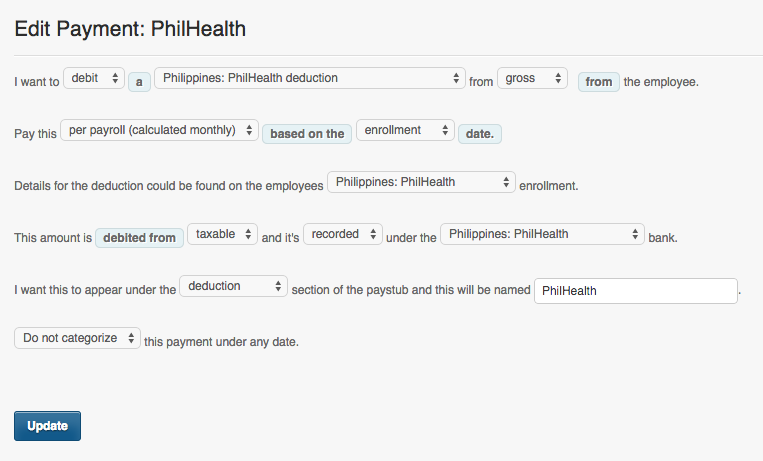

PhilHealth Deduction

Using the “Per payroll (calculated monthly)”

In using this payment, the system will based the deduction on the employee’s salary for that pay period.

The deduction will then be computed and follow the PhilHealth Contribution Table. Where in on the first pay period, it will use the “1st Pay Period” salary. It then deducts the difference between the monthly calculation (2nd pay period) and the PhilHealth contribution already deducted from the first pay period.

Example:

Employee’s Daily Rate is set to 466 per day.

January 1 – 15 (1st Pay Period)

Salary = 6,601.47

Using the PhilHealth Contribution Table (10,000 and below)

= 150.0

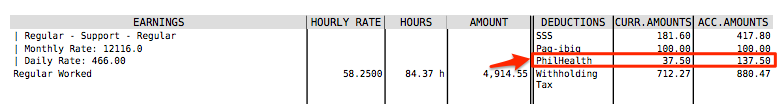

January 16 – 31 (2nd Pay Period)

Salary = 4,914.55

Using the PhilHealth Contribution Table (8,999.99 and below)

= 100.0 – 62.50

= 37.50

The system automatically deducts the difference between the monthly calculation (2nd pay period), and the PhilHealth contribution that was already deducted from the first pay period.

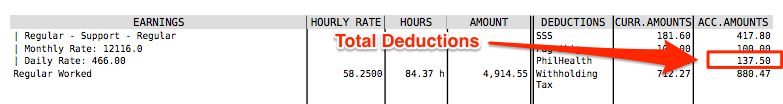

Monthly Computation:

Salary

= 1st Pay Period + 2nd Pay Period

= 6,601.47 + 4,914.55

= 11,516.02

Using the PhilHealth Contribution Table (11,000 – 11,999.99)

= 1st Pay Period + 2nd Pay Period

= 100.0 + 37.50

= 137.50

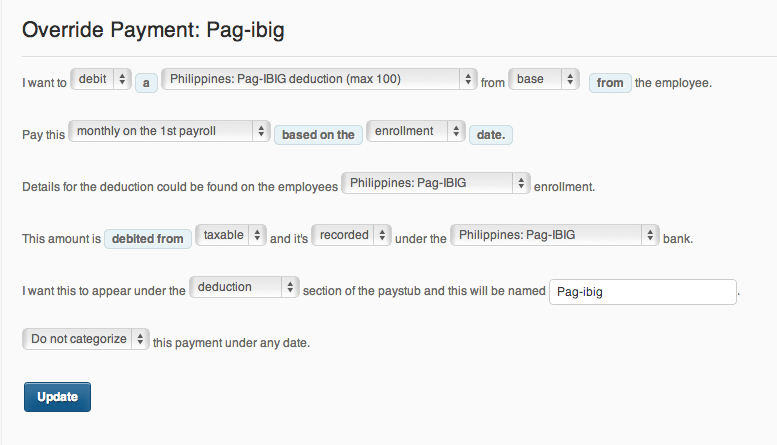

Pag-ibig Deduction

Using the “Monthly on the first or last payroll”

When using this payment, the system will be based on the employee’s salary either using base or gross pay.

The pag-ibig deduction will automatically deduct 100 pesos depending on which pay period you would like to deduct it.

If you select “Monthly on the first payroll”,

The system will deduct the Pag-ibig contribution based on the first pay period set up on your Account settings (Payroll Info).

If you select “Monthly on the last payroll”,

The system will deduct the Pag-ibig contribution based on the second pay period set up on your Account settings (Payroll Info).