What is a Double Holiday?

A Double Holiday occurs when a movable holiday lands on the same day as a fixed holiday. For example: When Araw ng Kagitingan (a fixed regular holiday on April 9th) is the same day as Maundy Thursday or Good Friday (a movable regular holidays in April).

How to pay employees for these days in the Philippines?

Given that the employee has not worked on the double holiday they are entitled to at least 200% of their basic wage. If they are required work on the double holiday then the employee is entitled to an additional 100% of the basic wage, totalling to 300%.

For example: If an employee make PhP 50.00/hour and usually works 8 hours a day.

Then on the unworked holiday they should be paid: PhP 50.00 X 200% X 8 hours/day = 800 PhP for that day

On a double holiday that they worked they should be paid: PhP 50.00 X 300% X 8 hours/day = 1200 PhP for that day

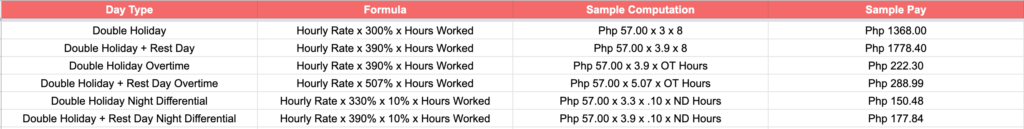

Here are the sample computations of a double holiday pay according to DOLE’s 2019 Handbook on Worker’s Statutory Monetary Benefits.