Charitable Contributions

Charitable contributions are taken from certain employees of certain races. They are only taken from citizens and permanent residences. Although employees are allowed to opt out of any of the charitable contributions all contributions are mandatorily opted in. An employee must get the correct forms from the particular fund to opt out.

Every employer needs to prepare and keep a register showing the name, address, rate of pay and allowances, the amount earned and the amount deducted from the earning of each employee as contributions to the Fund.

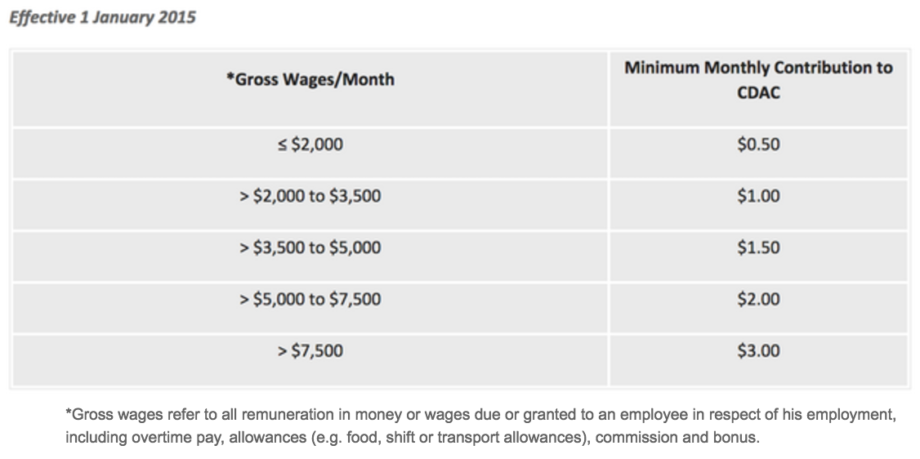

Chinese Development Assistance Council Fund (CDAC)

All employees belonging to the Chinese Community (every person who is a permanent resident or citizen of Singapore of Chinese descent) need to contribute monthly to the CDAC Fund. The prescribed amount will be deducted automatically from the wages of Chinese employees. If the employees wish to contribute a different amount or opt out, they have to obtain the relevant forms from CDAC.

The CDAC Fund is used to fund CDAC’s programmes and assistance schemes to help the students, workers and families from the lower income groups overcome their challenges and achieve social mobility. More information can be found at www.cdac.org.sg

There is no minimum wage amount required for contribution

CDAC Forms

Eurasian Community Fund (ECF)

A Eurasian is “a person of mixed European (or European-American) and Asian parentage.” This fund has it’s origins in the first world war. Singapore’s defences was left to a garrison of European volunteers. However, it was during the 1990s that the group begun to look after the interests of every single Eurasian in Singapore. Although they have quite a broad scope their particular areas of interest are education and family support

Mosque Building and Mendaki Fund (MBMF)

This is run by the Majilis Ugama Islam Singapure (MUIS) aka Islamic Religious Council of Singapore. The organization was founded to advise the President of Singapore on all Islamic matters.